Question

At the beginning of its operations in July 2020, Wheaton Pet Shop Ltd. began with 10,400 units of inventory that it purchased at a cost

At the beginning of its operations in July 2020, Wheaton Pet Shop Ltd. began with 10,400 units of inventory that it purchased at a cost of $14.00 each. The companys purchases during July were as follows:

| July 5 | 7,200 units @ $16.00 | |

| Sales during July: | ||

| July 2 | 9,100 units | |

| July 27 | 5,000 units |

Wheaton Pet Shop uses a perpetual inventory system.

Calculate the cost of goods sold for July using the weighted-average cost formula. (Round calculations for cost per unit to 2 decimal places, e.g. 10.52 and final answer to 0 decimal places, e.g. 61,052.)

| Cost of goods sold | $Enter the cost of goods sold in dollars rounded to 0 decimal places. |

Calculate the cost of goods sold for July using the first-in, first-out cost formula.

| Cost of goods sold | $Enter the cost of goods sold in dollars. |

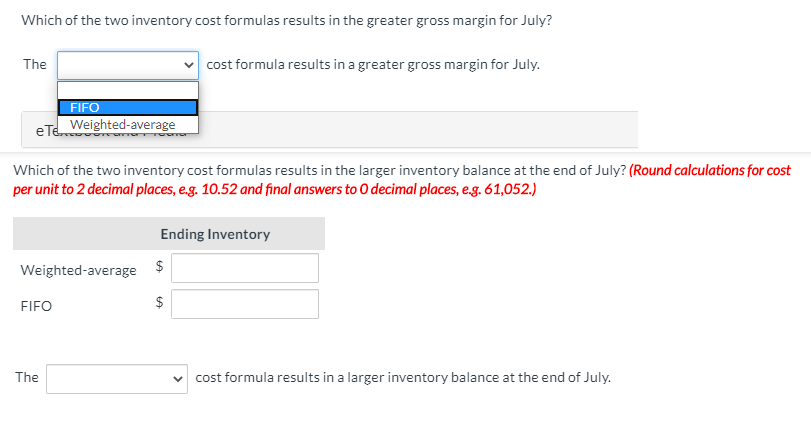

Which of the two inventory cost formulas results in the greater gross margin for July? The cost formula results in a greater gross margin for July. FIFO et Weighted average Which of the two inventory cost formulas results in the larger inventory balance at the end of July? (Round calculations for cost per unit to 2 decimal places, e.g. 10.52 and final answers to O decimal places, e.g. 61,052.) Ending Inventory Weighted average $ FIFO $ The cost formula results in a larger inventory balance at the end of July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started