Answered step by step

Verified Expert Solution

Question

1 Approved Answer

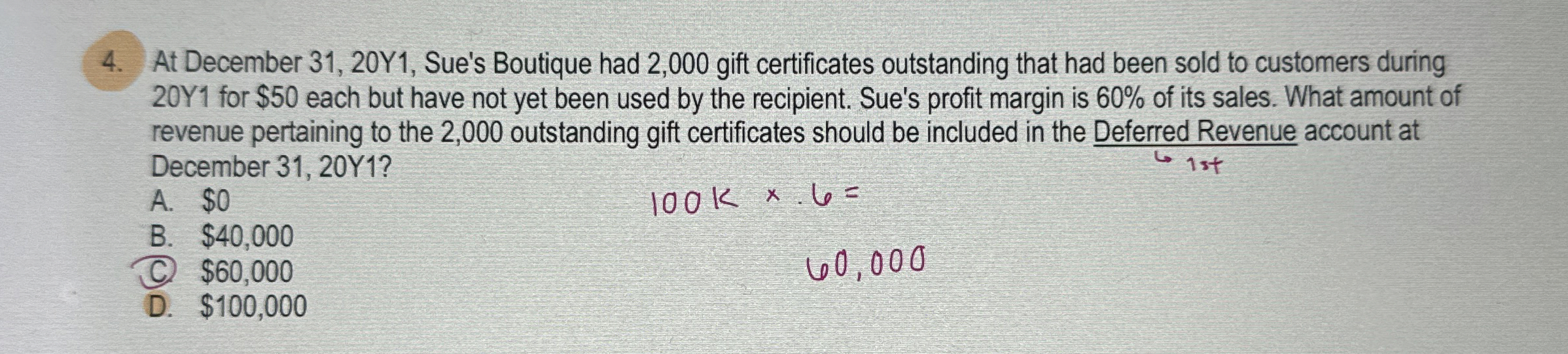

At December 3 1 , 2 0 Y 1 , Sue's Boutique had 2 , 0 0 0 gift certificates outstanding that had been sold

At December Sue's Boutique had gift certificates outstanding that had been sold to customers during

for $ each but have not yet been used by the recipient. Sue's profit margin is of its sales. What amount of

revenue pertaining to the outstanding gift certificates should be included in the Deferred Revenue account at

December Y

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started