Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of the 2013 income year, Jim and Jacquie set up an eBay account to sell personal items from their household. Setting

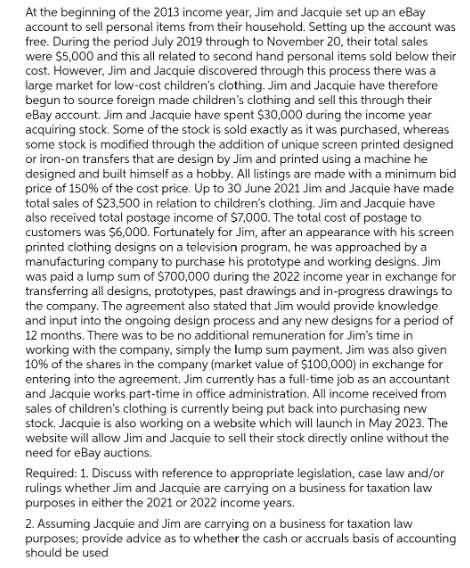

At the beginning of the 2013 income year, Jim and Jacquie set up an eBay account to sell personal items from their household. Setting up the account was free. During the period July 2019 through to November 20, their total sales were $5,000 and this all related to second hand personal items sold below their cost. However, Jim and Jacquie discovered through this process there was a large market for low-cost children's clothing. Jim and Jacquie have therefore begun to source foreign made children's clothing and sell this through their eBay account. Jim and Jacquie have spent $30,000 during the income year acquiring stock. Some of the stock is sold exactly as it was purchased, whereas some stock is modified through the addition of unique screen printed designed or iron-on transfers that are design by Jim and printed using a machine he designed and built himself as a hobby. All listings are made with a minimum bid price of 150% of the cost price. Up to 30 June 2021 Jim and Jacquie have made total sales of $23,500 in relation to children's clothing. Jim and Jacquie have also received total postage income of $7,000. The total cost of postage to customers was $6,000. Fortunately for Jim, after an appearance with his screen printed clothing designs on a television program, he was approached by a manufacturing company to purchase his prototype and working designs. Jim was paid a lump sum of $700,000 during the 2022 income year in exchange for transferring all designs, prototypes, past drawings and in-progress drawings to the company. The agreement also stated that Jim would provide knowledge and input into the ongoing design process and any new designs for a period of 12 months. There was to be no additional remuneration for Jim's time in working with the company, simply the lump sum payment. Jim was also given 10% of the shares in the company (market value of $100,000) in exchange for entering into the agreement. Jim currently has a full-time job as an accountant and Jacquie works part-time in office administration. All income received from sales of children's clothing is currently being put back into purchasing new stock. Jacquie is also working on a website which will launch in May 2023. The website will allow Jim and Jacquie to sell their stock directly online without the need for eBay auctions. Required: 1. Discuss with reference to appropriate legislation, case law and/or rulings whether Jim and Jacquie are carrying on a business for taxation law purposes in either the 2021 or 2022 income years. 2. Assuming Jacquie and Jim are carrying on a business for taxation law purposes; provide advice as to whether the cash or accruals basis of accounting should be used

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Under Australian taxation law the term business is not defined in the Income Tax Assessment Act 1997 Cth ITAA97 Therefore the courts have developed various tests and principles to determine whether an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started