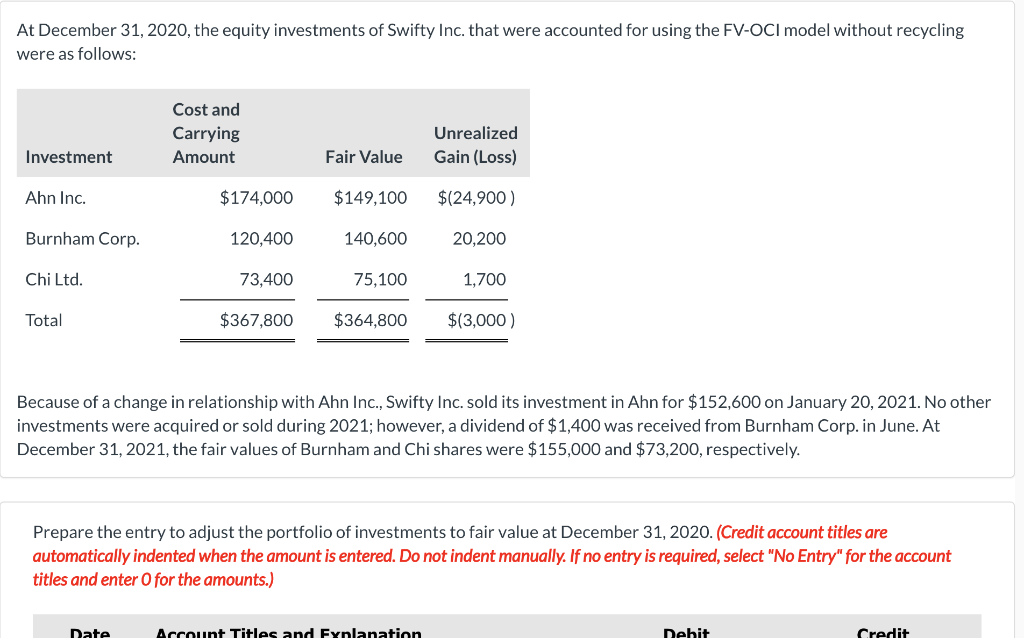

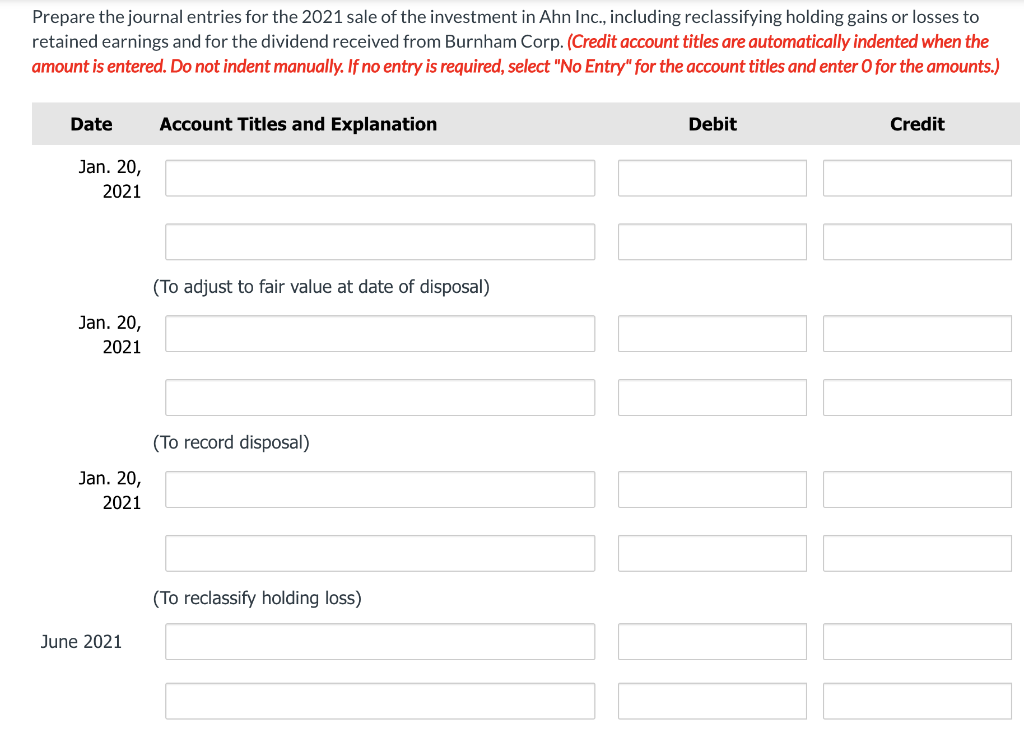

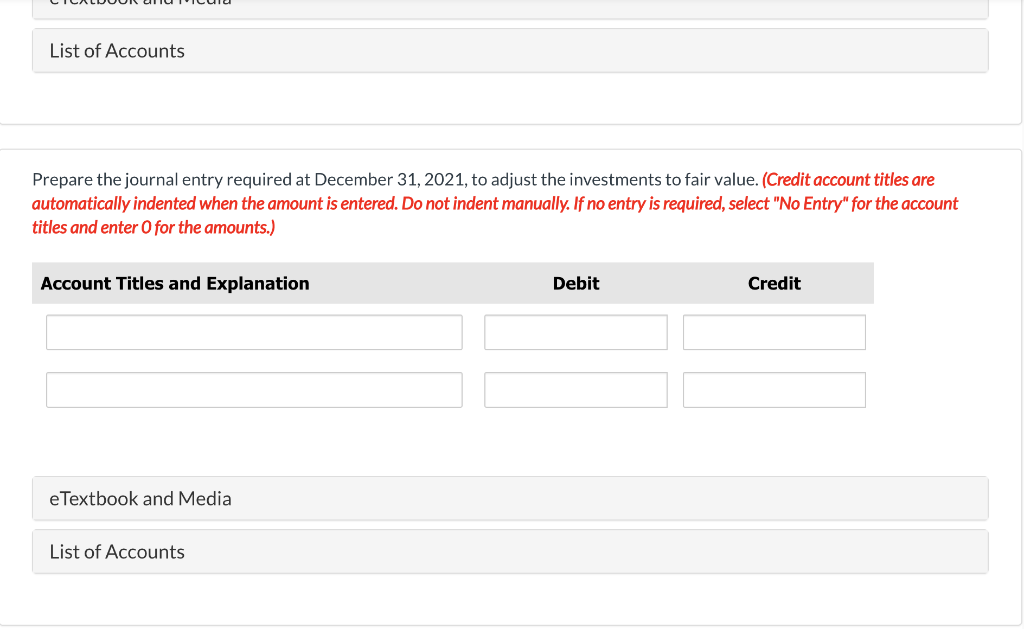

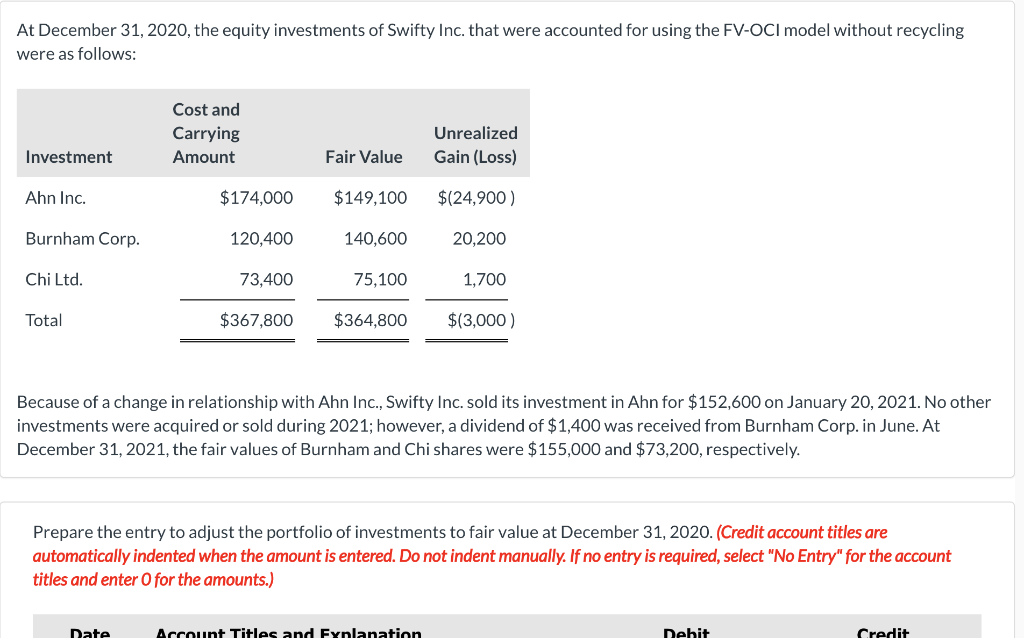

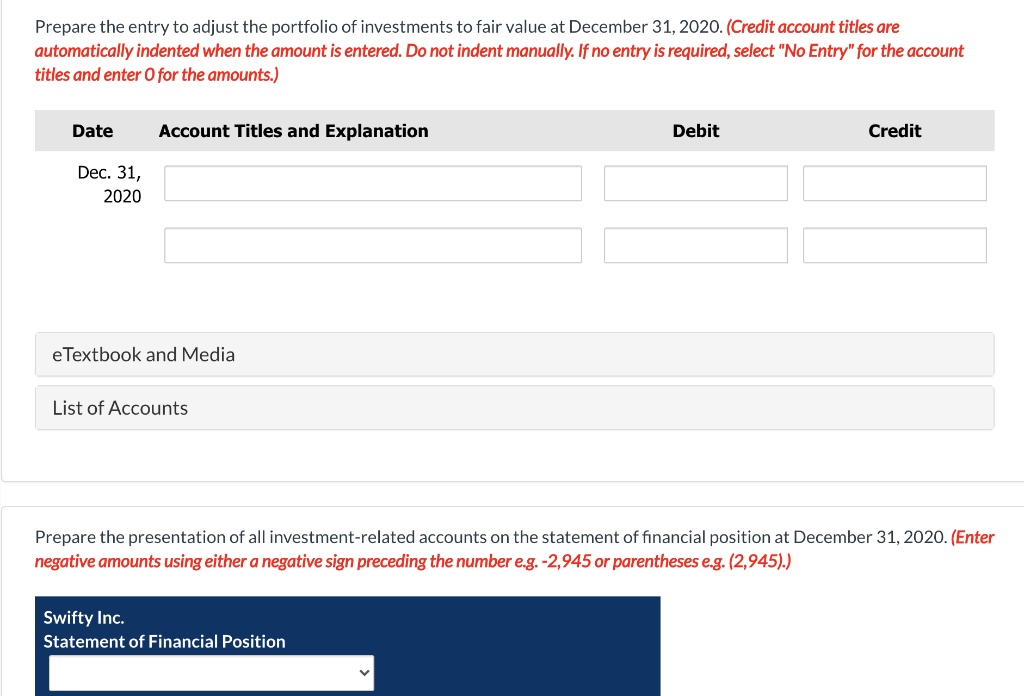

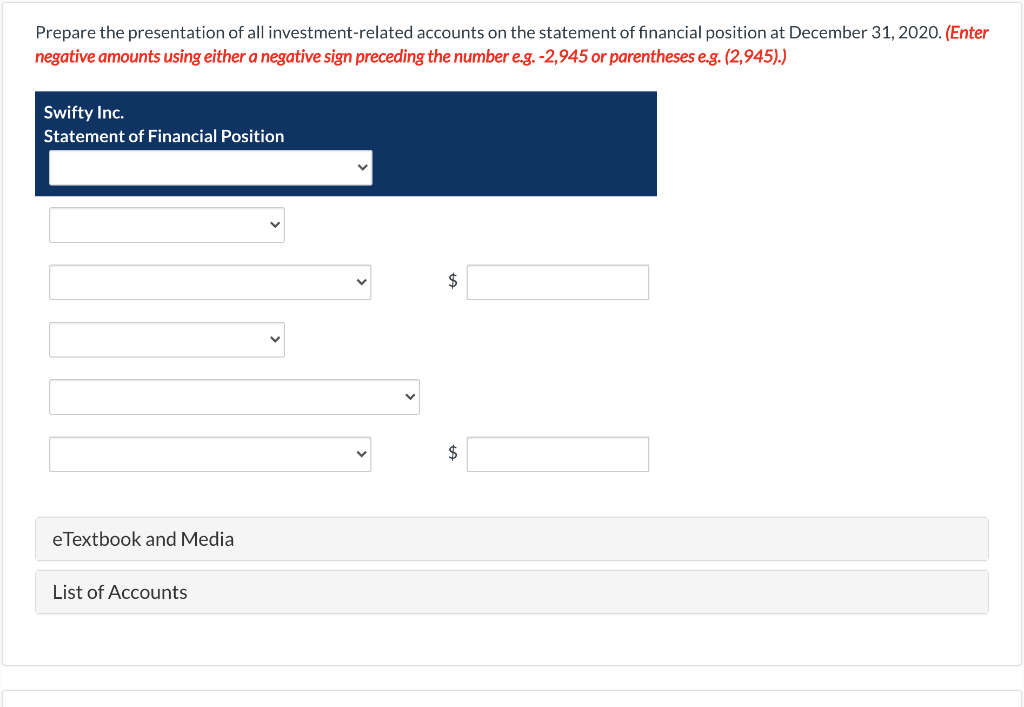

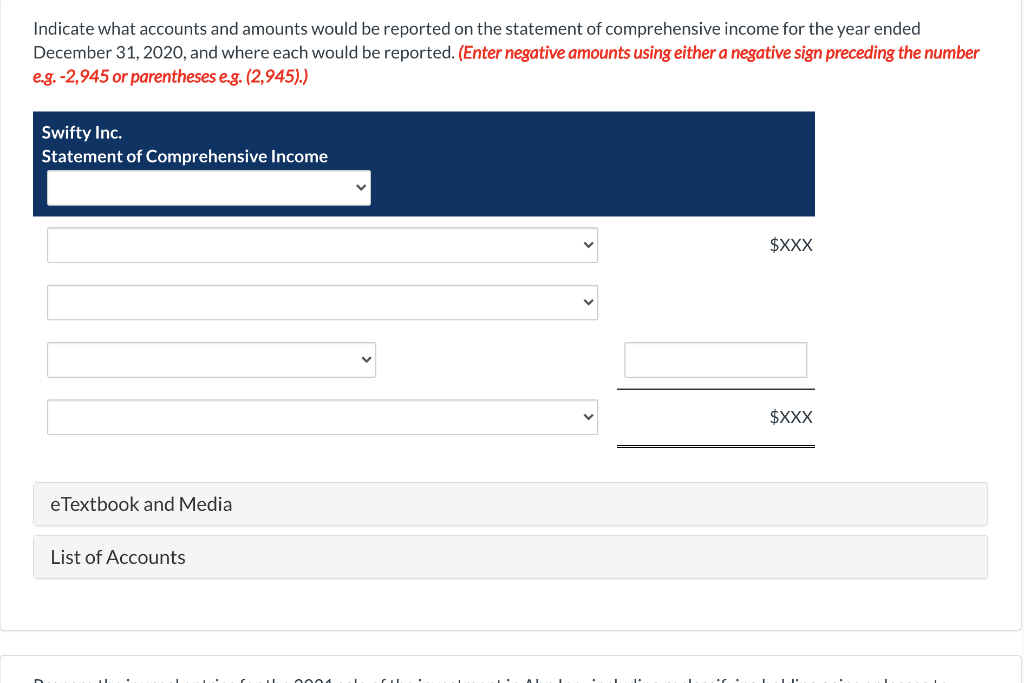

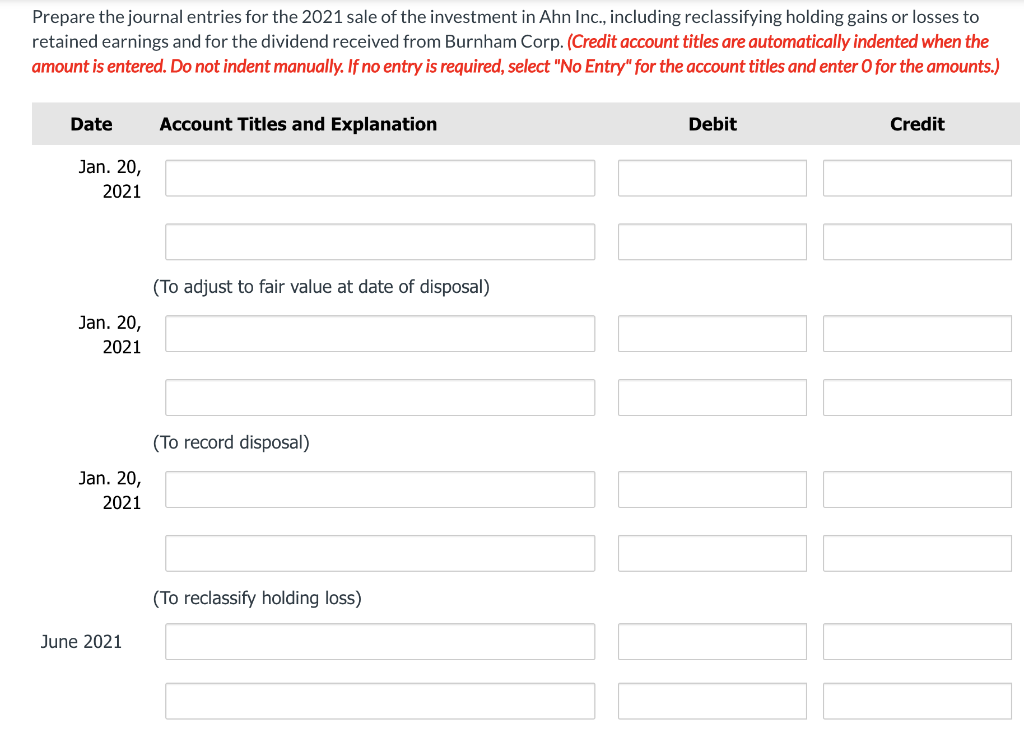

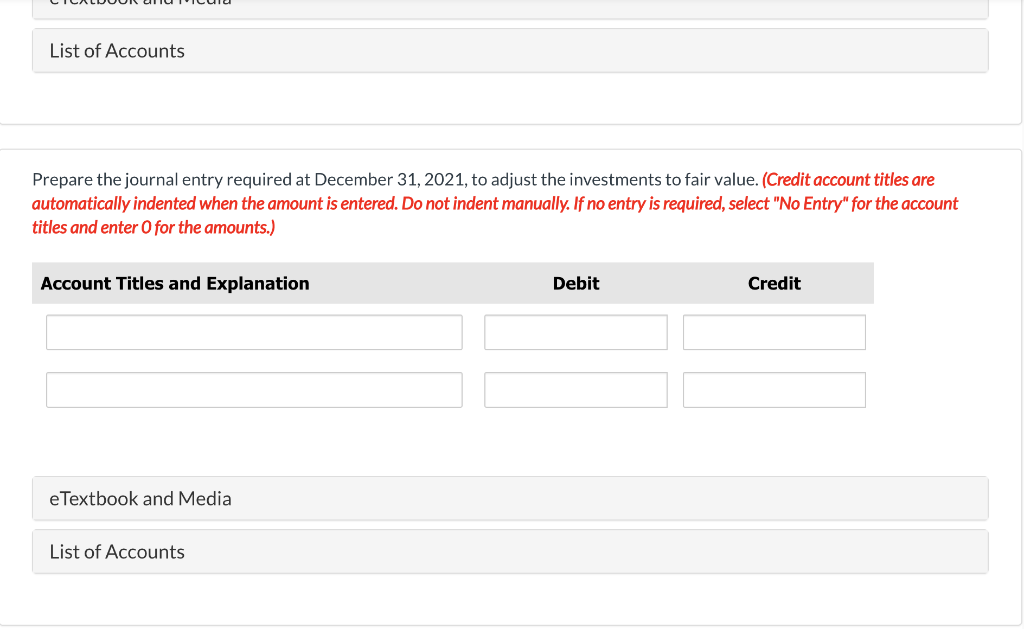

At December 31, 2020, the equity investments of Swifty Inc. that were accounted for using the FV-OCI model without recycling were as follows: Cost and Carrying Amount Unrealized Gain (Loss) Investment Fair Value Ahn Inc. $174,000 $149,100 $(24,900) Burnham Corp. 120,400 140,600 20,200 Chi Ltd. 73,400 75,100 1,700 Total $367,800 $364,800 $(3,000) Because of a change in relationship with Ahn Inc., Swifty Inc. sold its investment in Ahn for $152,600 on January 20, 2021. No other investments were acquired or sold during 2021; however, a dividend of $1,400 was received from Burnham Corp. in June. At December 31, 2021, the fair values of Burnham and Chi shares were $155,000 and $73,200, respectively. Prepare the entry to adjust the portfolio of investments to fair value at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Date Account Titles and Fynlanation Dehit Credit Prepare the entry to adjust the portfolio of investments to fair value at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 e Textbook and Media List of Accounts Prepare the presentation of all investment-related accounts on the statement of financial position at December 31, 2020. (Enter negative amounts using either a negative sign preceding the number eg.-2,945 or parentheses e.g. (2,945).) Swifty Inc. Statement of Financial Position V Prepare the presentation of all investment-related accounts on the statement of financial position at December 31, 2020. (Enter negative amounts using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Swifty Inc. Statement of Financial Position $ $ e Textbook and Media List of Accounts Indicate what accounts and amounts would be reported on the statement of comprehensive income for the year ended December 31, 2020, and where each would be reported. (Enter negative amounts using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Swifty Inc. Statement of Comprehensive Income $XXX $XXX e Textbook and Media List of Accounts Prepare the journal entries for the 2021 sale of the investment in Ahn Inc., including reclassifying holding gains or losses to retained earnings and for the dividend received from Burnham Corp. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 20, 2021 (To adjust to fair value at date of disposal) Jan. 20, 2021 (To record disposal) Jan. 20, 2021 (To reclassify holding loss) June 2021 List of Accounts Prepare the journal entry required at December 31, 2021, to adjust the investments to fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts