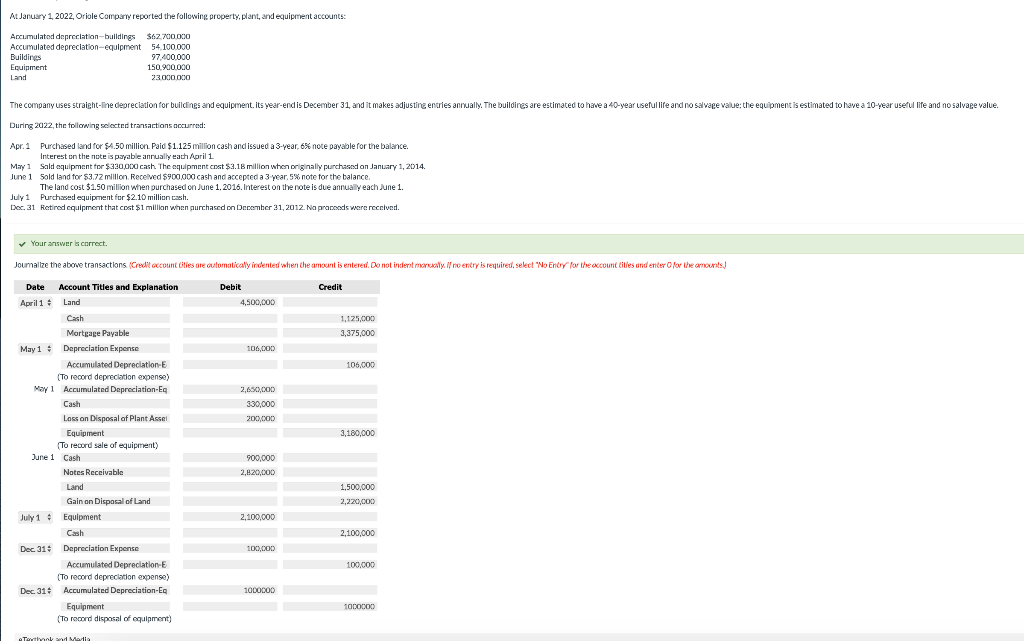

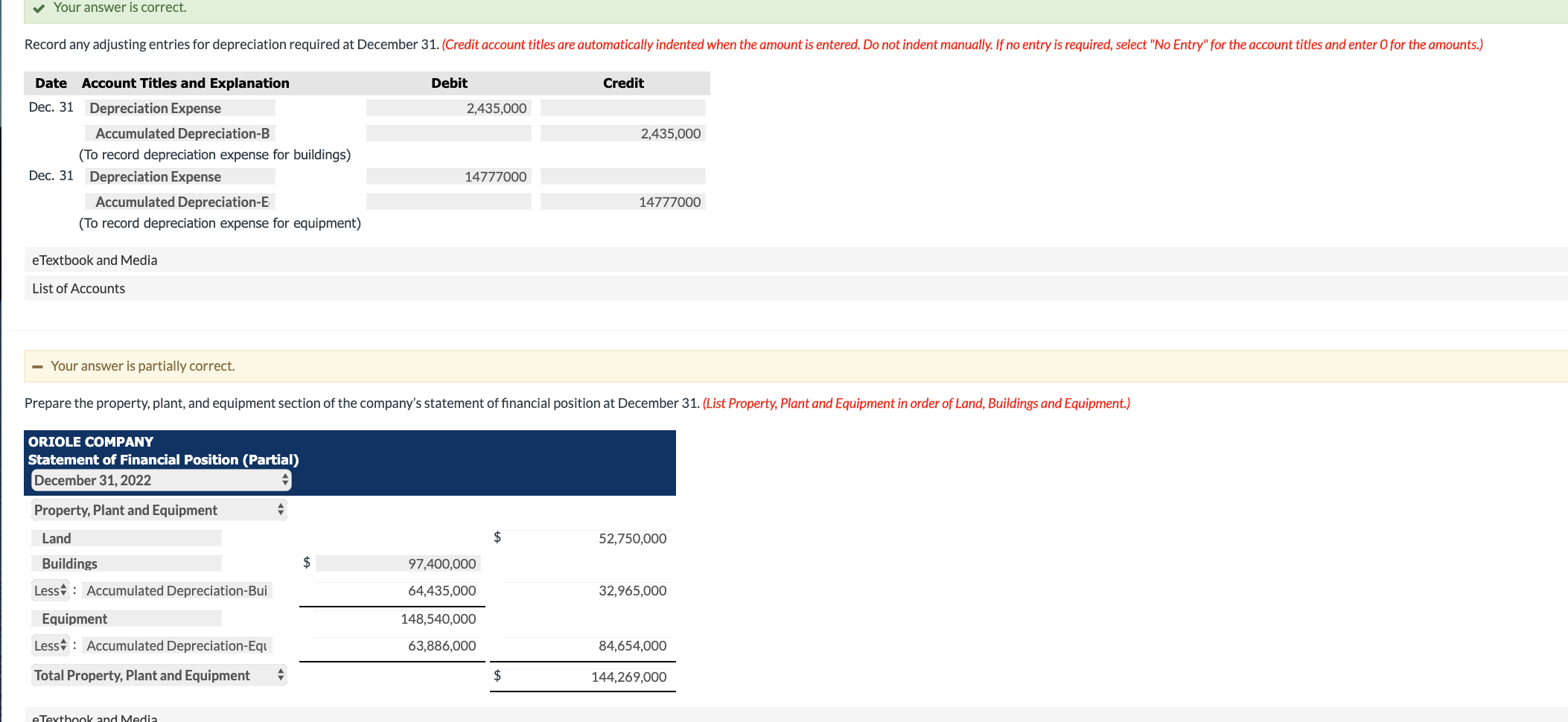

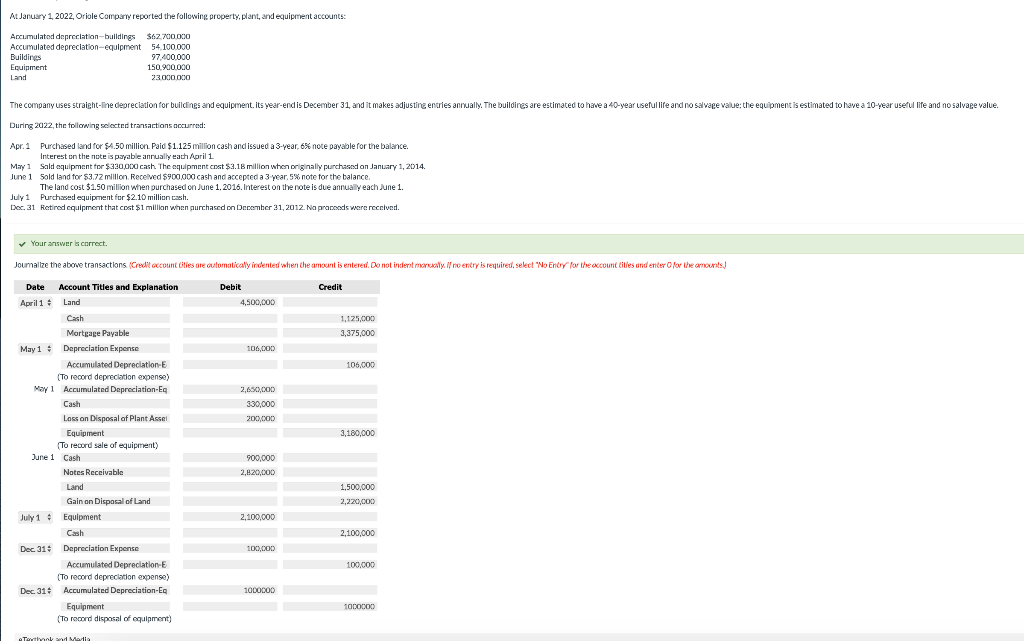

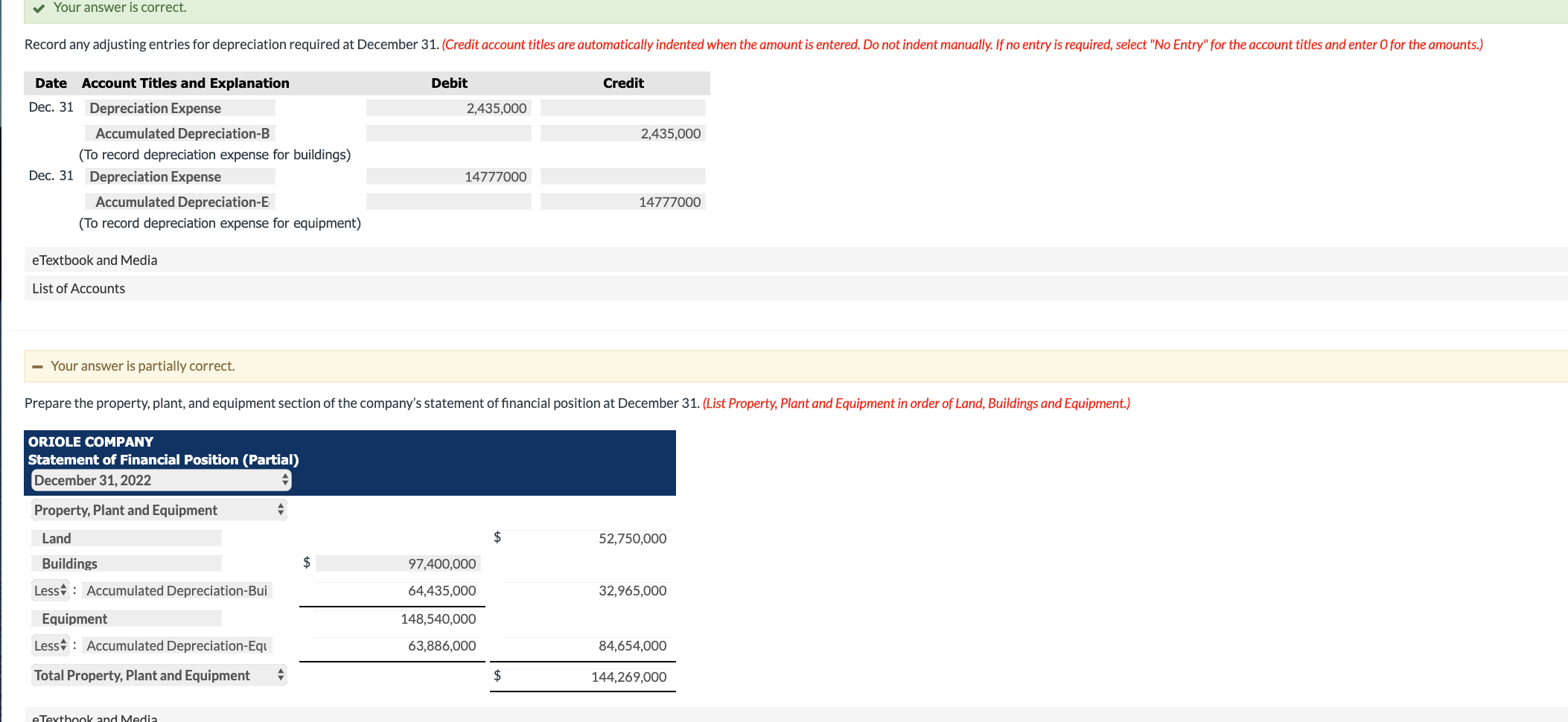

At January 1, 2022, Oriole Comparty reported the following property, plant, and equipment accounts: Accumulated depreciation buildings Accumulated depreciation equipment Buildings Equipment Land $62.700.000 54.100.000 97.400.000 150.900.000 23000.000 The company uses straight-line depreciation for buildings and equipment. its year-endis December 31, and it makes adjusting entries annually. The buildines are estimated to have a 40-year useful life and no salvace value the equipment is estimated to have a 10-year useful life and no salvage value. During 2022, the following selected transactions occurred: Apr 1 Purchased land for $4,50 million paid $1.125 million cash and issued a 3-year 656 note payable for the balance. Interest on the note is payable annually each April 1 May 1 Sald equipment for $330.000 cash. The equipment cost $3.15 million when originally purchased on January 1, 2014. June 1 Sald land for $3.72 million Received $900.000 cash and accepted a 3 year,5% note for the balance. The land cost $1.50 million when purchased on June 1, 2016. Interest on the note is due annually each June 1. July 1 Purchased equipment for $2.10 million cash. Dec 31 Retired equipment that cost $1 million when purchased on December 31, 2012. Na proceeds were received Your answer is correct. Journalize the above transactions (Credit account cities are automatically indented when the amount is entered. Do not inderstmarcally. If no entry is required. select "No Entry for the account cities and enter for the amounts Credit Debit 4,500,000 1,125.000 3,375,000 106,000 106,000 Date Account Titles and Explanation April 1 # Land Cash Mortgage Payable May 14 Depreciation Expense Accumulated Depreciation-E To record depreciation expense) May 1 Accumulated Depreciation Eq Cash Loss on Disposal of Plant Assel Equipment To record sale of equipment) June 1 Cash Notes Receivable Land Gain on Disposal of Land July 1 + Equipment 2,650,000 330,000 200,000 3,180,000 900,000 2,820,000 1,500,000 2,220,000 2,100,000 2.100,000 Dec 31+ 100,000 100,000 Depreciation Expense Accumulated Depreciation-E (To record depreciation expense) Accumulated Depreciation-Eg Dec. 31+ 1000000 1000000 Equipment (To record disposal of equipment) Torthand Media Your answer is correct. Record any adjusting entries for depreciation required at December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit 2,435,000 2,435,000 Date Account Titles and Explanation Dec. 31 Depreciation Expense Accumulated Depreciation-B (To record depreciation expense for buildings) Dec. 31 Depreciation Expense Accumulated Depreciation-E (To record depreciation expense for equipment) 14777000 14777000 e Textbook and Media List of Accounts - Your answer is partially correct. Prepare the property, plant, and equipment section of the company's statement of financial position at December 31. (List Property, Plant and Equipment in order of Land, Buildings and Equipment.) ORIOLE COMPANY Statement of Financial Position (Partial) December 31, 2022 Property, Plant and Equipment 52,750,000 $ 97,400,000 64,435,000 32,965,000 Land Buildings Less : Accumulated Depreciation-Bui Equipment Less : Accumulated Depreciation-Equ Total Property, Plant and Equipment 148,540,000 63,886,000 84,654,000 144,269,000 e Textbook and Media