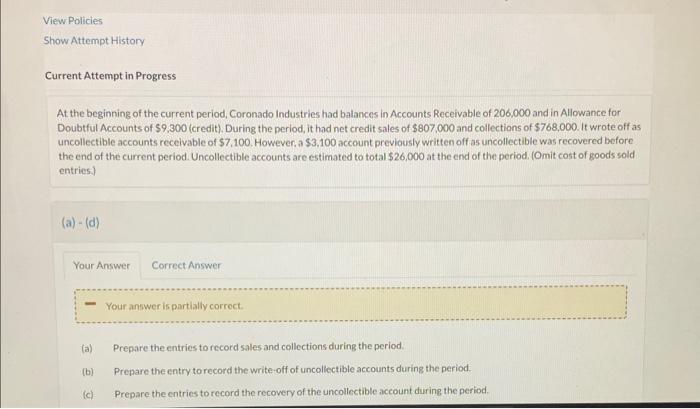

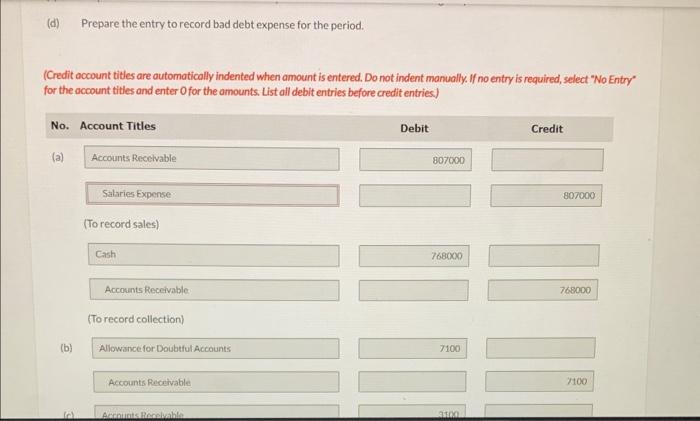

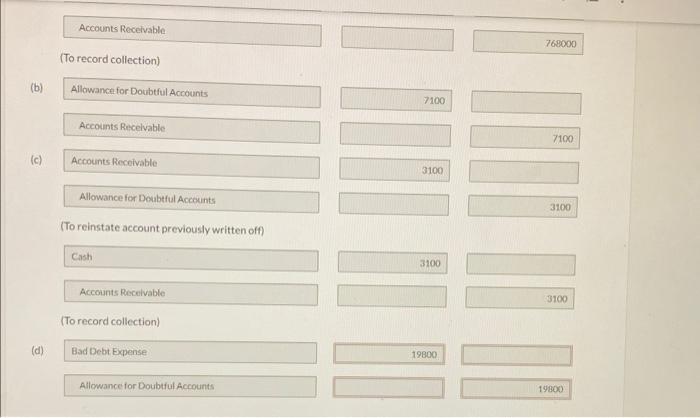

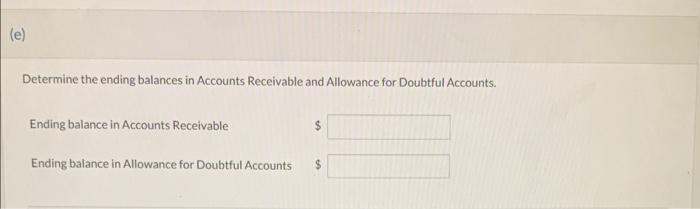

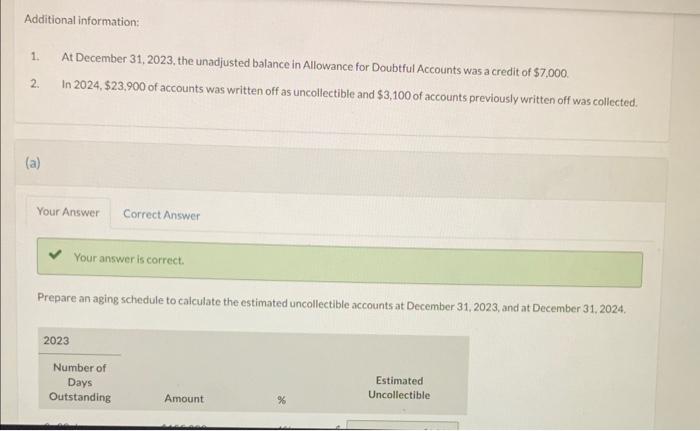

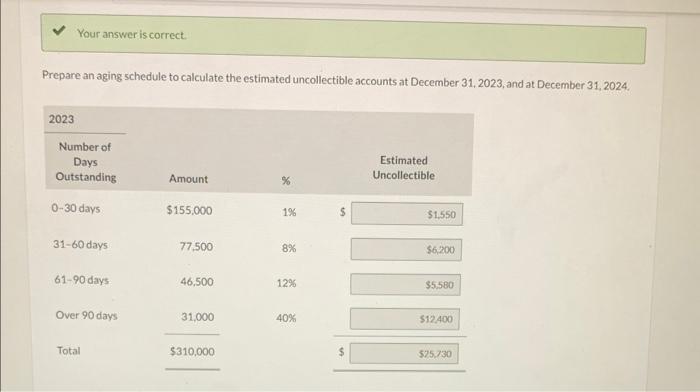

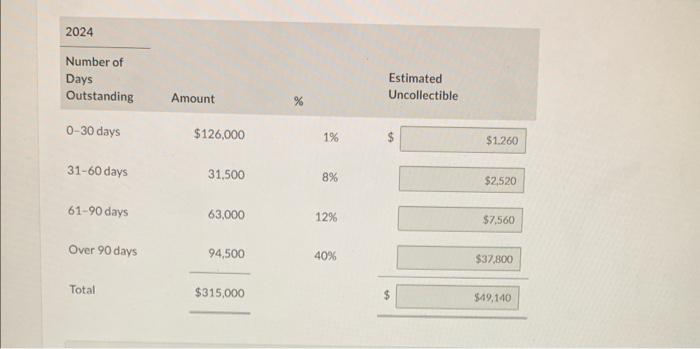

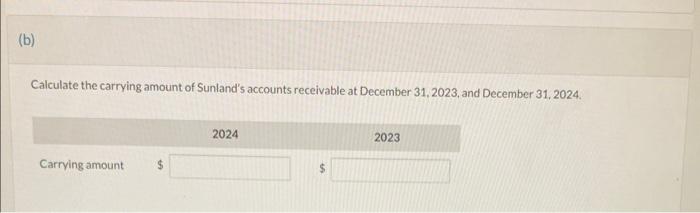

At the beginning of the current period, Coronado industries had balances in Accounts Receivable of 206.000 and in Allowance for Doubtful Accounts of $9,300 (credit). During the period, it had net credit sales of $807,000 and collections of $768,000. It wrote off as uncollectible accounts recelvable of $7,100. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $26,000 at the end of the period. (Omit cost of goods sold entries.) (d) Prepare the entry to record bad debt expense for the period. (Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. List all debit entries before credit entries) Accounts Receivable (To record collection) (b) Allowance for Dotibtful Accounts Accounts Recelvable (c) Accounts Recoivable Allowance for Doubtful Accounts (To reinstate account previously written off) Cash Accounts Recelvable (To record collection) (d) Bad Debt Expense Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts: Ending balance in Accounts Receivable Ending balance in Allowance for Doubtful Accounts View Policies Show Attempt History Current Attempt in Progress An aging analysis of Sunland Company's accounts receivable at December 31,2023 and 2024, showed the following: Additional information: Additional information: 1. At December 31,2023 , the unadjusted balance in Allowance for Doubtful Accounts was a credit of $7,000. 2. In 2024,$23,900 of accounts was written off as uncollectible and $3,100 of accounts previously written off was collected. (a) Your answer is correct. Prepare an aging schedule to calculate the estimated uncollectible accounts at December 31,2023 , and at December 31 . 2024. Your answer is correct. Prepare an aging schedule to calculate the estimated uncollectible accounts at December 31,2023 , and at December 31,2024. Calculate the carrying amount of Sunland's accounts receivable at December 31, 2023, and December 31, 2024