Answered step by step

Verified Expert Solution

Question

1 Approved Answer

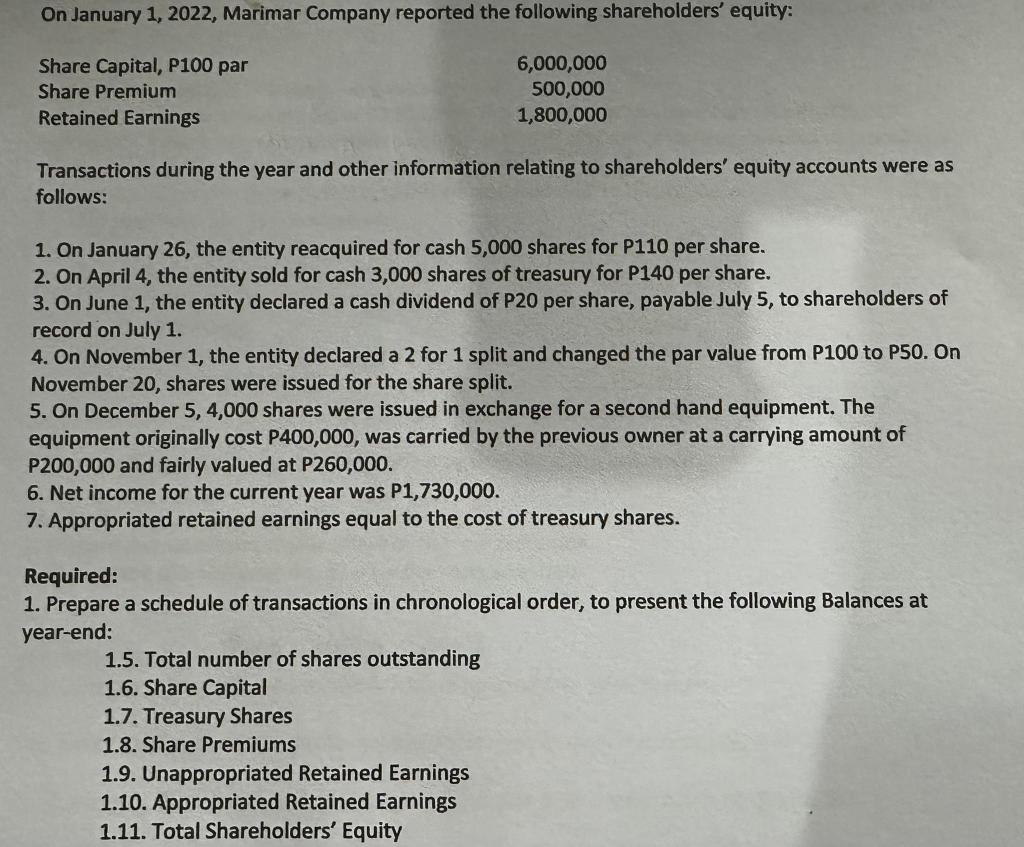

On January 1, 2022, Marimar Company reported the following shareholders' equity: Share Capital, P100 par 6,000,000 500,000 Share Premium Retained Earnings 1,800,000 Transactions during

On January 1, 2022, Marimar Company reported the following shareholders' equity: Share Capital, P100 par 6,000,000 500,000 Share Premium Retained Earnings 1,800,000 Transactions during the year and other information relating to shareholders' equity accounts were as follows: 1. On January 26, the entity reacquired for cash 5,000 shares for P110 per share. 2. On April 4, the entity sold for cash 3,000 shares of treasury for P140 per share. 3. On June 1, the entity declared a cash dividend of P20 per share, payable July 5, to shareholders of record on July 1. 4. On November 1, the entity declared a 2 for 1 split and changed the par value from P100 to P50. On November 20, shares were issued for the share split. 5. On December 5, 4,000 shares were issued in exchange for a second hand equipment. The equipment originally cost P400,000, was carried by the previous owner at a carrying amount of P200,000 and fairly valued at P260,000. 6. Net income for the current year was P1,730,000. 7. Appropriated retained earnings equal to the cost of treasury shares. Required: 1. Prepare a schedule of transactions in chronological order, to present the following Balances at year-end: 1.5. Total number of shares outstanding 1.6. Share Capital 1.7. Treasury Shares 1.8. Share Premiums 1.9. Unappropriated Retained Earnings 1.10. Appropriated Retained Earnings 1.11. Total Shareholders' Equity

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started