Question

At the beginning of 2021, Denton Ltd. has two depreciable properties in Class 8. The capital cost of each property is $46,000 and the

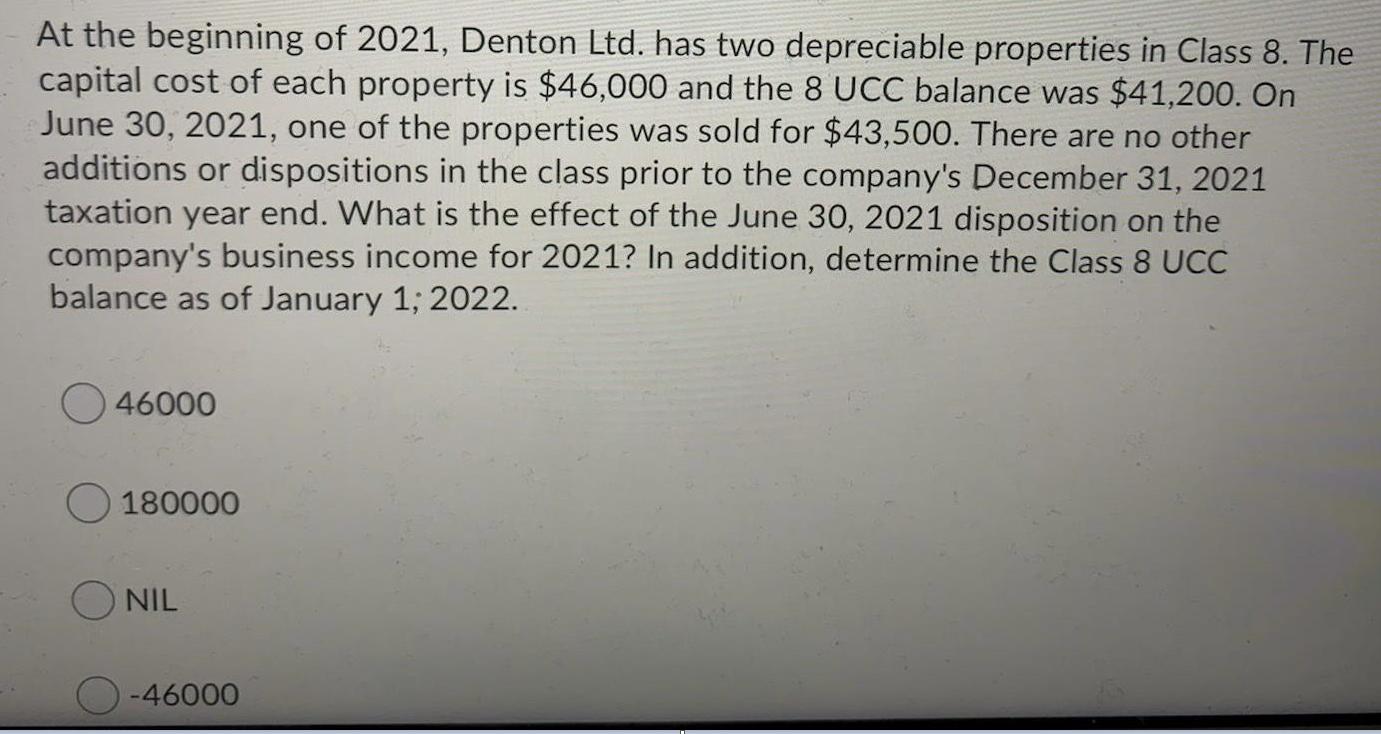

At the beginning of 2021, Denton Ltd. has two depreciable properties in Class 8. The capital cost of each property is $46,000 and the 8 UCC balance was $41,200. On June 30, 2021, one of the properties was sold for $43,500. There are no other additions or dispositions in the class prior to the company's December 31, 2021 taxation year end. What is the effect of the June 30, 2021 disposition on the company's business income for 2021? In addition, determine the Class 8 UCC balance as of January 1, 2022. 46000 O180000 ONIL -46000

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution UCC of the Class at the Beginning of The Year 41200 Add Acquisit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

5th edition

78025915, 978-1259115400, 1259115402, 978-0078025914

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App