Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At each calendar year-end, Booyah Supply Co. uses the percent of accounts receivable method to estimate bad debts. On December 31, 2010, it has outstanding

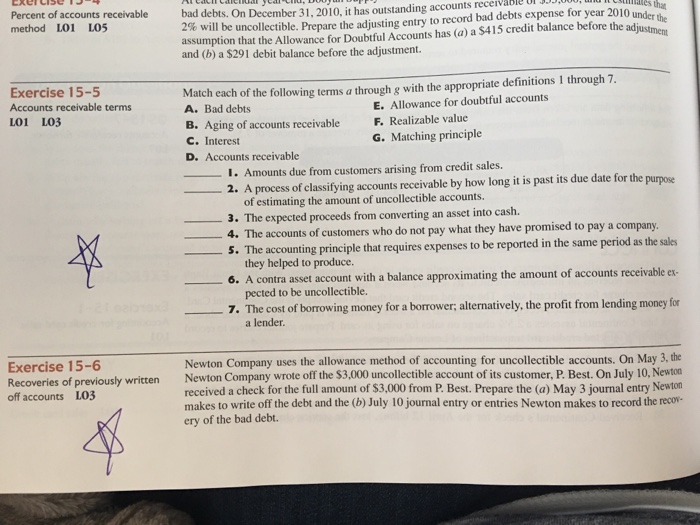

At each calendar year-end, Booyah Supply Co. uses the percent of accounts receivable method to estimate bad debts. On December 31, 2010, it has outstanding accounts receivable of $55,000, and it estimates that 2% will be uncollectible. Prepare the adjusting entry to record bad debts expense for year 2010 under the assumption that the Allowance for Doubtful Accounts has (a) a $415 credit balance before the adjustment and (b) a $291 debit balance before the adjustment. Match each of the following terms a through g with the appropriate definitions 1 through 7. A. Bad debts B. Aging of accounts receivable C. Interest D. Accounts receivable E. Allowance for doubtful accounts F. Realizable value G. Matching principle _____ 1. Amounts due from customers arising from credit sales. _____ 2. A process of classifying accounts receivable by how long it is past its due date for the purpose of estimating the amount of uncollectible accounts. _____ 3. The expected proceeds from converting an asset into cash. _____ 4. The accounts of customers who do not pay what they have promised to pay a company. _____ 5. The accounting principle that requires expenses to be reported in the same period as the sales they helped to produce. _____ 6. A contra asset account with a balance approximating the amount of accounts receivable expected to be uncollectible. _____ 7. The cost of borrowing money for a borrower: alternatively, the profit from lending money for a lender. Newton Company uses the allowance method of accounting for uncollectible accounts. On May 3, the Newton Company wrote off the $3,000 uncollectible account of its customer, P. Best. On July 10, Newton received a check for the full amount of $3,000 from P. Best. Prepare the (a) May 3 journal entry Newton makes to write off the debt and the (b) July 10 journal entry or entries Newton makes to record the recovery of the bad debt

At each calendar year-end, Booyah Supply Co. uses the percent of accounts receivable method to estimate bad debts. On December 31, 2010, it has outstanding accounts receivable of $55,000, and it estimates that 2% will be uncollectible. Prepare the adjusting entry to record bad debts expense for year 2010 under the assumption that the Allowance for Doubtful Accounts has (a) a $415 credit balance before the adjustment and (b) a $291 debit balance before the adjustment. Match each of the following terms a through g with the appropriate definitions 1 through 7. A. Bad debts B. Aging of accounts receivable C. Interest D. Accounts receivable E. Allowance for doubtful accounts F. Realizable value G. Matching principle _____ 1. Amounts due from customers arising from credit sales. _____ 2. A process of classifying accounts receivable by how long it is past its due date for the purpose of estimating the amount of uncollectible accounts. _____ 3. The expected proceeds from converting an asset into cash. _____ 4. The accounts of customers who do not pay what they have promised to pay a company. _____ 5. The accounting principle that requires expenses to be reported in the same period as the sales they helped to produce. _____ 6. A contra asset account with a balance approximating the amount of accounts receivable expected to be uncollectible. _____ 7. The cost of borrowing money for a borrower: alternatively, the profit from lending money for a lender. Newton Company uses the allowance method of accounting for uncollectible accounts. On May 3, the Newton Company wrote off the $3,000 uncollectible account of its customer, P. Best. On July 10, Newton received a check for the full amount of $3,000 from P. Best. Prepare the (a) May 3 journal entry Newton makes to write off the debt and the (b) July 10 journal entry or entries Newton makes to record the recovery of the bad debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started