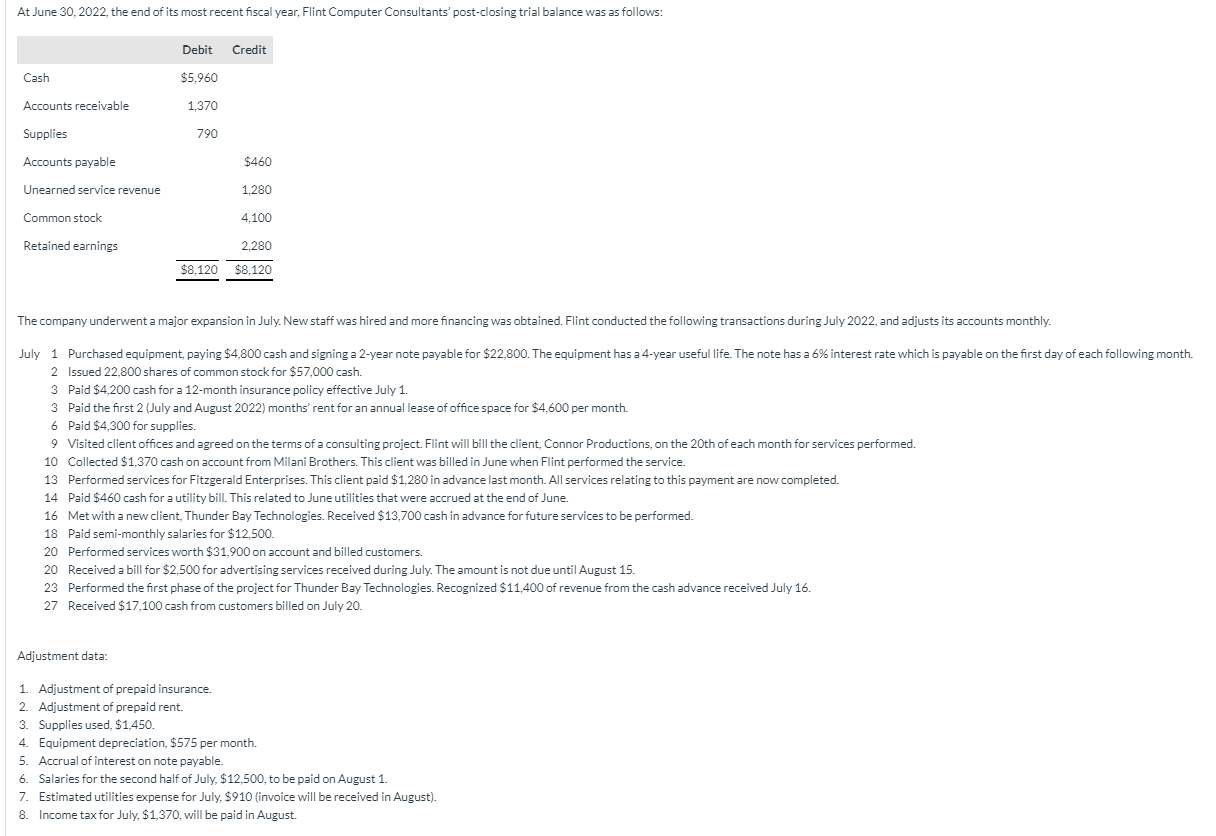

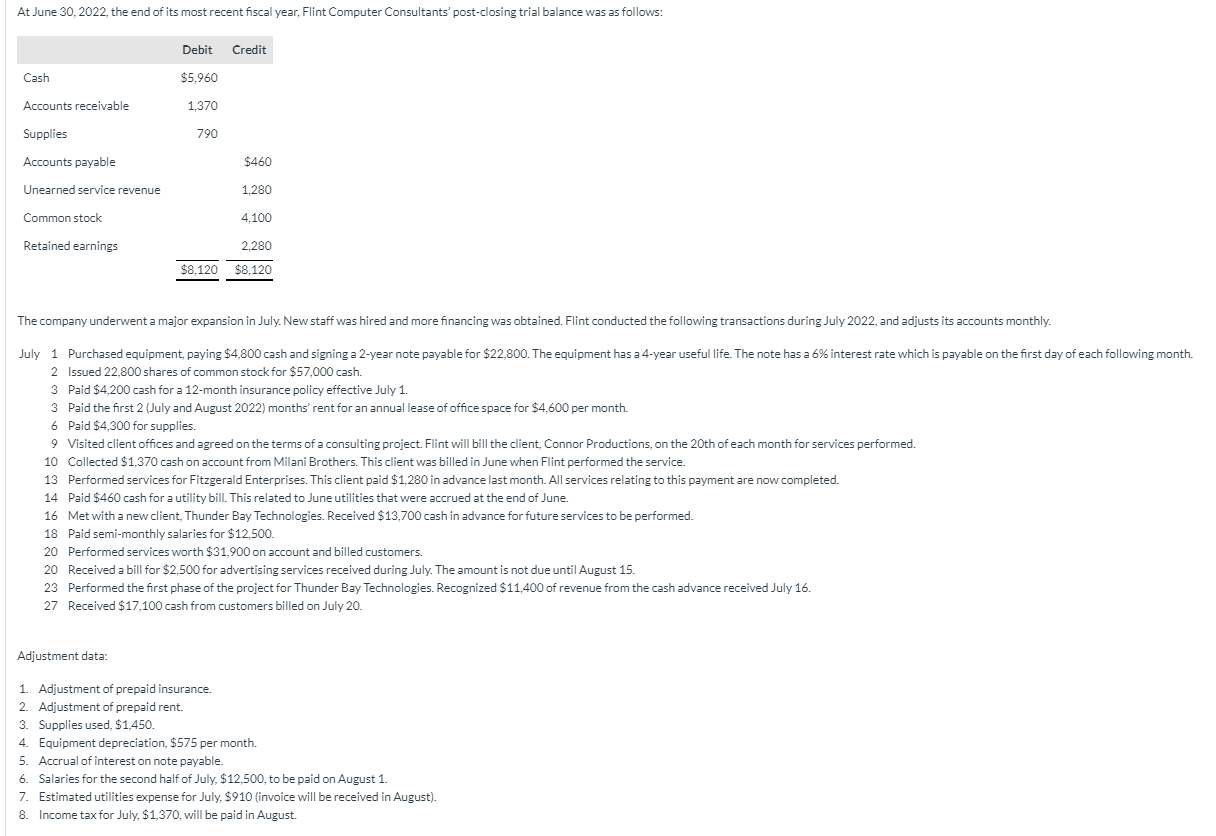

At June 30, 2022, the end of its most recent fiscal year, Flint Computer Consultants' post-closing trial balance was as follows: Debit Credit Cash $5,960 1,370 Accounts receivable Supplies 790 Accounts payable $460 Unearned service revenue 1.280 Common stock 4,100 Retained earnings 2,280 $8,120 $8,120 The company underwent a major expansion in July. New staff was hired and more financing was obtained. Flint conducted the following transactions during July 2022, and adjusts its accounts monthly. July 1 Purchased equipment, paying $4,800 cash and signing a 2-year note payable for $22,800. The equipment has a 4-year useful life. The note has a 6% interest rate which is payable on the first day of each following month. 2 Issued 22,800 shares of common stock for $57,000 cash. 3 Paid $4,200 cash for a 12-month insurance policy effective July 1. 3 Paid the first 2 (July and August 2022) months' rent for an annual lease of office space for $4,600 per month. 6 Paid $4,300 for supplies. 9 Visited client offices and agreed on the terms of a consulting project. Flint will bill the client, Connor Productions, on the 20th of each month for services performed. 10 Collected $1.370 cash on account from Milani Brothers. This client was billed in June when Flint performed the service. 13 Performed services for Fitzgerald Enterprises. This client paid $1,280 in advance last month. All services relating to this payment are now completed. 14 Paid $460 cash for a utility bill. This related to June utilities that were accrued at the end of June. 16 Met with a new client, Thunder Bay Technologies. Received $13,700 cash in advance for future services to be performed. 18 Paid semi-monthly salaries for $12.500. 20 Performed services worth $31,900 on account and billed customers. 20 Received a bill for $2.500 for advertising services received during July. The amount is not due until August 15. 23 Performed the first phase of the project for Thunder Bay Technologies. Recognized $11,400 of revenue from the cash advance received July 16. 27 Received $17,100 cash from customers billed on July 20. Adjustment data: 1. Adjustment of prepaid insurance. 2. Adjustment of prepaid rent. 3. Supplies used, $1,450. 4. Equipment depreciation, $575 per month. 5. Accrual of interest on note payable. 6. Salaries for the second half of July, $12.500, to be paid on August 1. 7. Estimated utilities expense for July $910 invoice will be received in August). 8. Income tax for July, $1,370, will be paid in August