Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At January 1, 2018, Roger Imports Inc. reported the following on its statement of financial position: Accounts receivable $1,772,000 Allowance for doubtful accounts 126,000 During

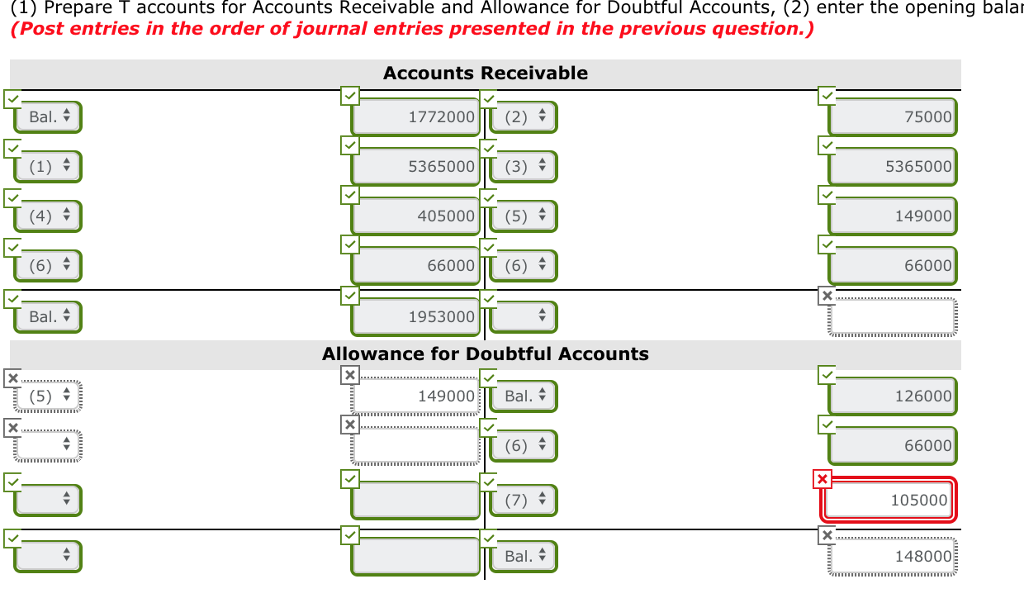

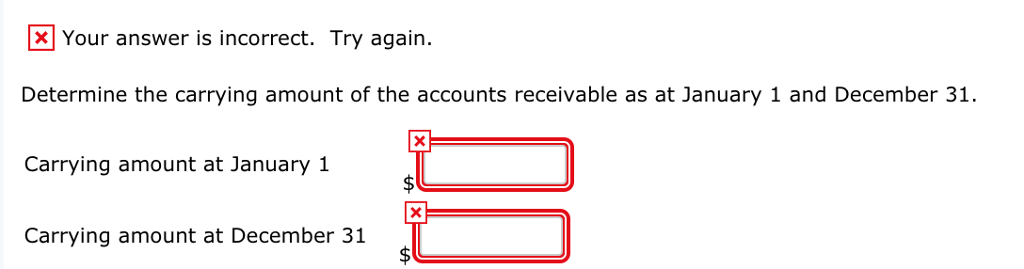

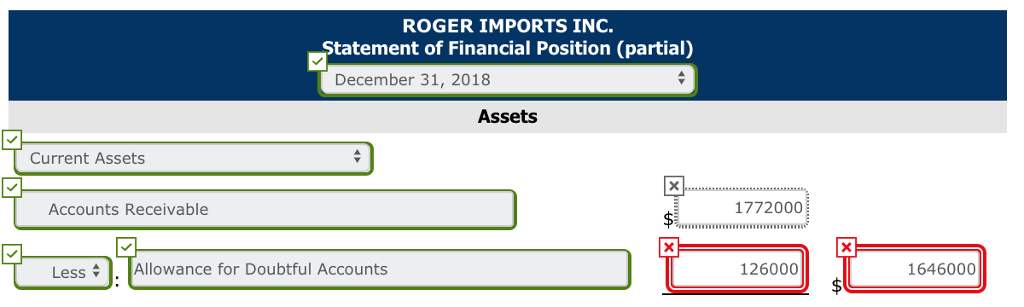

At January 1, 2018, Roger Imports Inc. reported the following on its statement of financial position:

| Accounts receivable | $1,772,000 | ||

| Allowance for doubtful accounts | 126,000 |

During 2018, the company had the following summary transactions for receivables:

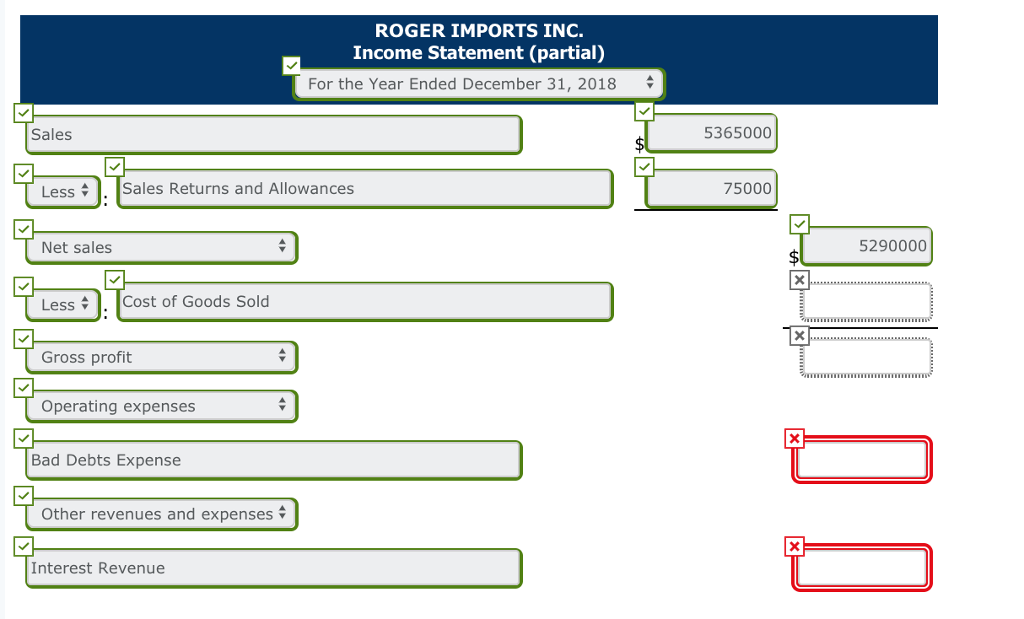

| 1. | Sales on account, $5,365,000; Cost of goods sold, $2,964,000 | ||

| 2. | Sales returns and allowances, $75,000; Cost of goods returned to inventory, $40,000 | ||

| 3. | Collections of accounts receivable, $5,365,000 | ||

| 4. | Interest added to overdue accounts, $405,000 | ||

| 5. | Write offs of accounts receivable deemed uncollectible, $149,000 | ||

| 6. | Collection of accounts previously written off as uncollectible, $66,000 | ||

| 7. | After considering all of the above transactions, total estimated uncollectible accounts, $105,000 |

Prepare journal entries to record each of the above summary transactions

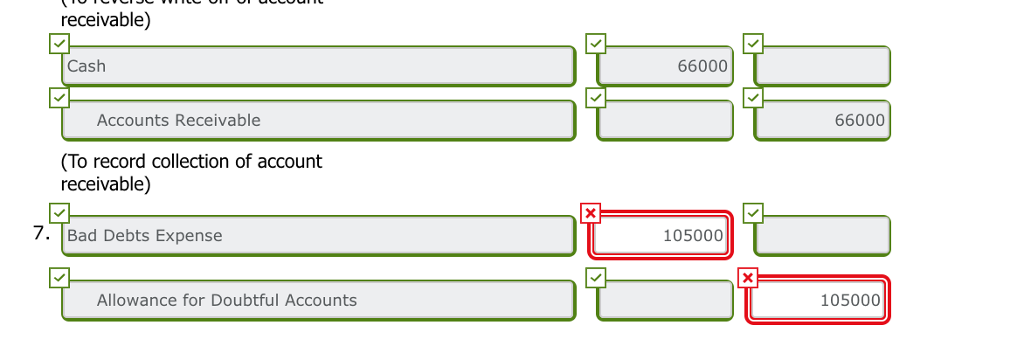

receivable) Cash 66000 Accounts Receivable 66000 (To record collection of account receivable) /. Bad Debts Expense 105000 Allowance for Doubtful Accounts 105000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started