Answered step by step

Verified Expert Solution

Question

1 Approved Answer

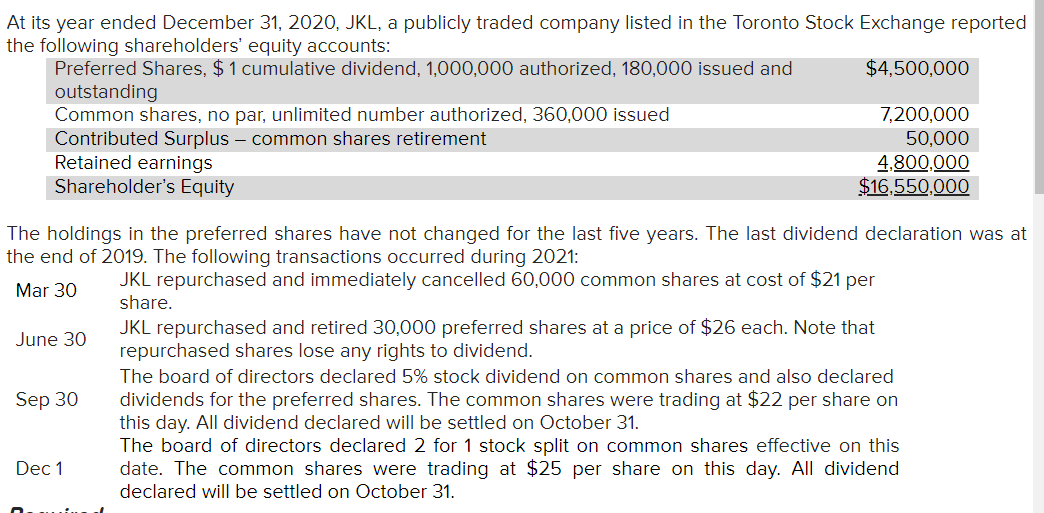

At its year ended December 31, 2020, JKL, a publicly traded company listed in the Toronto Stock Exchange reported the following shareholders' equity accounts: Preferred

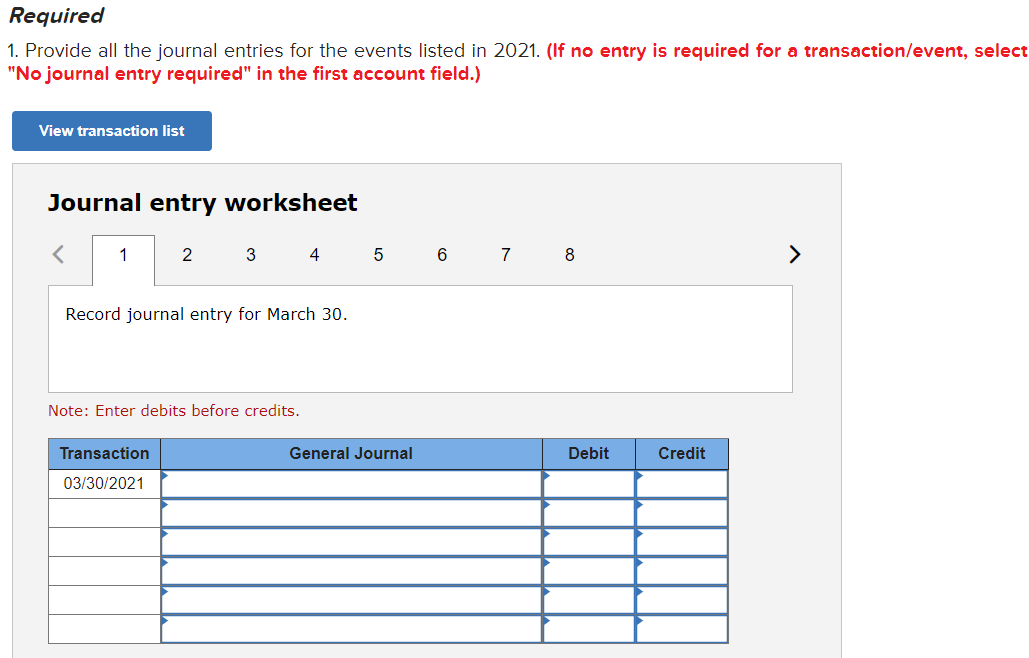

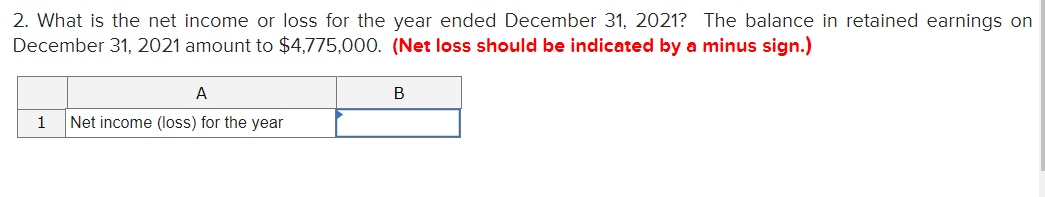

At its year ended December 31, 2020, JKL, a publicly traded company listed in the Toronto Stock Exchange reported the following shareholders' equity accounts: Preferred Shares, $ 1 cumulative dividend, 1,000,000 authorized, 180,000 issued and $4,500,000 outstanding Common shares, no par, unlimited number authorized, 360,000 issued 7,200,000 Contributed Surplus common shares retirement 50,000 Retained earnings 4,800,000 Shareholder's Equity $16,550,000 The holdings in the preferred shares have not changed for the last five years. The last dividend declaration was at the end of 2019. The following transactions occurred during 2021: JKL repurchased and immediately cancelled 60,000 common shares at cost of $21 per Mar 30 share. JKL repurchased and retired 30,000 preferred shares at a price of $26 each. Note that June 30 repurchased shares lose any rights to dividend. The board of directors declared 5% stock dividend on common shares and also declared Sep 30 dividends for the preferred shares. The common shares were trading at $22 per share on this day. All dividend declared will be settled on October 31. The board of directors declared 2 for 1 stock split on common shares effective on this Dec 1 date. The common shares were trading at $25 per share on this day. All dividend declared will be settled on October 31. Required 1. Provide all the journal entries for the events listed in 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record journal entry for March 30. Note: Enter debits before credits. Transaction General Journal Debit Credit 03/30/2021 2. What is the net income or loss for the year ended December 31, 2021? The balance in retained earnings on December 31, 2021 amount to $4,775,000. (Net loss should be indicated by a minus sign.) B 1 Net income (loss) for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started