At the beginning of 2016, Mr. Lindon had a $10,250 [(1/2) ($20,500)] net capital loss carry forward and a non-capital loss carry forward of

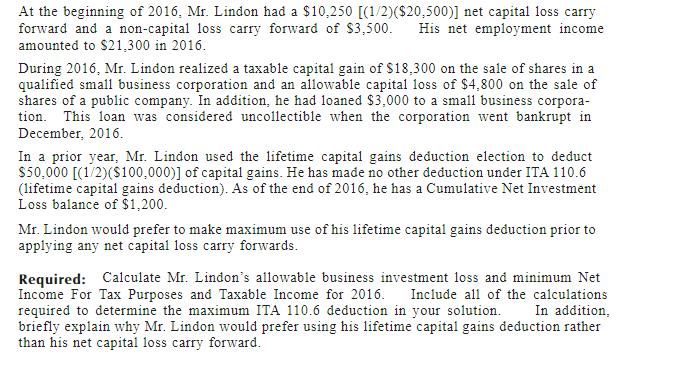

At the beginning of 2016, Mr. Lindon had a $10,250 [(1/2) ($20,500)] net capital loss carry forward and a non-capital loss carry forward of $3,500. His net employment income amounted to $21,300 in 2016. During 2016, Mr. Lindon realized a taxable capital gain of $18,300 on the sale of shares in a qualified small business corporation and an allowable capital loss of $4,800 on the sale of shares of a public company. In addition, he had loaned $3,000 to a small business corpora- tion. This loan was considered uncollectible when the corporation went bankrupt in December, 2016. In a prior year, Mr. Lindon used the lifetime capital gains deduction election to deduct $50,000 [(1/2)($100,000)] of capital gains. He has made no other deduction under ITA 110.6 (lifetime capital gains deduction). As of the end of 2016, he has a Cumulative Net Investment Loss balance of $1,200. Mr. Lindon would prefer to make maximum use of his lifetime capital gains deduction prior to applying any net capital loss carry forwards. Required: Calculate Mr. Lindon's allowable business investment loss and minimum Net Income For Tax Purposes and Taxable Income for 2016. Include all of the calculations required to determine the maximum ITA 110.6 deduction in your solution. In addition, briefly explain why Mr. Lindon would prefer using his lifetime capital gains deduction rather than his net capital loss carry forward.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The maximum ITA 1106 deduction that Mr Lindon can claim in 2016 is 50000 This is because he has alre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started