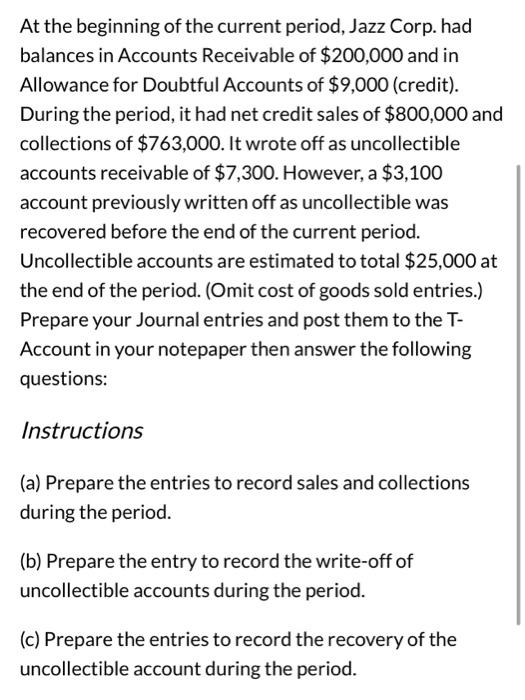

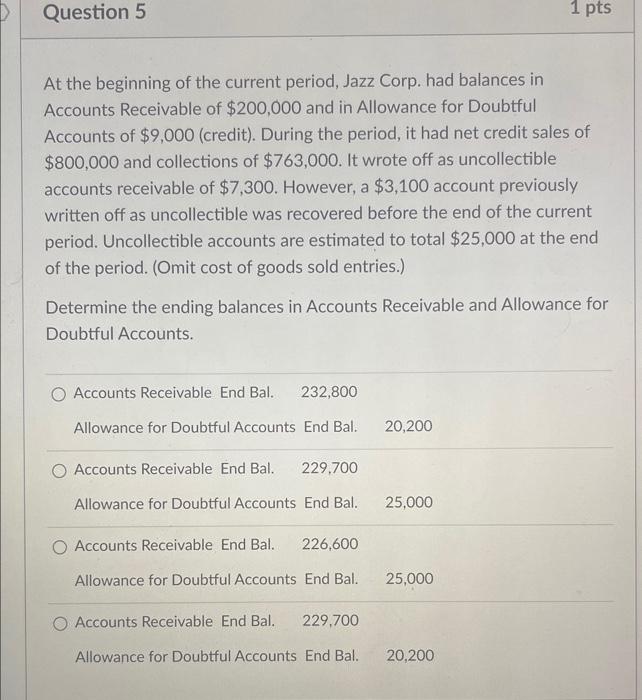

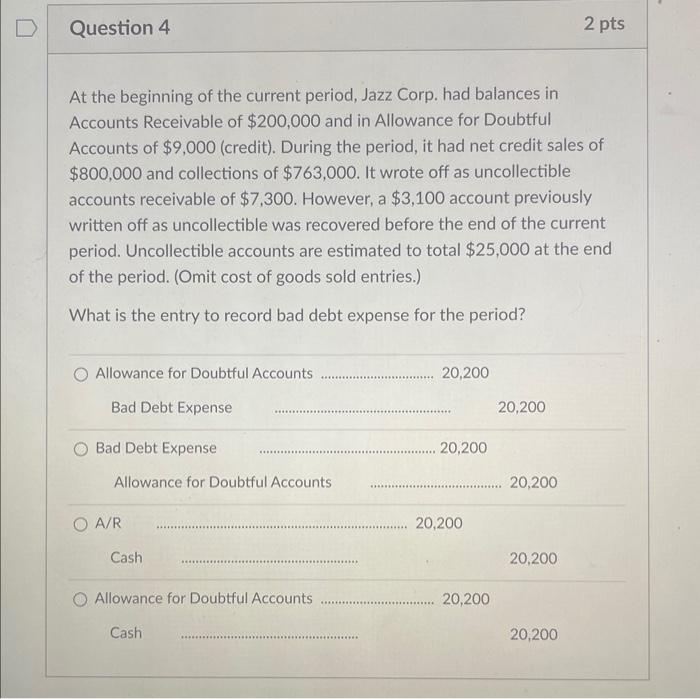

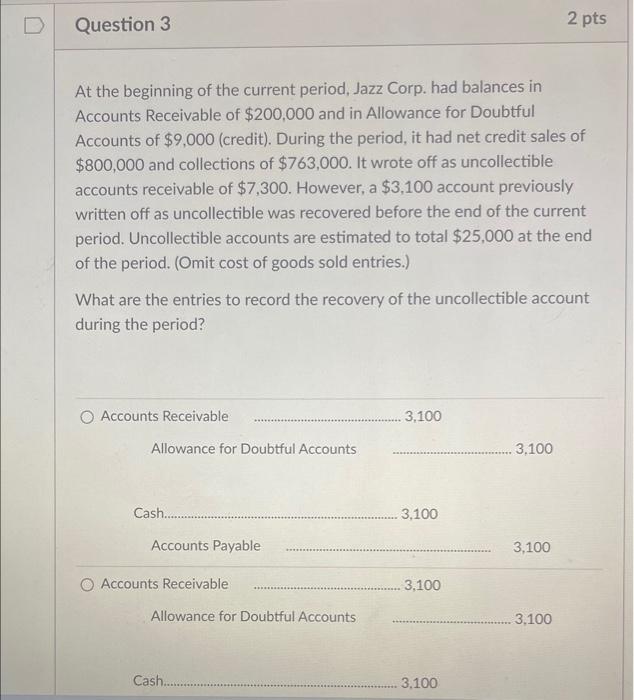

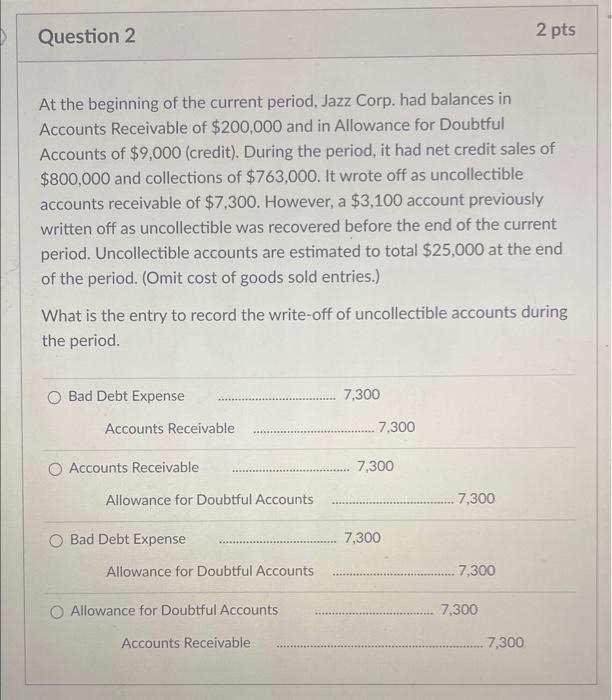

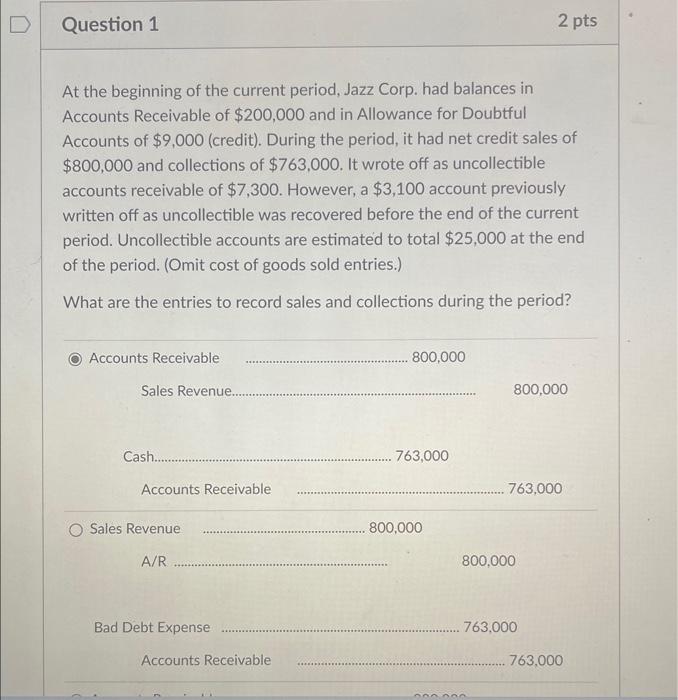

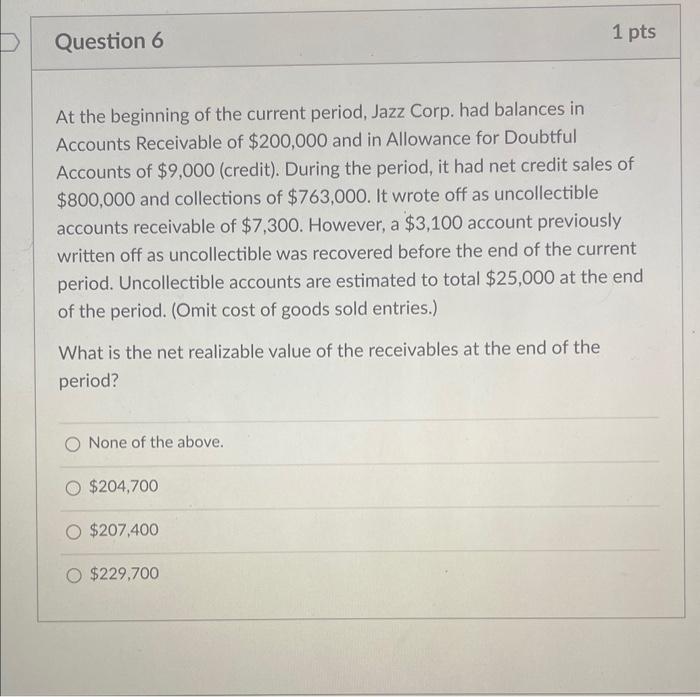

At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) Prepare your Journal entries and post them to the TAccount in your notepaper then answer the following questions: Instructions (a) Prepare the entries to record sales and collections during the period. (b) Prepare the entry to record the write-off of uncollectible accounts during the period. (c) Prepare the entries to record the recovery of the uncollectible account during the period. At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. Accounts Receivable End Bal. 232,800 Allowance for Doubtful Accounts End Bal. 20,200 Accounts Receivable End Bal. 229,700 Allowance for Doubtful Accounts End Bal. 25,000 Accounts Receivable End Bal. 226,600 Allowance for Doubtful Accounts End Bal. 25,000 Accounts Receivable End Bal. 229,700 Allowance for Doubtful Accounts End Bal. 20,200 At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) What is the entry to record bad debt expense for the period? Allowance for Doubtful Accounts 20,200 Bad Debt Expense 20,200 Bad Debt Expense 20,200 Allowance for Doubtful Accounts 20,200 A/R 20,200 Cash 20,200 At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) What are the entries to record the recovery of the uncollectible account during the period? At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) What is the entry to record the write-off of uncollectible accounts during the period. At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) What are the entries to record sales and collections during the period? At the beginning of the current period, Jazz Corp. had balances in Accounts Receivable of $200,000 and in Allowance for Doubtful Accounts of $9,000 (credit). During the period, it had net credit sales of $800,000 and collections of $763,000. It wrote off as uncollectible accounts receivable of $7,300. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,000 at the end of the period. (Omit cost of goods sold entries.) What is the net realizable value of the receivables at the end of the period? None of the above. $204,700 $207,400 $229,700