Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of the year, an investor purchases a quantity of shares in two companies as specified in Table 1. Now, a year later,

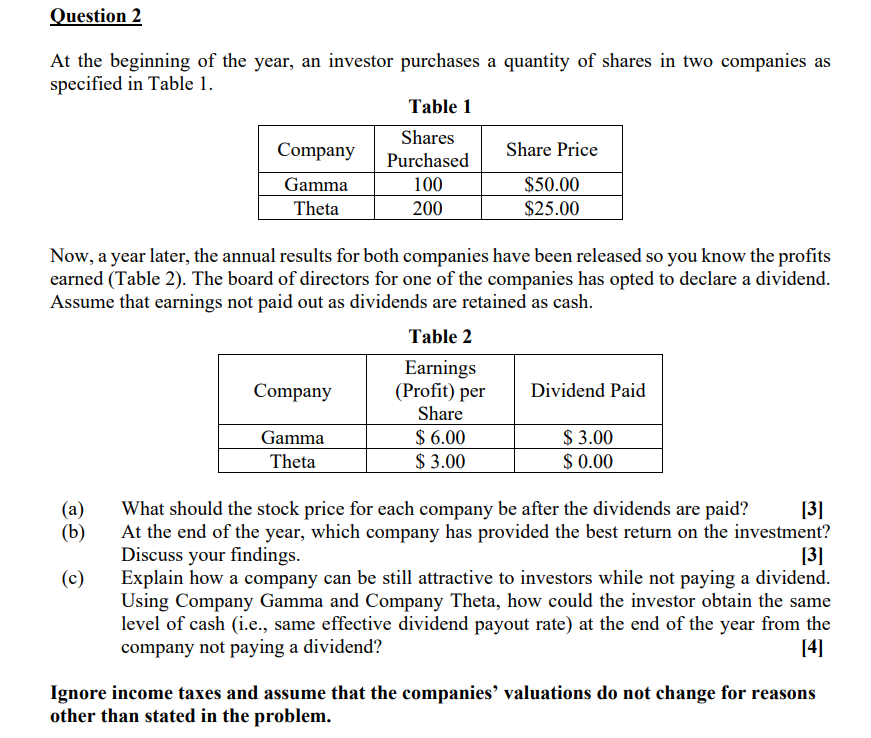

At the beginning of the year, an investor purchases a quantity of shares in two companies as specified in Table 1. Now, a year later, the annual results for both companies have been released so you know the profits earned (Table 2). The board of directors for one of the companies has opted to declare a dividend. Assume that earnings not paid out as dividends are retained as cash. (a) What should the stock price for each company be after the dividends are paid? [3] (b) At the end of the year, which company has provided the best return on the investment? Discuss your findings. [3] (c) Explain how a company can be still attractive to investors while not paying a dividend. Using Company Gamma and Company Theta, how could the investor obtain the same level of cash (i.e., same effective dividend payout rate) at the end of the year from the company not paying a dividend? [4] Ignore income taxes and assume that the companies' valuations do not change for reasons other than stated in the

At the beginning of the year, an investor purchases a quantity of shares in two companies as specified in Table 1. Now, a year later, the annual results for both companies have been released so you know the profits earned (Table 2). The board of directors for one of the companies has opted to declare a dividend. Assume that earnings not paid out as dividends are retained as cash. (a) What should the stock price for each company be after the dividends are paid? [3] (b) At the end of the year, which company has provided the best return on the investment? Discuss your findings. [3] (c) Explain how a company can be still attractive to investors while not paying a dividend. Using Company Gamma and Company Theta, how could the investor obtain the same level of cash (i.e., same effective dividend payout rate) at the end of the year from the company not paying a dividend? [4] Ignore income taxes and assume that the companies' valuations do not change for reasons other than stated in the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started