Question

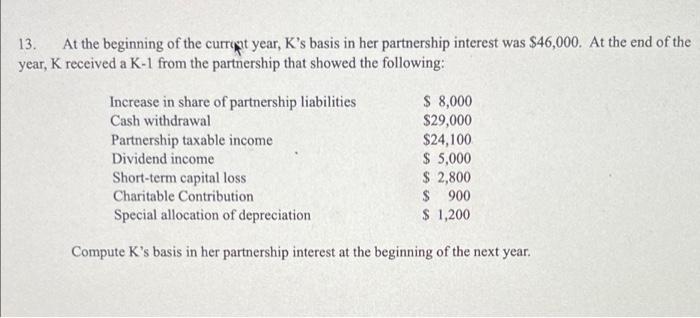

At the beginning of the curront year, K's basis in her partnership interest was $46,000. At the end of the year, K received a

At the beginning of the curront year, K's basis in her partnership interest was $46,000. At the end of the year, K received a K-1 from the partnership that showed the following: 13. $ 8,000 $29,000 Increase in share of partnership liabilities Cash withdrawal $24,100 $ 5,000 $ 2,800 $ 900 $ 1,200 Partnership taxable income Dividend income Short-term capital loss Charitable Contribution Special allocation of depreciation Compute K's basis in her partnership interest at the beginning of the next year.

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Answer Amt openingcaptal 46000 Adyustiment Addi Inirease in shaney ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investments

Authors: Gordon J. Alexander, William F. Sharpe, Jeffery V. Bailey

3rd edition

132926172, 978-0132926171

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App