Answered step by step

Verified Expert Solution

Question

1 Approved Answer

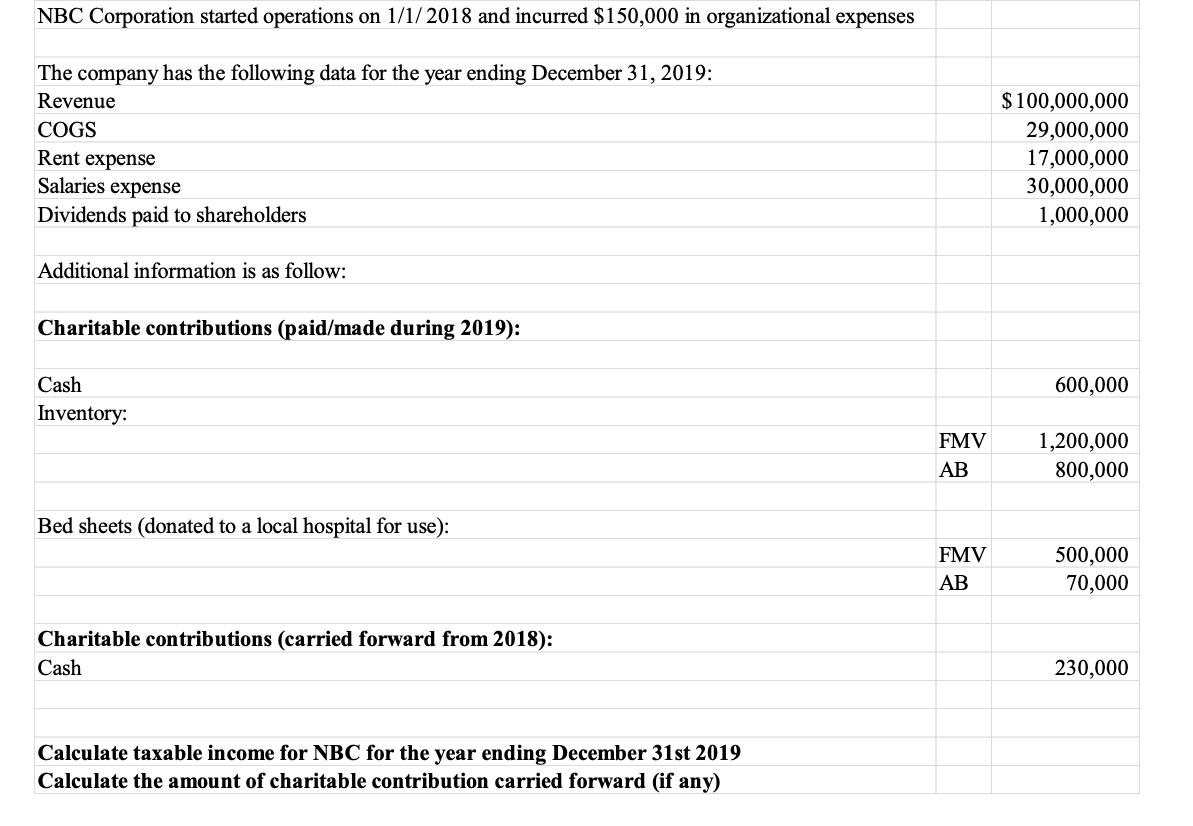

NBC Corporation started operations on 1/1/2018 and incurred $150,000 in organizational expenses The company has the following data for the year ending December 31,

NBC Corporation started operations on 1/1/2018 and incurred $150,000 in organizational expenses The company has the following data for the year ending December 31, 2019: Revenue COGS Rent expense Salaries expense Dividends paid to shareholders Additional information is as follow: Charitable contributions (paid/made during 2019): Cash Inventory: Bed sheets (donated to a local hospital for use): Charitable contributions (carried forward from 2018): Cash Calculate taxable income for NBC for the year ending December 31st 2019 Calculate the amount of charitable contribution carried forward (if any) FMV AB FMV AB $100,000,000 29,000,000 17,000,000 30,000,000 1,000,000 600,000 1,200,000 800,000 500,000 70,000 230,000

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Taxable income for NBC for the year ending December 31st 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started