Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of June, Circuit Country has a balance in inventory of $2,450. The following transactions occur during the month of June. June

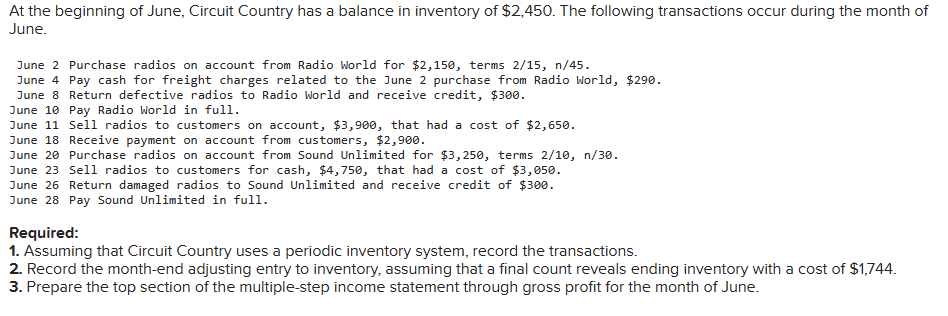

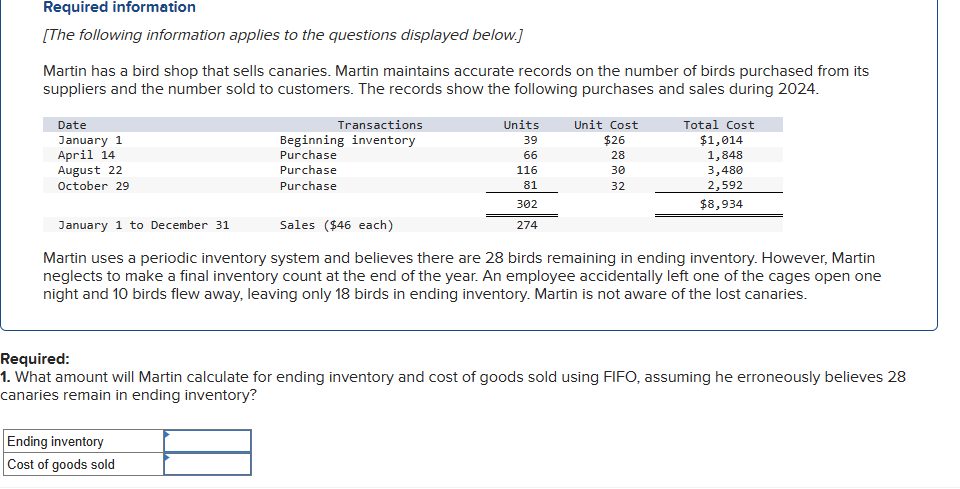

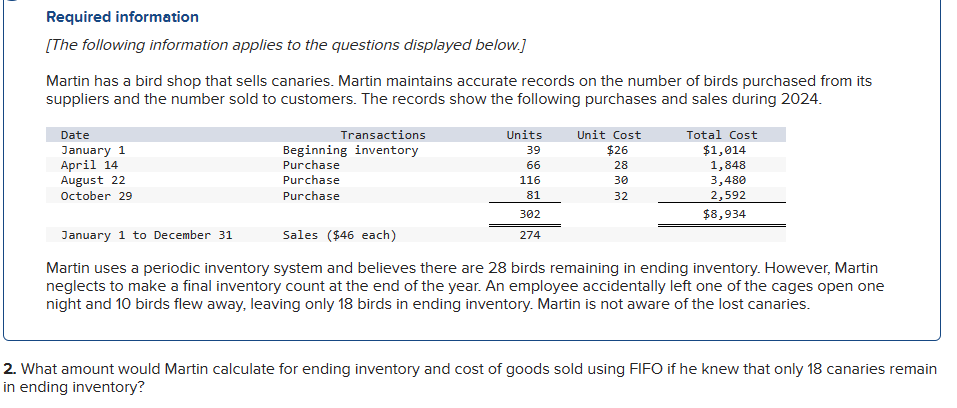

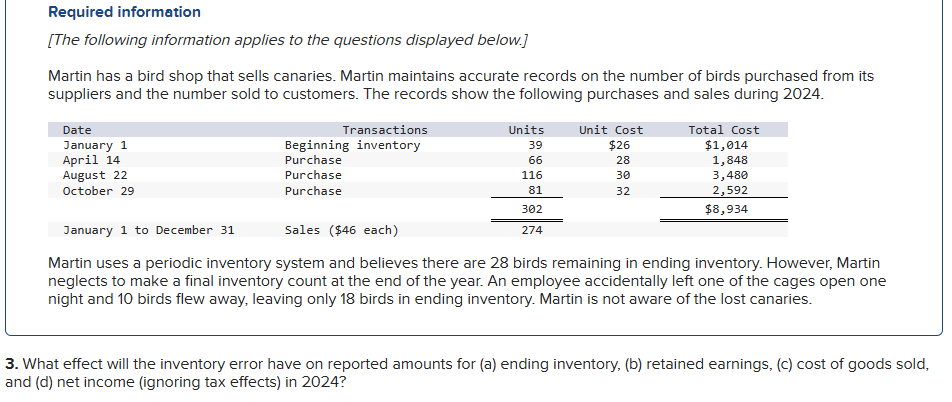

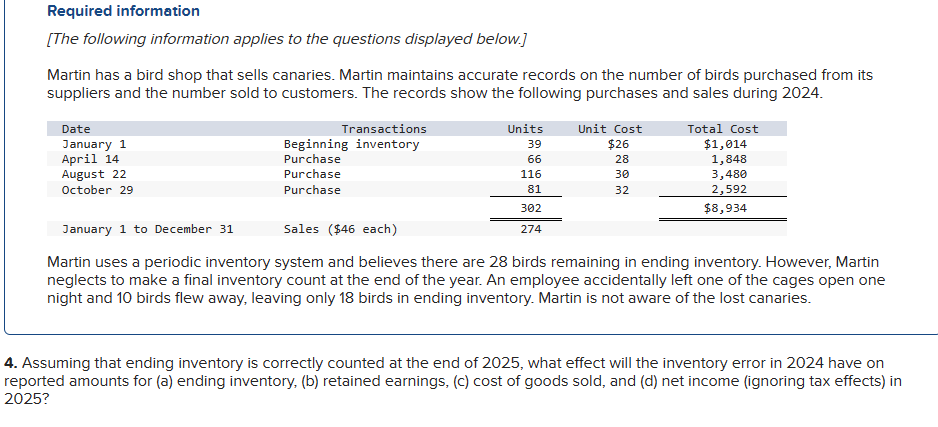

At the beginning of June, Circuit Country has a balance in inventory of $2,450. The following transactions occur during the month of June. June 2 Purchase radios on account from Radio World for $2,150, terms 2/15, n/45. June 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $290. June 8 Return defective radios to Radio World and receive credit, $300. June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $3,900, that had a cost of $2,650. June 18 Receive payment on account from customers, $2,900. June 20 Purchase radios on account from Sound Unlimited for $3,250, terms 2/10, n/30. June 23 Sell radios to customers for cash, $4,750, that had a cost of $3,050. June 26 Return damaged radios to Sound Unlimited and receive credit of $300. June 28 Pay Sound Unlimited in full. Required: 1. Assuming that Circuit Country uses a periodic inventory system, record the transactions. 2. Record the month-end adjusting entry to inventory, assuming that a final count reveals ending inventory with a cost of $1,744. 3. Prepare the top section of the multiple-step income statement through gross profit for the month of June. Required information [The following information applies to the questions displayed below.] Martin has a bird shop that sells canaries. Martin maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2024. Date January 1 April 14 August 22 October 29 Transactions Beginning inventory Purchase Purchase Purchase Units 39 66 Ending inventory Cost of goods sold 116 81 302 274 Unit Cost $26 28 30 32 Total Cost $1,014 1,848 3,480 2,592 $8,934 January 1 to December 31 Sales ($46 each) Martin uses a periodic inventory system and believes there are 28 birds remaining in ending inventory. However, Martin neglects to make a final inventory count at the end of the year. An employee accidentally left one of the cages open one night and 10 birds flew away, leaving only 18 birds in ending inventory. Martin is not aware of the lost canaries. Required: 1. What amount will Martin calculate for ending inventory and cost of goods sold using FIFO, assuming he erroneously believes 28 canaries remain in ending inventory? Required information [The following information applies to the questions displayed below.] Martin has a bird shop that sells canaries. Martin maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2024. Date January 1 April 14 August 22 October 29 Transactions Beginning inventory Purchase Purchase Purchase Units 39 66 116 81 302 274 Unit Cost $26 28 30 32 Total Cost $1,014 1,848 3,480 2,592 $8,934 January 1 to December 31 Sales ($46 each) Martin uses a periodic inventory system and believes there are 28 birds remaining in ending inventory. However, Martin neglects to make a final inventory count at the end of the year. An employee accidentally left one of the cages open one night and 10 birds flew away, leaving only 18 birds in ending inventory. Martin is not aware of the lost canaries. 2. What amount would Martin calculate for ending inventory and cost of goods sold using FIFO if he knew that only 18 canaries remain in ending inventory? Required information [The following information applies to the questions displayed below.] Martin has a bird shop that sells canaries. Martin maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2024. Date January 1 April 14 August 22 October 29 Transactions Beginning inventory Purchase Purchase Purchase Units 39 66 116 81 302 274 Unit Cost $26 28 30 32 Total Cost $1,014 1,848 3,480 2,592 $8,934 January 1 to December 31 Sales ($46 each) Martin uses a periodic inventory system and believes there are 28 birds remaining in ending inventory. However, Martin neglects to make a final inventory count at the end of the year. An employee accidentally left one of the cages open one night and 10 birds flew away, leaving only 18 birds in ending inventory. Martin is not aware of the lost canaries. 3. What effect will the inventory error have on reported amounts for (a) ending inventory, (b) retained earnings, (c) cost of goods sold, and (d) net income (ignoring tax effects) in 2024? Required information [The following information applies to the questions displayed below.] Martin has a bird shop that sells canaries. Martin maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2024. Date January 1 April 14 August 22 October 29 Transactions Beginning inventory Purchase Purchase Purchase Units 39 66 116 81 302 274 Unit Cost $26 28 30 32 Total Cost $1,014 1,848 3,480 2,592 $8,934 January 1 to December 31 Sales ($46 each) Martin uses a periodic inventory system and believes there are 28 birds remaining in ending inventory. However, Martin neglects to make a final inventory count at the end of the year. An employee accidentally left one of the cages open one night and 10 birds flew away, leaving only 18 birds in ending inventory. Martin is not aware of the lost canaries. 4. Assuming that ending inventory is correctly counted at the end of 2025, what effect will the inventory error in 2024 have on reported amounts for (a) ending inventory, (b) retained earnings, (c) cost of goods sold, and (d) net income (ignoring tax effects) in 2025?

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Recording Transactions Assuming periodic inventory system Date Transactions Debit Credit Jun 2 Inventory Purchase Radio World 215098 210700 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started