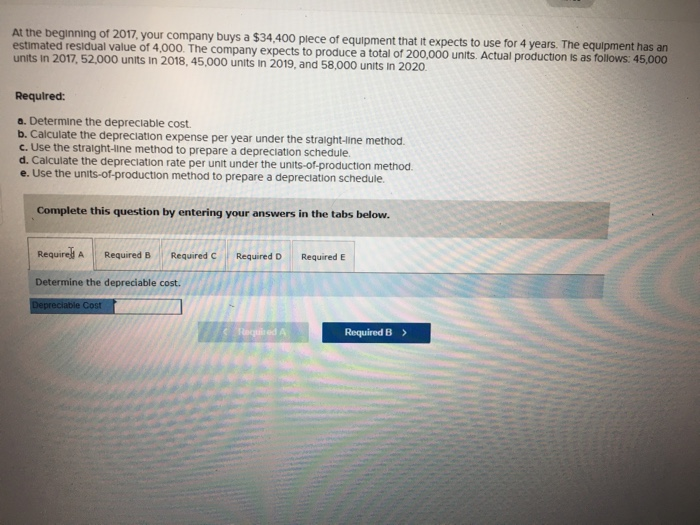

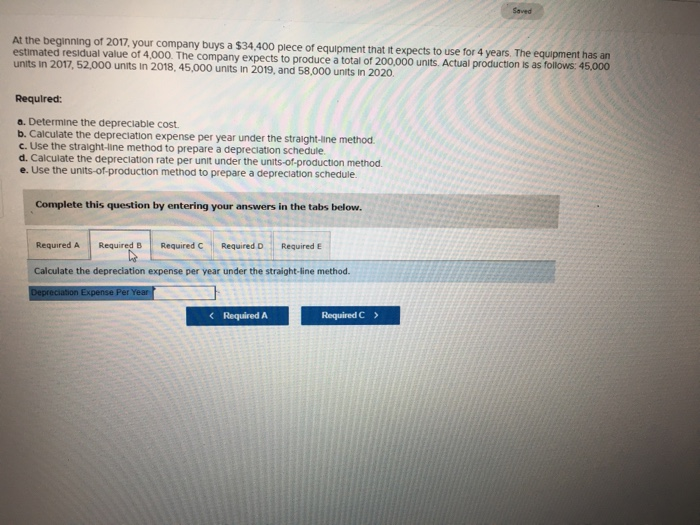

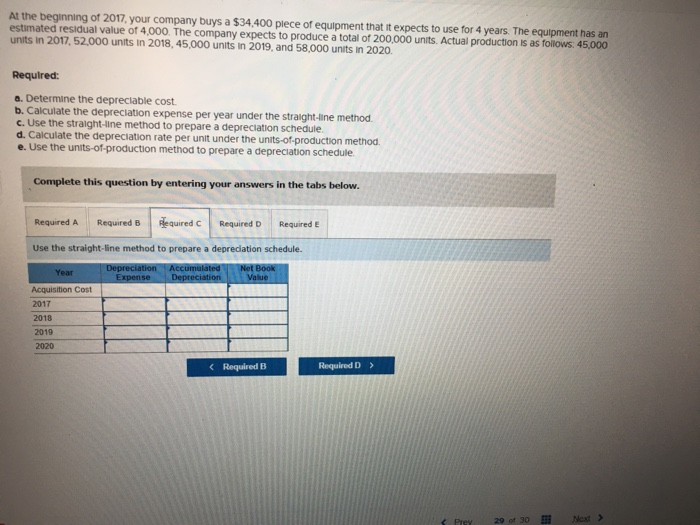

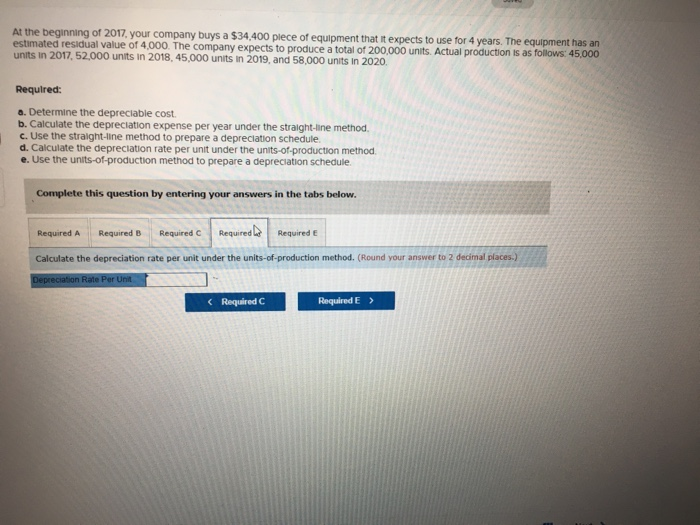

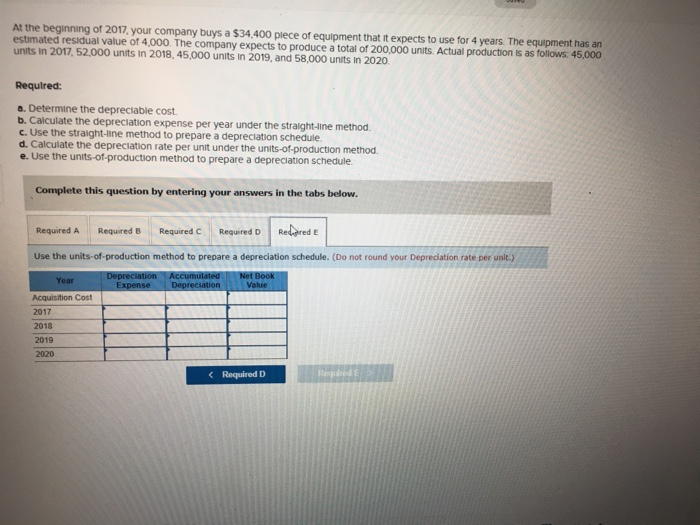

At the beginning of 2017, your company buys a $34,400 plece of equipment that it expects to use for 4 years. The equlpment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 45,000 units in 2017, 52,000 units in 2018, 45,000 units in 2019, and 58,000 units in 2020. Required: a. Determine the depreciable cost b. Calculate the depreciation expense per year under the straight-line method. c. Use the stralght-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreclation schedule Complete this question by entering your answers in the tabs below. Requirel A Required B Required C Required D Required E Determine the depreciable cost. Depreciable Cost Required A Required B Saved At the beginning of 2017, your company buys a $34,400 plece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 45,000 units in 2017, 52,000 units in 2018, 45,000 units in 2019, and 58,000 units in 2020. Required: a. Determine the depreciable cost b. Calculate the depreciation expense per year under the straight-line method c. Use the straight-line method to prepare a depreciation schedule d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. Complete this question by entering your answers in the tabs below. Required B Required A Required C Required D Required E Calculate the depreciation expense per year under the straight-line method. Depreciation Expense Per Year Required C Required A At the beginning of 2017, your company buys a $34,400 plece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 45,000 units in 2017, 52,000 units in 2018, 45,000 units in 2019, and 58,000 units in 2020. Required: a. Determine the depreciable cost b. Calculate the depreciation expense per year under the straight-line method c. Use the straight-line method to prepare a depreciation schedule d. Calculate the depreciation rate per unit under the units-of-production method e. Use the units-of-production method to prepare a depreciation schedule Complete this question by entering your answers in the tabs below. equired C Required A Required B Required D Required E Use the straight-line method to prepare a depreciation schedule. Accumulated Depreciation Net Book Value Depreciation Year Expense Acquisition Cost 2017 2018 2019 2020 Required B Required D Noxt > 29 of 30 Prey At the beginning of 2017, your company buys a $34,400 plece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 45,000 units in 2017, 52,000 units in 2018, 45,000 units in 2019, and 58,000 units In 2020. Required: a. Determine the depreciable cost b. Calculate the depreciation expense per year under the straight-line method. c. Use the stralght-line method to prepare a depreclation schedule d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule Complete this question by entering your answers in the tabs below. Required Required A Required B Required C Required E Calculate the depreciation rate per unit under the units-of-production method. (Round your answer to 2 decimal places.) Depreciation Rate Per Unit Required C Required E At the beginning of 2017, your company buys a $34,400 plece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 45,000 units in 2017, 52,000 units in 2018, 45,000 units in 2019, and 58,000 units in 2020 Required: a. Determine the depreciable cost b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule d. Calculate the depreciation rate per unit under the units-of-production method e. Use the units-of-production method to prepare a depreciation schedule. Complete this question by entering your answers in the tabs below. Redred Required A Required B Required C Required D Use the units-of-production method to prepare a depreciation schedule. (Do not round your Deprediation rate per unit.) Net Book Value Depreciation Expense Accumulated Year Depreciation Acquisition Cost 2017 2018 2019 2020 Reqded E Required D