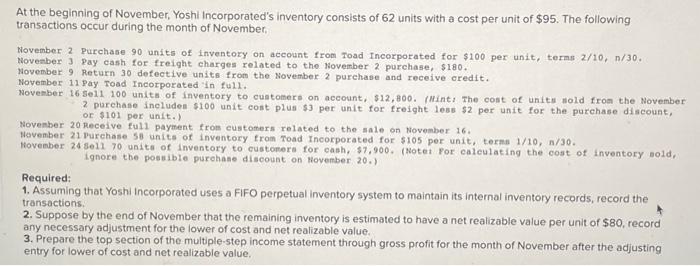

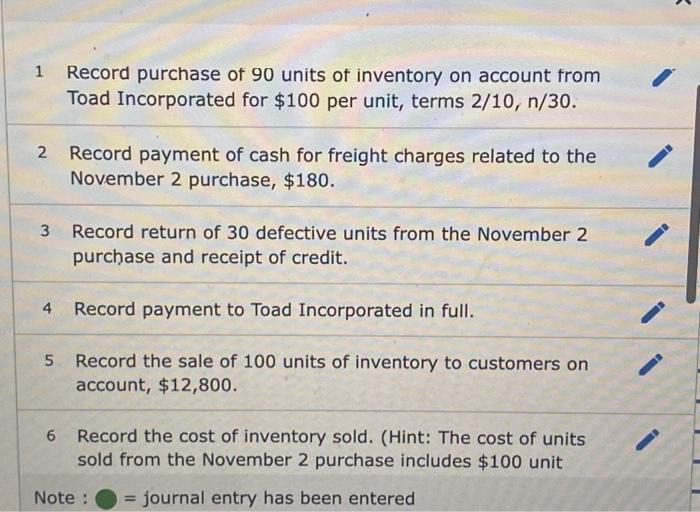

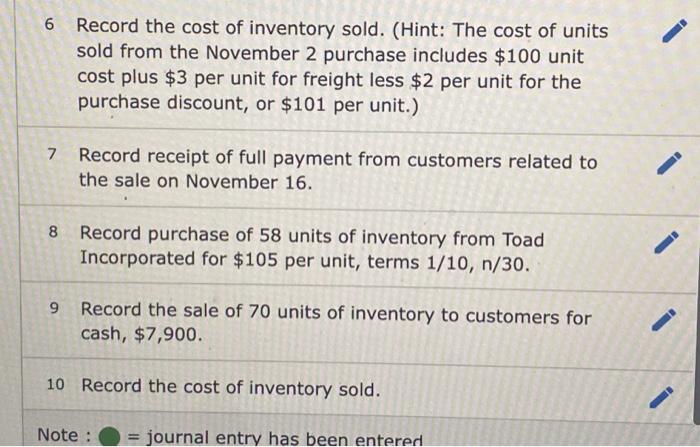

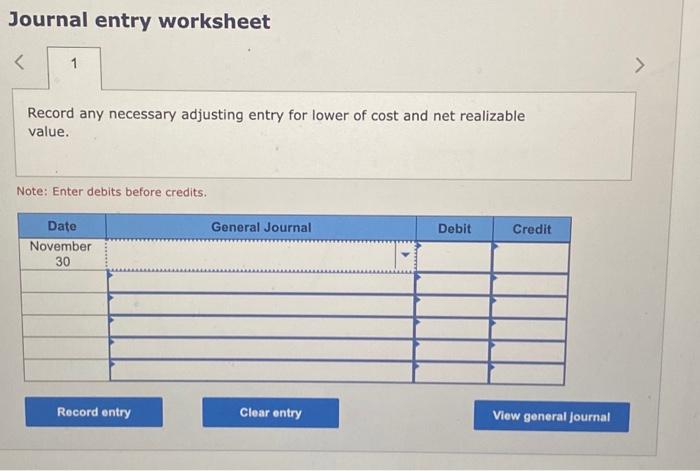

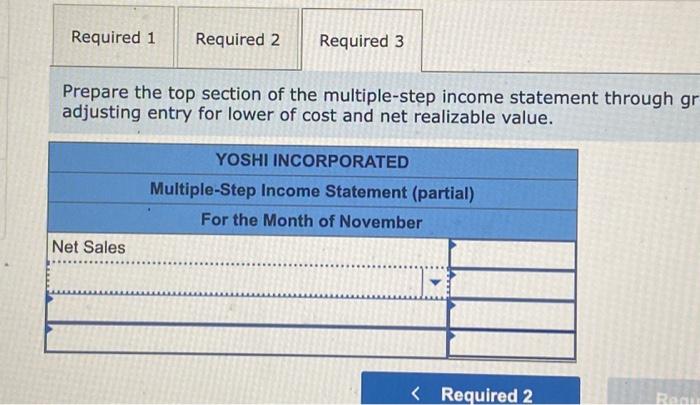

At the beginning of November, Yoshi Incorporated's inventory consists of 62 units with a cost per unit of $95. The following transactions occur during the month of November, November 2 Purchase 90 units of inventory on account f rom road Incorporated for $100 per unit, teras 2/10, n/30. Novenber 3 pay cash for freight charges related to tho November 2 purchase, $180. November 9 Return 30 defective units from the November 2 purehase and receive eredit. Noyember 11 Pay road Incorporated in full. Novenber 16 sel1 100 units of inventory to customers on account, $12,800. (Hint) The cost of units nold fron the November 2 purchase includen $100 unit cont plus $3 per unit for freight less $2 per unit for the purchase discoust, or $101 per unit.) November 20 Receive full payment from eustomers related to the sale on November 16. Nevember 21 purchase 58 units of inventory from Toad Incorporated for $105 per unit, terms 1/10, n/30. Hovenber 24 sell 70 units of inventory to customers for eash, $7,900. (Notet For caleulating the cost of inventory sold, ignore the possible purchase discount on November 20,1 Required: 1. Assuming that Yoshi incorporated uses a FIFO perpetual inventory system to maintain its internal inventory records, record the transactions. 2. Suppose by the end of November that the remaining inventory is estimated to have a net realizable value per unit of $80, record any necessary adjustment for the lower of cost and net realizable value. 3. Prepare the top section of the multiple-step income statement through gross profit for the month of November after the adjusting entry for lower of cost and net realizable value. 1 Record purchase of 90 units of inventory on account from Toad Incorporated for $100 per unit, terms 2/10,n/30. 2 Record payment of cash for freight charges related to the November 2 purchase, $180. 3 Record return of 30 defective units from the November 2 purchase and receipt of credit. 4 Record payment to Toad Incorporated in full. 5. Record the sale of 100 units of inventory to customers on account, $12,800. 6 Record the cost of inventory sold. (Hint: The cost of units sold from the November 2 purchase includes $100 unit 6 Record the cost of inventory sold. (Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $3 per unit for freight less $2 per unit for the purchase discount, or $101 per unit.) 7 Record receipt of full payment from customers related to the sale on November 16. 8 Record purchase of 58 units of inventory from Toad Incorporated for $105 per unit, terms 1/10,n/30. 9 Record the sale of 70 units of inventory to customers for cash, $7,900. 10 Record the cost of inventory sold. Journal entry worksheet Record any necessary adjusting entry for lower of cost and net realizable value. Note: Enter debits before credits. Prepare the top section of the multiple-step income statement through gr adjusting entry for lower of cost and net realizable value