Answered step by step

Verified Expert Solution

Question

1 Approved Answer

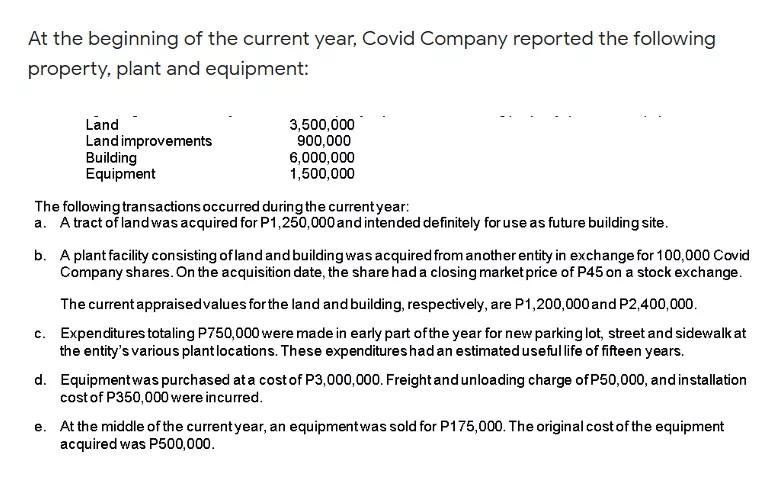

At the beginning of the current year, Covid Company reported the following property, plant and equipment: Land 3,500,000 Land improvements 900,000 Building 6,000,000 Equipment 1,500,000

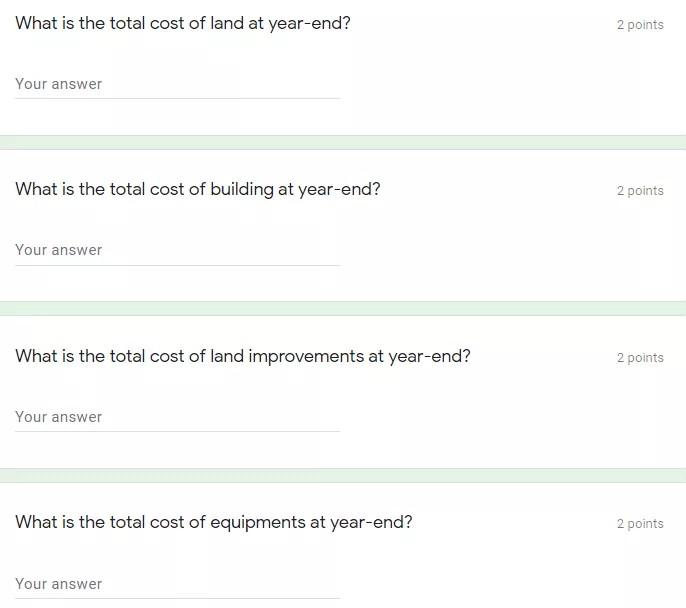

At the beginning of the current year, Covid Company reported the following property, plant and equipment: Land 3,500,000 Land improvements 900,000 Building 6,000,000 Equipment 1,500,000 The following transactions occurred during the current year: a. A tract of landwas acquired for P1,250,000 and intended definitely for use as future building site. b. A plant facility consisting of land and building was acquired from another entity in exchange for 100,000 Covid Company shares. On the acquisition date, the share had a closing market price of P45 on a stock exchange. The current appraisedvalues for the land and building, respectively, are P1,200,000 and P2,400,000. c. Expenditures totaling P750,000 were made in early part of the year for new parking lot, street and sidewalk at the entity's various plantlocations. These expenditures had an estimated useful life of fifteen years. d. Equipment was purchased at a cost of P3,000,000. Freight and unloading charge of P50,000, and installation cost of P350,000 were incurred. e. At the middle of the current year, an equipment was sold for P175,000. The original cost of the equipment acquired was P500,000. What is the total cost of land at year-end? 2 points Your answer What is the total cost of building at year-end? 2 points Your answer What is the total cost of land improvements at year-end? 2 points Your answer What is the total cost of equipments at year-end? 2 points Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started