Question

At December 31, 2018, before any year-end adjustments, the Accounts Receivable balance of TM Manufacture, Inc., is $ 340,000. The Allowance for Uncollectible Accounts has

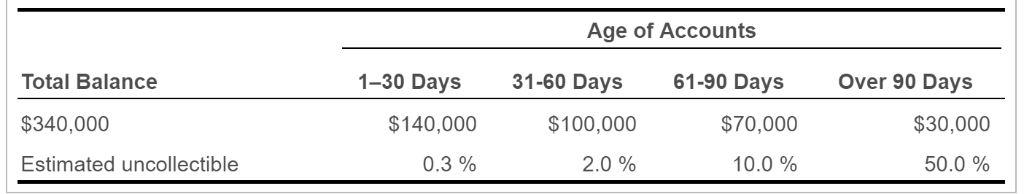

At December 31, 2018, before any year-end adjustments, the Accounts Receivable balance of TM Manufacture, Inc., is $ 340,000. The Allowance for Uncollectible Accounts has a(n) $ 19,500 credit balance. TM Manufacture prepares the following aging schedule for Accounts Receivable:

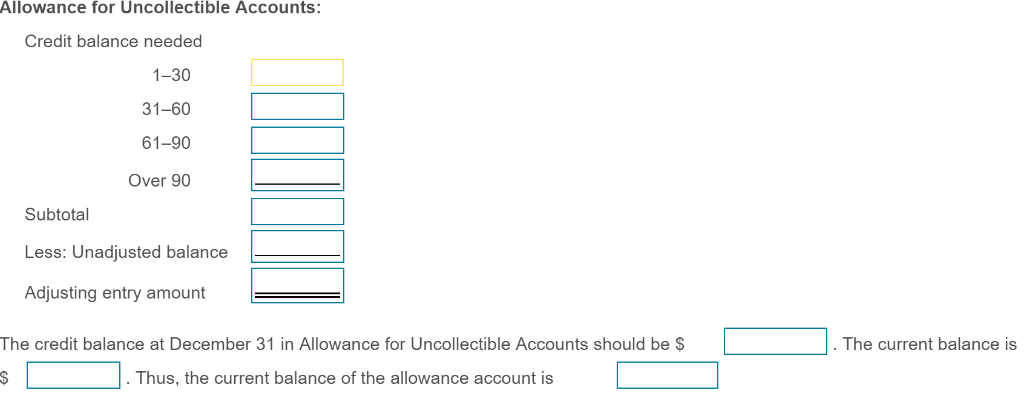

Based on the aging of Accounts Receivable, is the unadjusted balance of the allowance account adequate? Too high? Too low? First, calculate a revised allowance for uncollectible accounts amount and the adjusting entry amount rounded to the nearest dollar.

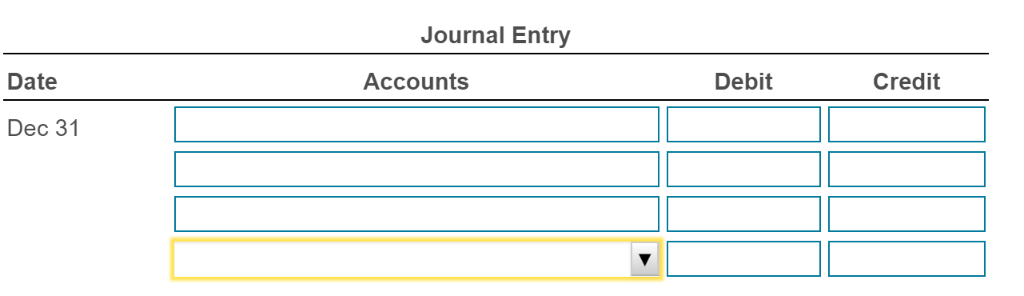

Make the entry required by the aging schedule. Prepare a T-account for the allowance. First, make the entry required by the aging schedule. (Record debits first, then credits. Exclude explanations from any journal entries.)

Choices for accounts: Accounts Receivable, Allowance for uncollectible accounts, Cash, Sales, Selling expense, Uncollectible account expense.

Choices for accounts: Accounts Receivable, Allowance for uncollectible accounts, Cash, Sales, Selling expense, Uncollectible account expense.

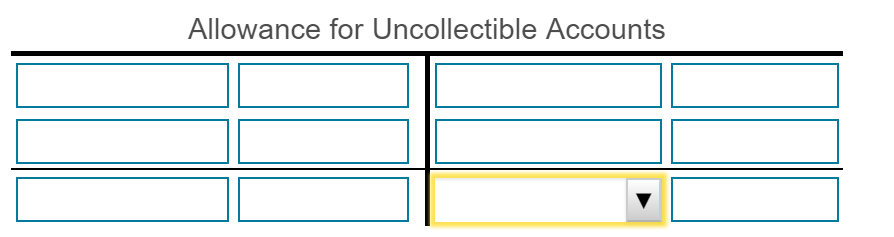

Prepare a t-account for the allowance. Lefthand side choices contains: Bal before adj, Adj entry, Bal after adj.

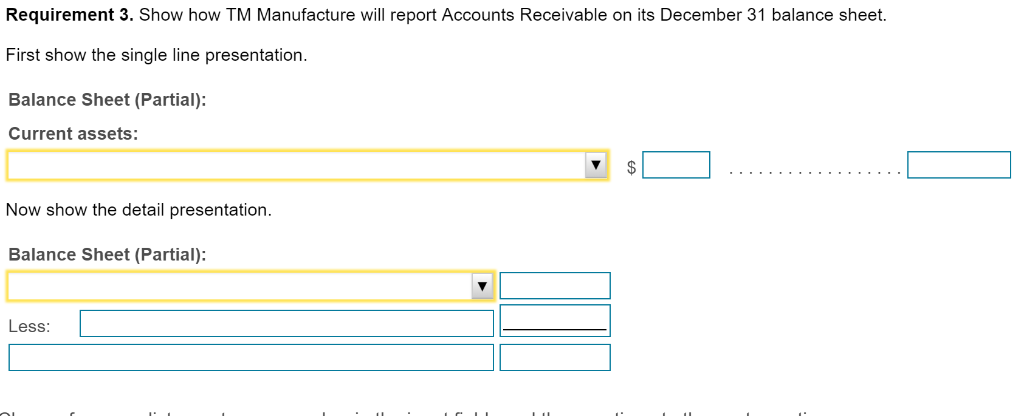

Age of Accounts Total Balance $340,000 Estimated uncollectible 1-30 Days 31-60 Days 61-90 Days Over 90 Days $140,000 $100,000 $70,000 $30,000 0.3% 2.0 % 10.0 % 50.0 % Allowance for Uncollectible Accounts Credit balance needed 1-30 31-60 61-90 Over 90 Subtotal Less: Unadjusted balance Adjusting entry amount The credit balance at December 31 in Allowance for Uncollectible Accounts should be$ The current balance is Thus, the current balance of the allowance account is Journal Entry Date Accounts Debit Credit Dec 31 Allowance for Uncollectible Accounts Requirement 3. Show how TM Manufacture will report Accounts Receivable on its December 31 balance sheet. First show the single line presentation. Balance Sheet (Partial): Current assets: Now show the detail presentation Balance Sheet (Partial): Less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started