Answered step by step

Verified Expert Solution

Question

1 Approved Answer

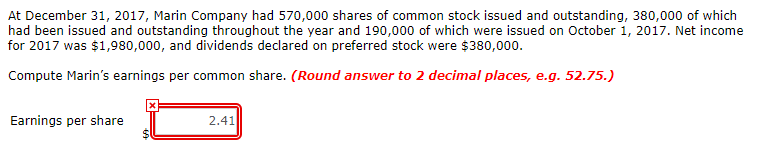

At December 31, 2017, Marin Company had 570,000 shares of common stock issued and outstanding, 380,000 of which had been issued and outstanding throughout the

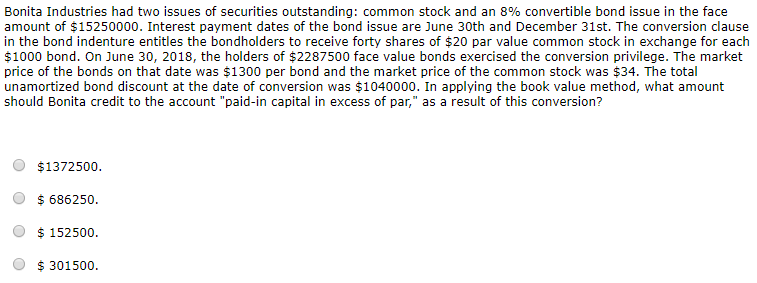

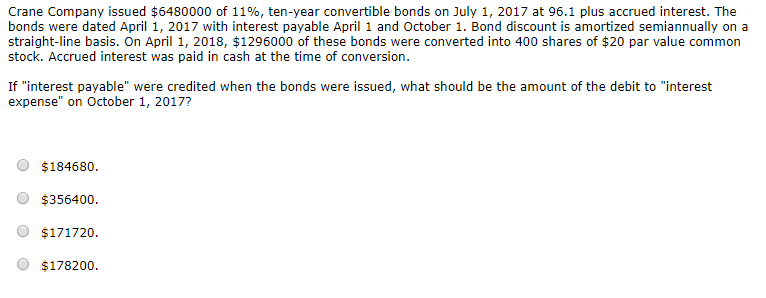

At December 31, 2017, Marin Company had 570,000 shares of common stock issued and outstanding, 380,000 of which had been issued and outstanding throughout the year and 190,000 of which were issued on October 1, 2017. Net income for 2017 was $1,980,000, and dividends declared on preferred stock were $380,000. Compute Marin's earnings per common share. (Round answer to 2 decimal places, e.g. 52.75.) Earnings per share 2.41 Bonita Industries had two issues of securities outstanding: common stock and an 8% convertible bond issue in the face amount of $15250000. Interest payment dates of the bond issue are June 30th and December 31st. The conversion clause in the bond indenture entitles the bondholders to receive forty shares of $20 par value common stock in exchange for each $1000 bond. On June 30, 2018, the holders of $2287500 face value bonds exercised the conversion privilege. The market price of the bonds on that date was $1300 per bond and the market price of the common stock was $34. The total unamortized bond discount at the date of conversion was $1040000. In applying the book value method, what amount should Bonita credit to the account "paid-in capital in excess of par," as a result of this conversion? $1372500. $ 686250. $ 152500. $ 301500. Crane Company issued $6480000 of 11%, ten-year convertible bonds on July 1, 2017 at 96.1 plus accrued interest. The bonds were dated April 1, 2017 with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2018, $1296000 of these bonds were converted into 400 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion. If "interest payable" were credited when the bonds were issued, what should be the amount of the debit to "interest expense" on October 1, 2017? O $184680. O $356400. O $171720. O $178200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started