Answered step by step

Verified Expert Solution

Question

1 Approved Answer

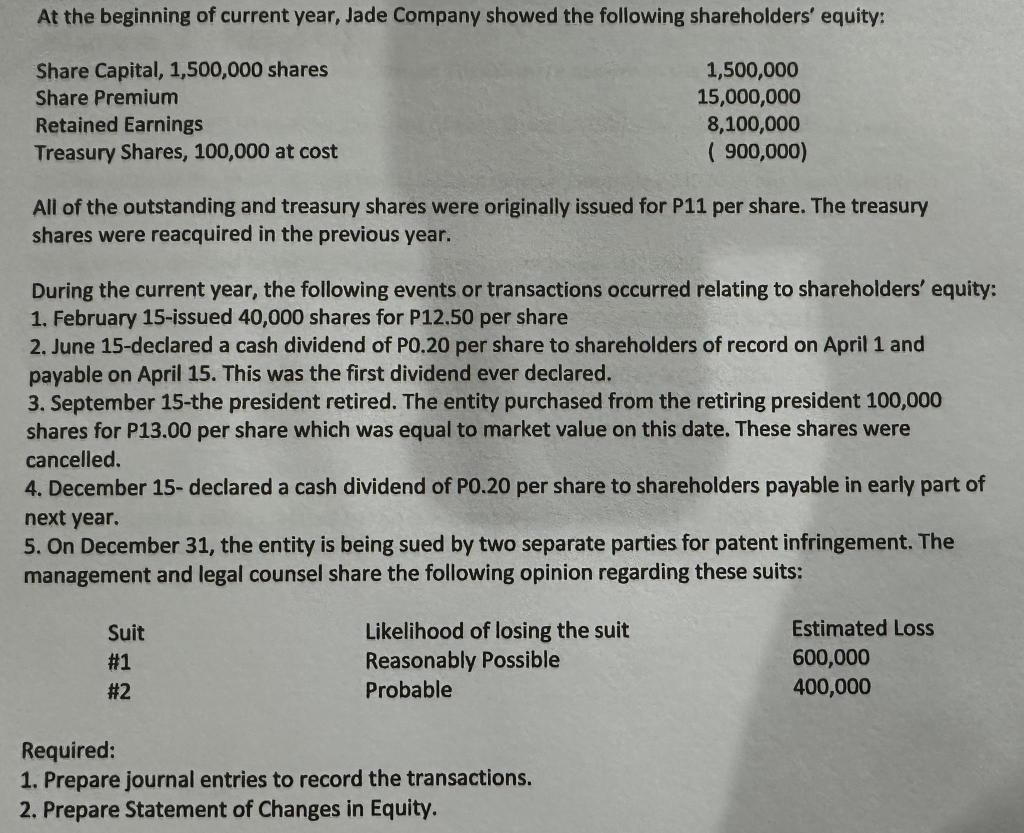

At the beginning of current year, Jade Company showed the following shareholders' equity: Share Capital, 1,500,000 shares Share Premium 1,500,000 15,000,000 8,100,000 ( 900,000)

At the beginning of current year, Jade Company showed the following shareholders' equity: Share Capital, 1,500,000 shares Share Premium 1,500,000 15,000,000 8,100,000 ( 900,000) Retained Earnings Treasury Shares, 100,000 at cost All of the outstanding and treasury shares were originally issued for P11 per share. The treasury shares were reacquired in the previous year. During the current year, the following events or transactions occurred relating to shareholders' equity: 1. February 15-issued 40,000 shares for P12.50 per share 2. June 15-declared a cash dividend of P0.20 per share to shareholders of record on April 1 and payable on April 15. This was the first dividend ever declared. 3. September 15-the president retired. The entity purchased from the retiring president 100,000 shares for P13.00 per share which was equal to market value on this date. These shares were cancelled. 4. December 15- declared a cash dividend of P0.20 per share to shareholders payable in early part of next year. 5. On December 31, the entity is being sued by two separate parties for patent infringement. The management and legal counsel share the following opinion regarding these suits: Suit #1 #2 Likelihood of losing the suit Reasonably Possible Probable Required: 1. Prepare journal entries to record the transactions. 2. Prepare Statement of Changes in Equity. Estimated Loss 600,000 400,000

Step by Step Solution

★★★★★

3.24 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To properly provide the journal entries and Statement of Changes in Equity we need to consider the transactions and events provided Lets go through ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started