Answered step by step

Verified Expert Solution

Question

1 Approved Answer

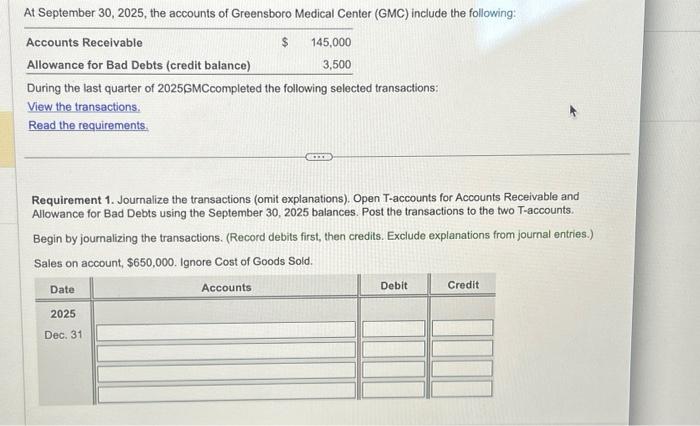

At September 30, 2025, the accounts of Greensboro Medical Center (GMC) include the following: Accounts Receivable Allowance for Bad Debts (credit balance) During the last

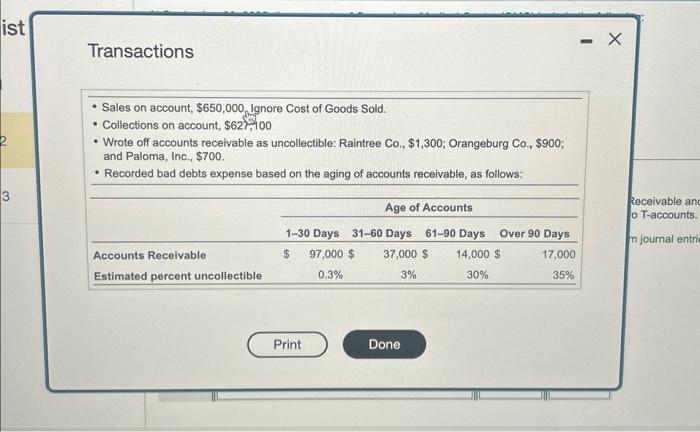

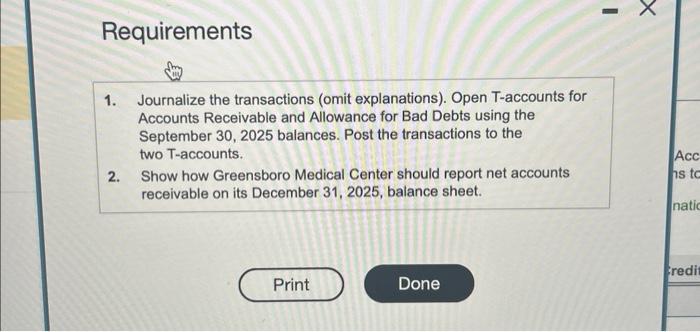

At September 30, 2025, the accounts of Greensboro Medical Center (GMC) include the following: Accounts Receivable Allowance for Bad Debts (credit balance) During the last quarter of 2025GMCcompleted the following selected transactions: View the transactions. Read the requirements. Requirement 1. Journalize the transactions (omit explanations). Open T-accounts for Accounts Receivable and Allowance for Bad Debts using the September 30, 2025 balances. Post the transactions to the two T-accounts. Begin by journalizing the transactions. (Record debits first, then credits. Exclude explanations from journal entries.) Sales on account, $650,000. Ignore Cost of Goods Sold. Date $ 145,000 3,500 2025 Dec. 31 Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started