Answered step by step

Verified Expert Solution

Question

1 Approved Answer

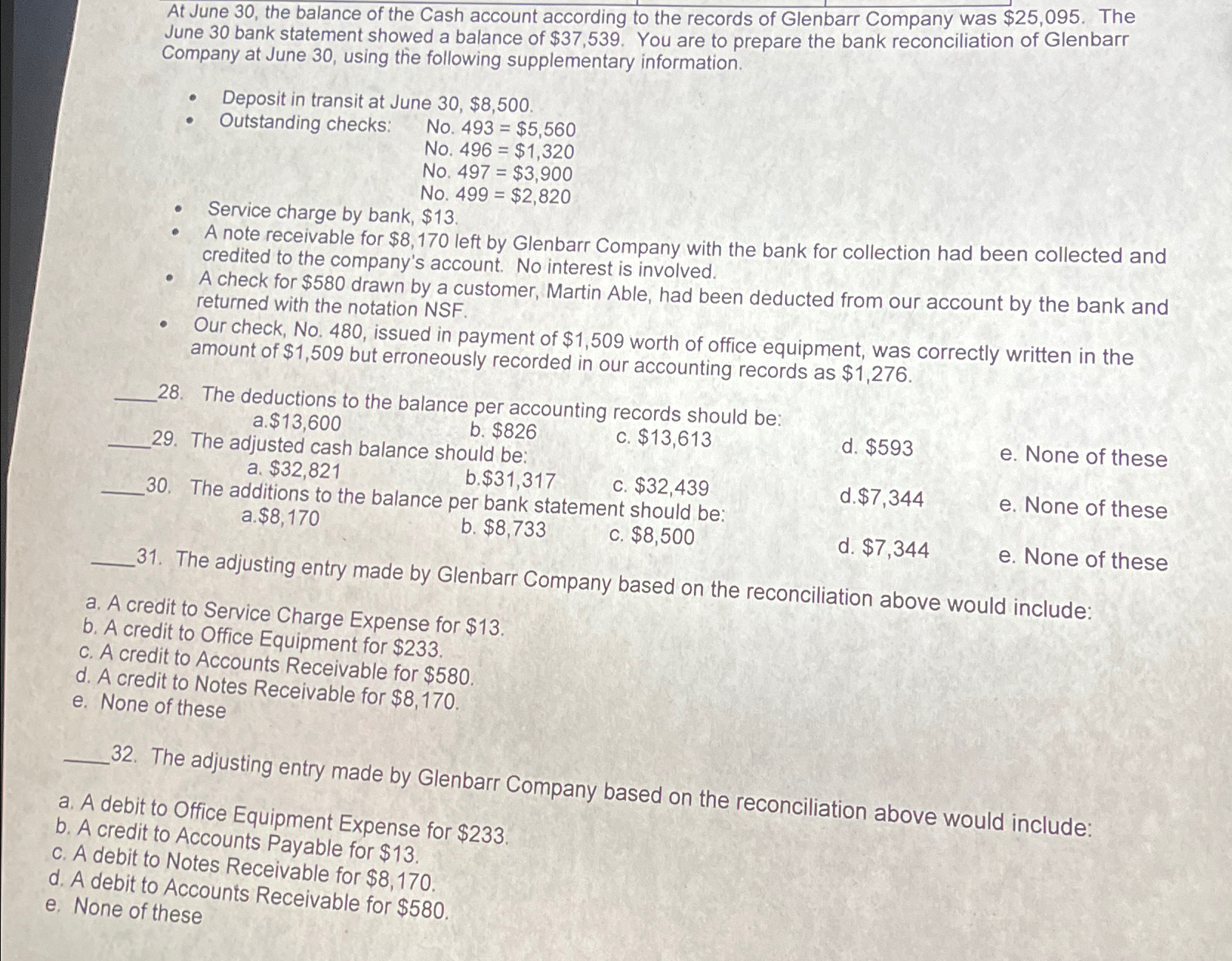

At June 3 0 , the balance of the Cash account according to the records of Glenbarr Company was $ 2 5 , 0 9

At June the balance of the Cash account according to the records of Glenbarr Company was $ The June bank statement showed a balance of $ You are to prepare the bank reconciliation of Glenbarr Company at June using the following supplementary information.

Deposit in transit at June $

Outstanding checks: No$

No$

No$

No$

Service charge by bank, $

A note receivable for $ left by Glenbarr Company with the bank for collection had been collected and credited to the company's account. No interest is involved.

A check for $ drawn by a customer, Martin Able, had been deducted from our account by the bank and returned with the notation NSF

Our check, No issued in payment of $ worth of office equipment, was correctly written in the amount of $ but erroneously recorded in our accounting records as $

The deductions to the balance per accounting records should be:

a $

b $

c $

d $

e None of these

a $

b $

c $

The adjusted cash balance should be: $ $ $

The additions the balance per bank statement should :

a $

b $

c $

d $

e None of these

d $

e None of these

The adjusting entry made by Glenbarr Company based on the reconciliation above would include:

a A credit to Service Charge Expense for $

b A credit to Office Equipment for $

c A credit to Accounts Receivable for $

d A credit to Notes Receivable for $

e None of these

The adjusting entry made by Glenbarr Company based on the reconciliation above would include:

a A debit to Office Equipment Expense for $

b A credit to Accounts Payable for $

c A debit to Notes Receivable for $

d A debit to Accounts Receivable for $

e None of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started