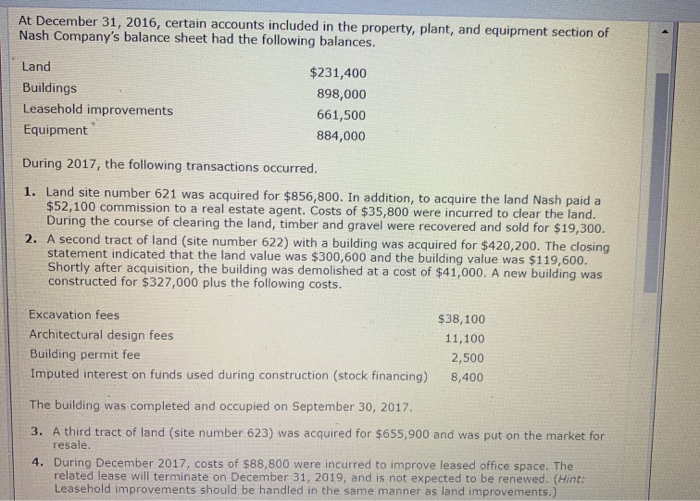

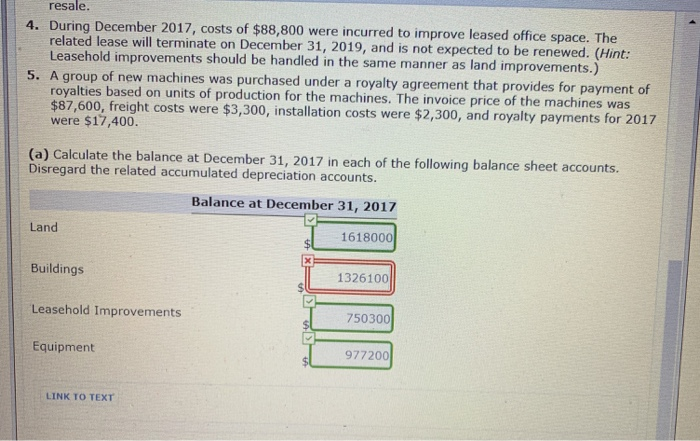

At December 31, 2016, certain accounts included in the property, plant, and equipment section of Nash Company's balance sheet had the following balances. Land $231,400 Buildings 898,000 Leasehold improvements 661,500 Equipment 884,000 During 2017, the following transactions occurred. 1. Land site number 621 was acquired for $856,800. In addition, to acquire the land Nash paid a $52,100 commission to a real estate agent. Costs of $35,800 were incurred to clear the land. During the course of clearing the land, timber and gravel 2. A second tract of land (site number 622) with a building was acquired for $420,200. The closing statement indicated that the land value was $300,600 and the building value was $119,600. Shortly after acquisition, the building was demolished at a cost of $41,000. A new building was constructed for $327,000 plus the following costs. covered and sold for $19,300. were re Excavation fees $38,100 Architectural design fees 11,100 Building permit fee Imputed interest on funds used during construction (stock financing) 2,500 8,400 The building completed and occupied on September 30, 2017. was 3. A third tract of land (site number 623) was acquired for $655,900 and was put on the market for resale. 4. During December 2017, costs of $88,800 were incurred to improve leased office space. The related lease will terminate on December 31, 2019, and is not expected to be renewed. (Hint: Leasehold improvements should be handled in the same manner as land improvements.) resale. 4. During December 2017, costs of $88,800 were incurred to improve leased office space. The related lease will terminate on December 31, 2019, and is not expected to be renewed. (Hint: Leasehold improvements should be handled in the same manner as 5. A group of new machines was purchased under a royalty agreement that provides for payment of royalties based on units of production for the machines. The invoice price of the machines was $87,600, freight costs were $3,300, installation costs were $2,300, and royalty payments for 2017 were $17,400. land improvements.) (a) Calculate the balance at December 31, 2017 in each of the following balance sheet accounts. Disregard the related accumulated depreciation accounts. Balance at December 31, 2017 Land 1618000 Buildings 1326100 Leasehold Improvements 750300 Equipment 977200 LINK TO TEXT