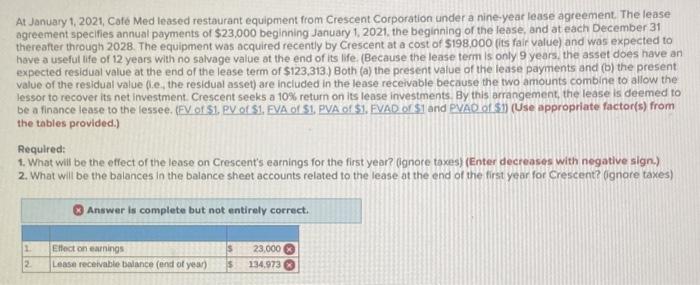

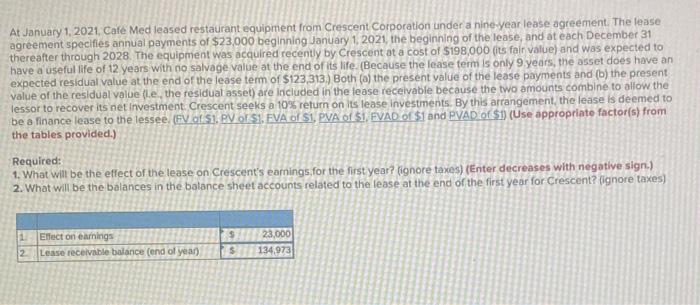

At January 1, 2021, Caf Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $23,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 thereafter through 2028. The equipment was acquired recently by Crescent at a cost of $198,000 (its fair value) and was expected to have a useful life of 12 years with no salvage value of the end of its life (Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $123,313) Both (a) the present value of the lease payments and (b) the present value of the residual value (le, the residual asset) are included in the lease receivable because the two amounts combine to allow the lessor to recover its net investment Crescent seeks a 10% return on its lease investments. By this arrangement, the lease is deemed to be a finance lease to the lessee. (FV of S1, PV of S1, EVA of 51. PVA of $1. FVAD of S1 and PVAD O $11 (Use appropriate factor(s) from the tables provided) Required: 1. What will be the effect of the lease on Crescent's earnings for the first year? (gnore taxes) (Enter decreases with negative sign.) 2. What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Crescent? (gnore taxes) Answer is complete but not entirely correct. 1 2 Effect on earnings ease receivable balance (and of year) 23.000 134.973 At January 1, 2021, Cafe Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $23,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 thereafter through 2028. The equipment was acquired recently by Crescent at a cost of $198.000 (its fair value) and was expected to have a useful life of 12 years with no salvage value at the end of its life. (Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $123,313. Both (a) the present value of the lease payments and (b) the present value of the residual value (le the residual asset) are included in the lease receivable because the two amounts combine to allow the lessor to recover its net investment Crescent seeks a 10% return on its lease investments. By this arrangement, the lease is deemed to be a finance lease to the lessee (FV of S1, PV of S1, FVA of S1, PVA of S1, FVAD of $1 and PVAD ($1 (Use appropriate factor(s) from the tables provided.) Required: 1. What will be the effect of the lease on Crescent's earnings for the first year? (ignore taxes) (Enter decreases with negative sign.) 2. What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Crescent? [ignore taxes) 1 Effect on earnings 2 Lease receivable balance (end of year) 1923,000 134 973