Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes

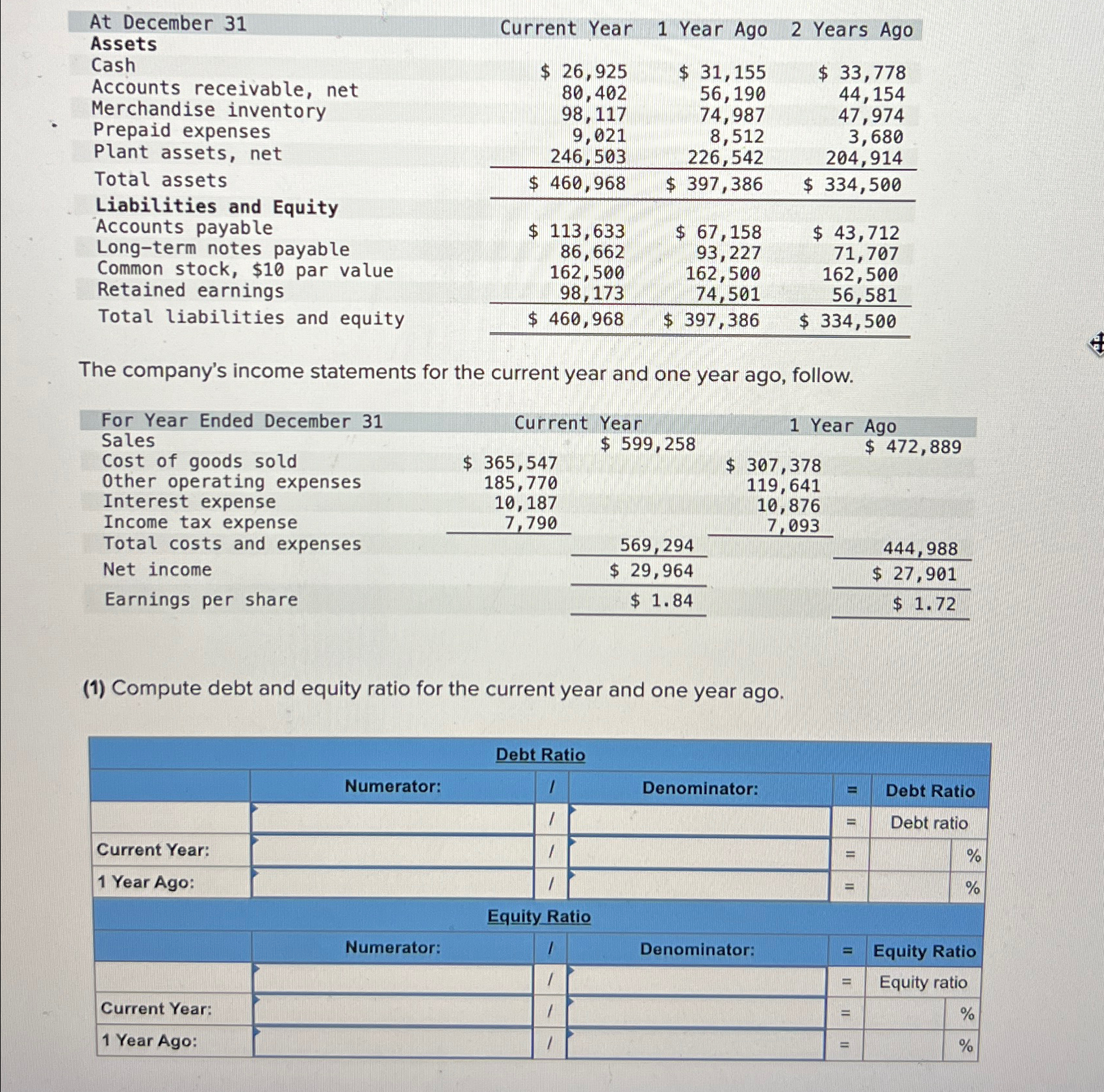

At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Year 1 Year Ago 2 Years Ago $ 26,925 80,402 $ 31,155 56,190 98,117 9,021 246,503 $ 460,968 $ 113,633 86,662 74,987 8,512 226,542 $ 397,386 $ 67,158 93,227 162,500 74,501 162,500 98,173 $ 460,968 $ 397,386 $ 33,778 44,154 47,974 3,680 204,914 $ 334,500 $ 43,712 71,707 162,500 56,581 $ 334,500 The company's income statements for the current year and one year ago, follow. 1 Year Ago $ 472,889 569,294 $ 29,964 $ 1.84 $ 307,378 119,641 10,876 7,093 444,988 $ 27,901 $ 1.72 For Year Ended December 31 Sales Current Year $ 599,258 Cost of goods sold 365,547 Other operating expenses 185,770 Interest expense 10,187 Income tax expense 7,790 Total costs and expenses Net income Earnings per share (1) Compute debt and equity ratio for the current year and one year ago. Current Year: 1 Year Ago: Current Year: 1 Year Ago: Debt Ratio Numerator: Denominator: = II II Debt Ratio Debt ratio % % Equity Ratio Numerator: Denominator: = Equity Ratio = Equity ratio = IL % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started