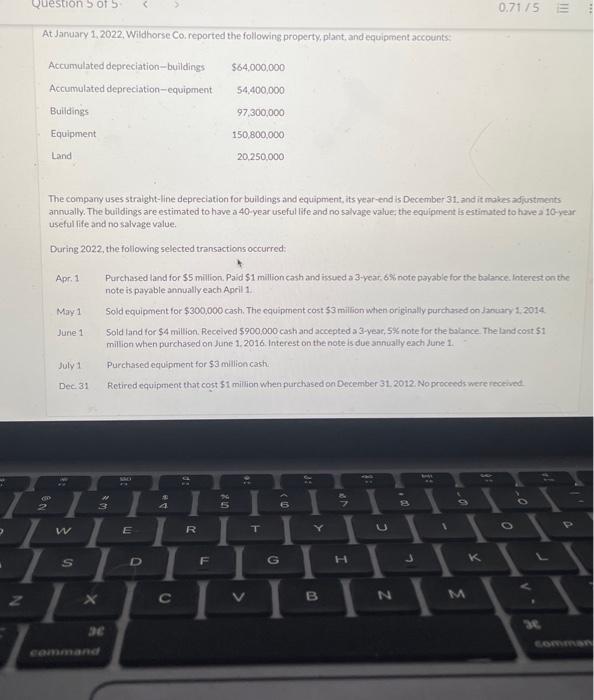

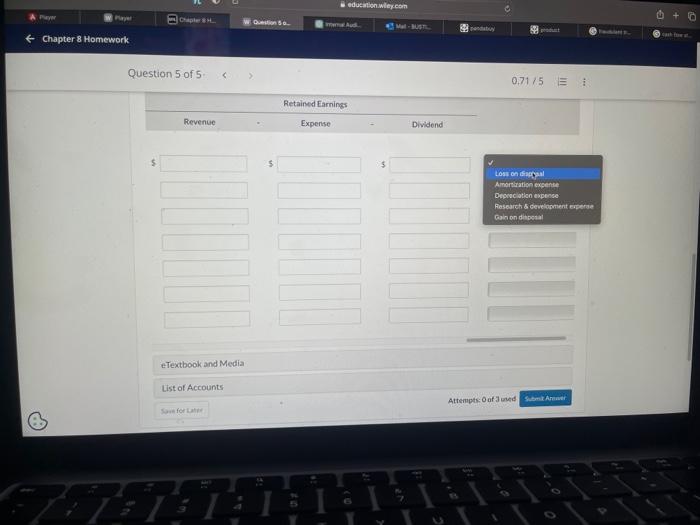

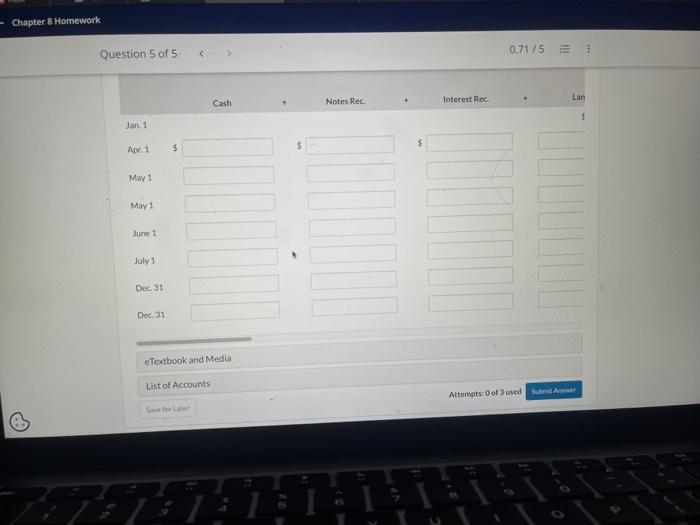

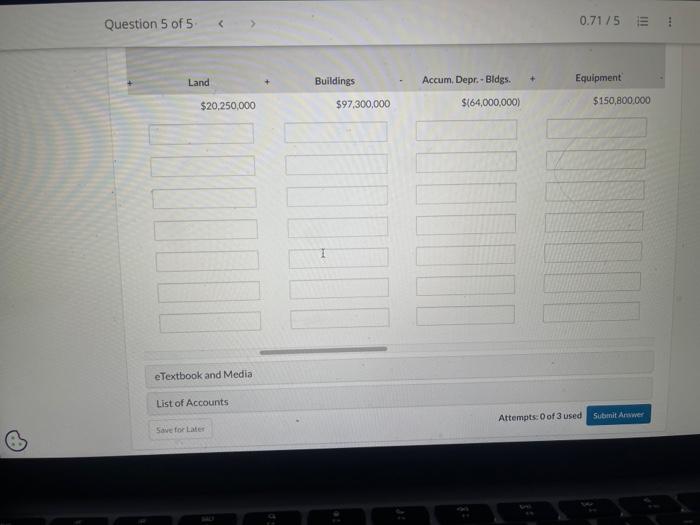

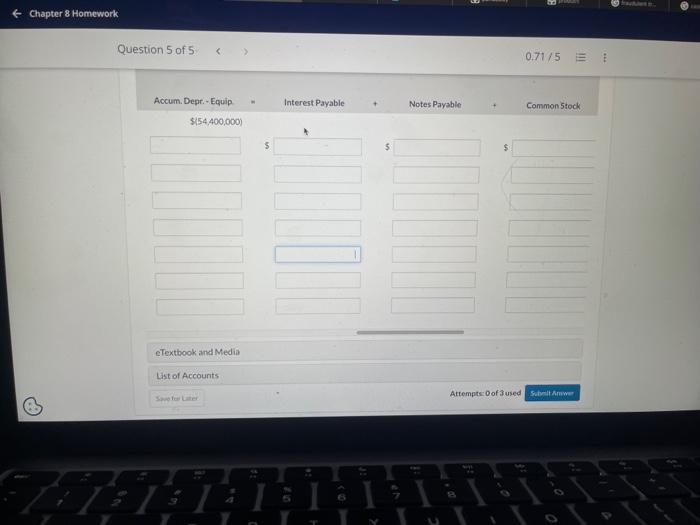

At Jaruary 1,2022, Wildhorse Co, reported the following property, plant, and equipment accounts: The company uses straight-line depreciation for buildings and equipment, its year-end is December 31 . and it makes adjustments annually. The buildings are estimated to have a 40 year useful life and no salvage value, the equipment is estimated to hrve a 10 -year useful life and no salvage value. During 2022, the following selected transactions occurred: Apr. 1 Purchased land for $5 million. Paid $1 millioncash and issued a 3 year, 6$ note payabie for the balance, Interest on the note is payable anmuallyeach April 1. May 1 Sold equipment for $300,000 cash. The equipment cost $3 million when originally purchared on January 1,2014. June 1 Sold land for $4 million. Received $900,000 cash and accepted a 3 -year, 5% note for the batance. The land cont $1 million when purchased on June 1.2016. Interest on the note is due annually each June 1. July 1 Purchased equipment for $3 millioncash. Dec.31 Retired equipment that cost 51 milion when purchased on December 31.2012 . No procecds wererecerved Chapter 8 Homework Question 5 of 50.71/5 At Jaruary 1,2022, Wildhorse Co, reported the following property, plant, and equipment accounts: The company uses straight-line depreciation for buildings and equipment, its year-end is December 31 . and it makes adjustments annually. The buildings are estimated to have a 40 year useful life and no salvage value, the equipment is estimated to hrve a 10 -year useful life and no salvage value. During 2022, the following selected transactions occurred: Apr. 1 Purchased land for $5 million. Paid $1 millioncash and issued a 3 year, 6$ note payabie for the balance, Interest on the note is payable anmuallyeach April 1. May 1 Sold equipment for $300,000 cash. The equipment cost $3 million when originally purchared on January 1,2014. June 1 Sold land for $4 million. Received $900,000 cash and accepted a 3 -year, 5% note for the batance. The land cont $1 million when purchased on June 1.2016. Interest on the note is due annually each June 1. July 1 Purchased equipment for $3 millioncash. Dec.31 Retired equipment that cost 51 milion when purchased on December 31.2012 . No procecds wererecerved Chapter 8 Homework Question 5 of 50.71/5