Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of its 2020 calendar-year accounting period, Clay, Inc. had retained earnings of $6,500,000. During 2020, Clay reported income from continuing operations

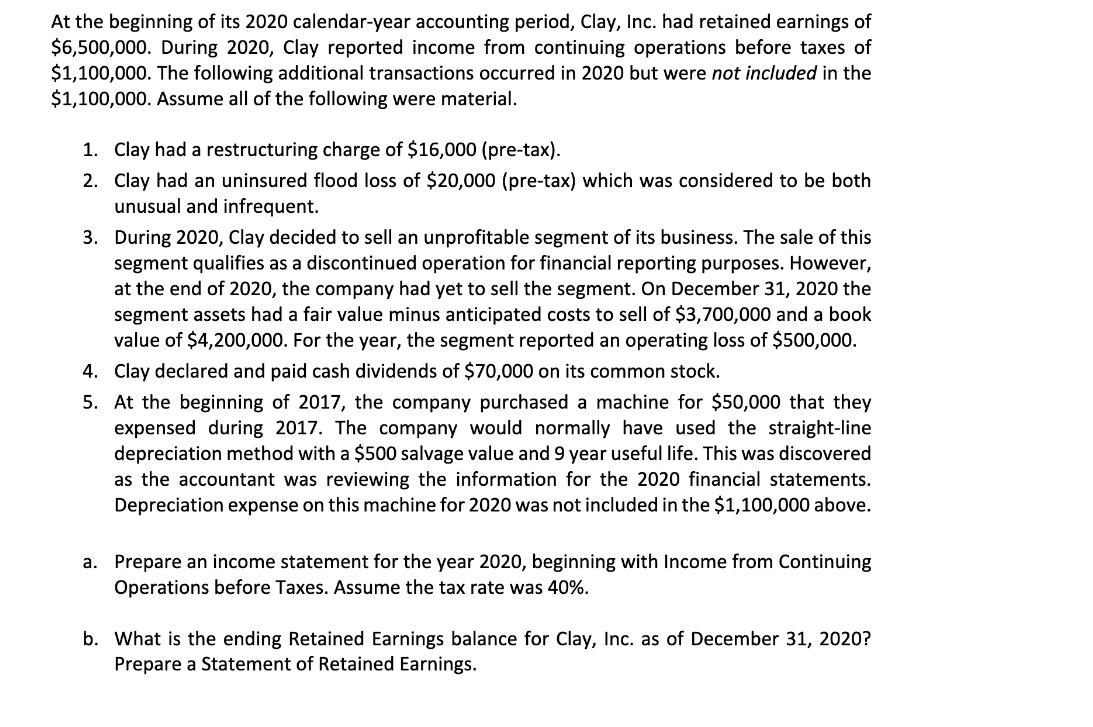

At the beginning of its 2020 calendar-year accounting period, Clay, Inc. had retained earnings of $6,500,000. During 2020, Clay reported income from continuing operations before taxes of $1,100,000. The following additional transactions occurred in 2020 but were not included in the $1,100,000. Assume all of the following were material. 1. Clay had a restructuring charge of $16,000 (pre-tax). 2. Clay had an uninsured flood loss of $20,000 (pre-tax) which was considered to be both unusual and infrequent. 3. During 2020, Clay decided to sell an unprofitable segment of its business. The sale of this segment qualifies as a discontinued operation for financial reporting purposes. However, at the end of 2020, the company had yet to sell the segment. On December 31, 2020 the segment assets had a fair value minus anticipated costs to sell of $3,700,000 and a book value of $4,200,000. For the year, the segment reported an operating loss of $500,000. 4. Clay declared and paid cash dividends of $70,000 on its common stock. 5. At the beginning of 2017, the company purchased a machine for $50,000 that they expensed during 2017. The company would normally have used the straight-line depreciation method with a $500 salvage value and 9 year useful life. This was discovered as the accountant was reviewing the information for the 2020 financial statements. Depreciation expense on this machine for 2020 was not included in the $1,100,000 above. a. Prepare an income statement for the year 2020, beginning with Income from Continuing Operations before Taxes. Assume the tax rate was 40%. b. What is the ending Retained Earnings balance for Clay, Inc. as of December 31, 2020? Prepare a Statement of Retained Earnings.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Income Statement for the Year 2020 Amount in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started