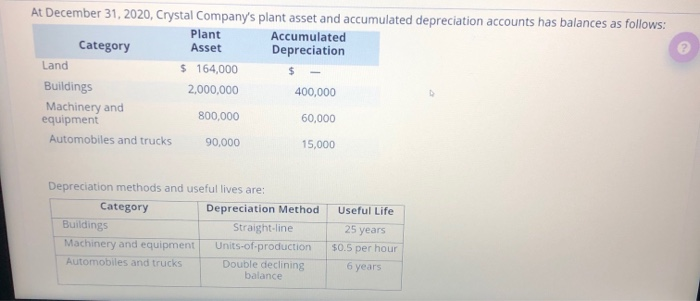

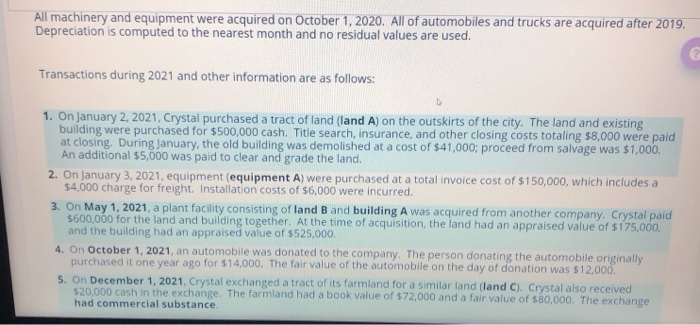

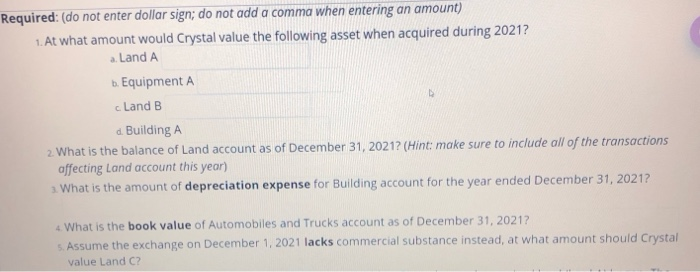

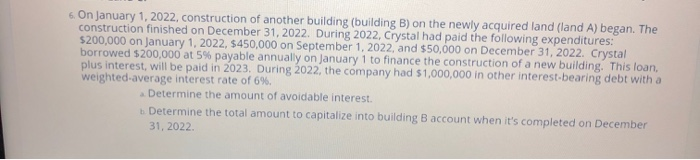

At December 31, 2020, Crystal Company's plant asset and accumulated depreciation accounts has balances as follows: Plant Accumulated Category Asset Depreciation Land $ 164,000 $ Buildings 2,000,000 400,000 Machinery and equipment 800,000 60,000 Automobiles and trucks 90,000 15,000 Useful Life Depreciation methods and useful lives are: Category Depreciation Method Buildings Straight-line Machinery and equipment Units-of-production Automobiles and trucks Double declining balance 25 years $0.5 per hour 6 years All machinery and equipment were acquired on October 1, 2020. All of automobiles and trucks are acquired after 2019. Depreciation is computed to the nearest month and no residual values are used. Transactions during 2021 and other information are as follows: > 1. On January 2, 2021, Crystal purchased a tract of land (land A) on the outskirts of the city. The land and existing building were purchased for $500,000 cash. Title search, insurance, and other closing costs totaling $8,000 were paid at closing. During January, the old building was demolished at a cost of $41,000; proceed from salvage was $1,000. An additional $5,000 was paid to clear and grade the land. 2. On January 3, 2021, equipment (equipment A) were purchased at a total invoice cost of $150,000, which includes a $4,000 charge for freight. Installation costs of $6,000 were incurred. 3. On May 1, 2021, a plant facility consisting of land B and building A was acquired from another company. Crystal paid $600,000 for the land and building together. At the time of acquisition, the land had an appraised value of $175,000, and the building had an appraised value of $525,000. 4. On October 1, 2021, an automobile was donated to the company. The person donating the automobile originally purchased it one year ago for $14,000. The fair value of the automobile on the day of donation was $12,000. 5. On December 1, 2021, Crystal exchanged a tract of its farmland for a similar land (land C). Crystal also received $20,000 cash in the exchange. The farmland had a book value of $72,000 and a fair value of $80,000. The exchange had commercial substance. Required: (do not enter dollar sign; do not add a comma when entering an amount) 1. At what amount would Crystal value the following asset when acquired during 2021? a Land A b. Equipment A c Land B d. Building A 2. What is the balance of Land account as of December 31, 2021? (Hint: make sure to include all of the transactions affecting Land account this year) 3. What is the amount of depreciation expense for Building account for the year ended December 31, 2021? 4. What is the book value of Automobiles and Trucks account as of December 31, 2021? 5. Assume the exchange on December 1, 2021 lacks commercial substance instead, at what amount should Crystal value Land C? 6. On January 1, 2022, construction of another building (building B) on the newly acquired land (land A) began. The construction finished on December 31, 2022. During 2022, Crystal had paid the following expenditures: $200,000 on January 1, 2022, $450,000 on September 1, 2022, and $50,000 on December 31, 2022. Crystal borrowed $200,000 at 5% payable annually on January 1 to finance the construction of a new building. This loan plus interest, will be paid in 2023. During 2022, the company had $1,000,000 in other interest-bearing debt with a weighted average interest rate of 6%. Determine the amount of avoidable interest b. Determine the total amount to capitalize into building B account when it's completed on December 31, 2022