Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At one time, it was announced that two giant French retailers, Carrefour SA and Promodes SA, would merge. A headline in the Wall Street

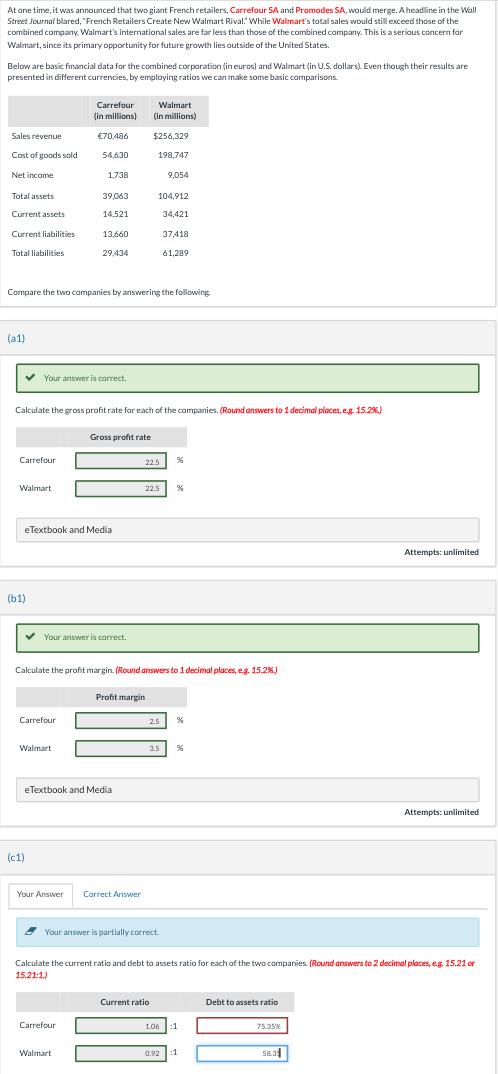

At one time, it was announced that two giant French retailers, Carrefour SA and Promodes SA, would merge. A headline in the Wall Street Journal blared, "French Retailers Create New Walmart Rival." While Walmart's total sales would still exceed those of the combined company. Walmart's international sales are far less than those of the combined company. This is a serious concern for Walmart, since its primary opportunity for future growth lies outside of the United States. Below are basic financial data for the combined corporation (in euros) and Walmart (in U.S. dollars). Even though their results are presented in different currencies, by employing ratios we can make some basic comparisons. Carrefour (in millions) Walmart (in millions) Sales revenue 70,486 $256,329 Cost of goods sold 54,630 198,747 Net income 1,738 9,054 Total assets 39,063 104,912 Current assets 14,521 34,421 Current liabilities 13,660 37,418 Total liabilities 29.434 61,289 Compare the two companies by answering the following (a1) Your answer is correct. Calculate the gross profit rate for each of the companies. (Round answers to 1 decimal places, e.g. 15.2%) 22.5 % Gross profit rate Carrefour Walmart (b1) eTextbook and Media Your answer is correct. 22.5 % Calculate the profit margin. (Round answers to 1 decimal places, eg. 15.2%) Profit margin Carrefour 2.5 % Walmart (C1) eTextbook and Media Your Answer Correct Answer 3.5 % Attempts: unlimited Attempts: unlimited Your answer is partially correct. Calculate the current ratio and debt to assets ratio for each of the two companies. (Round answers to 2 decimal places, eg. 15.21 or 15.21:1.) Carrefour Walmart Current ratio Debt to assets ratio 1.06 :1 75.35% 0.92 1 58.3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started