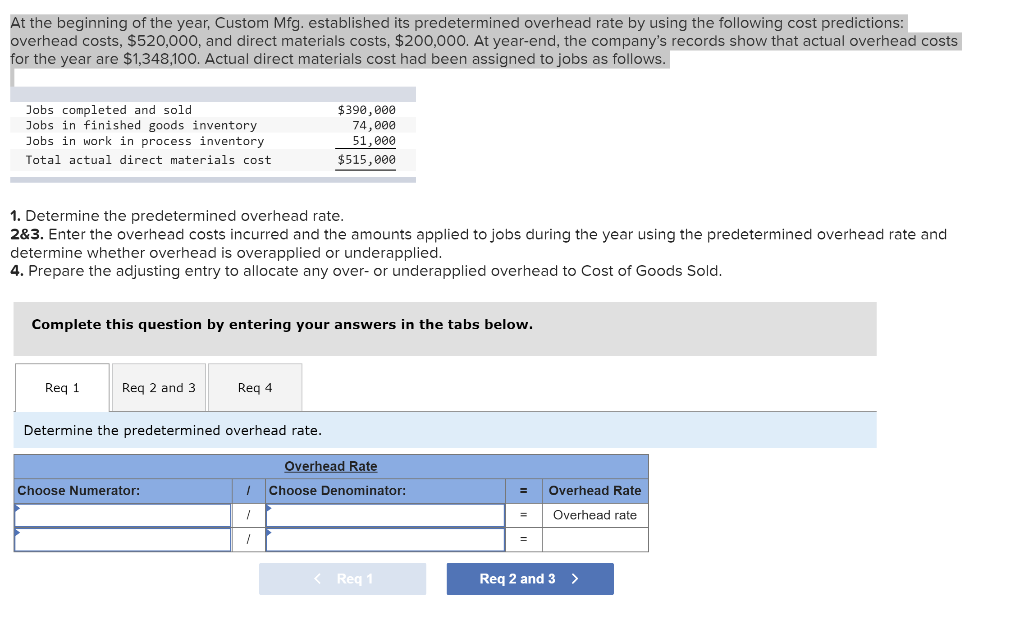

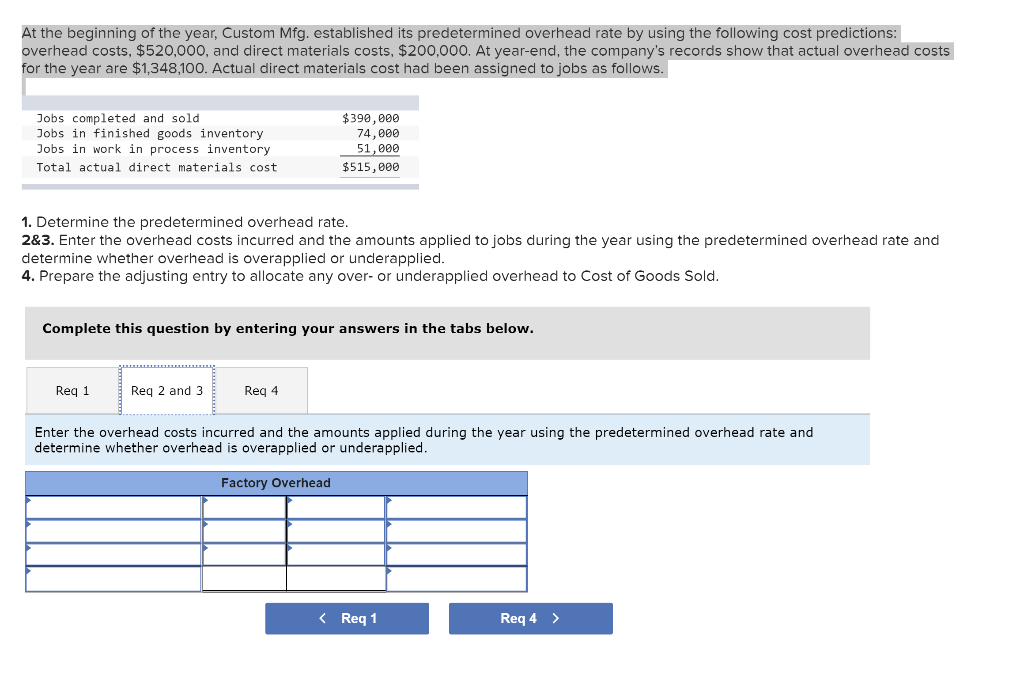

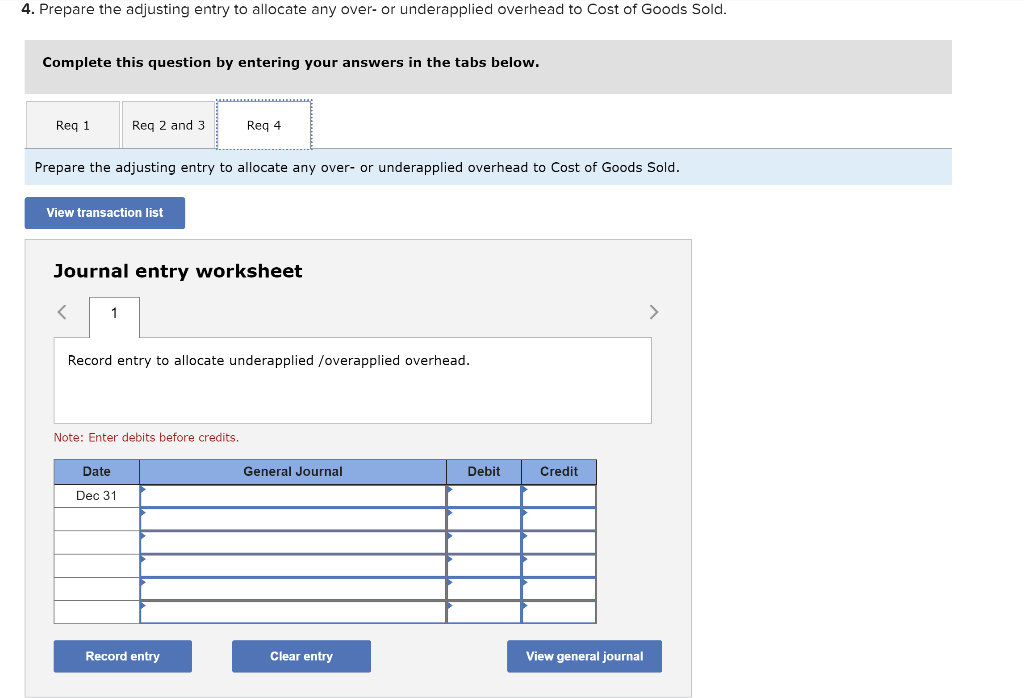

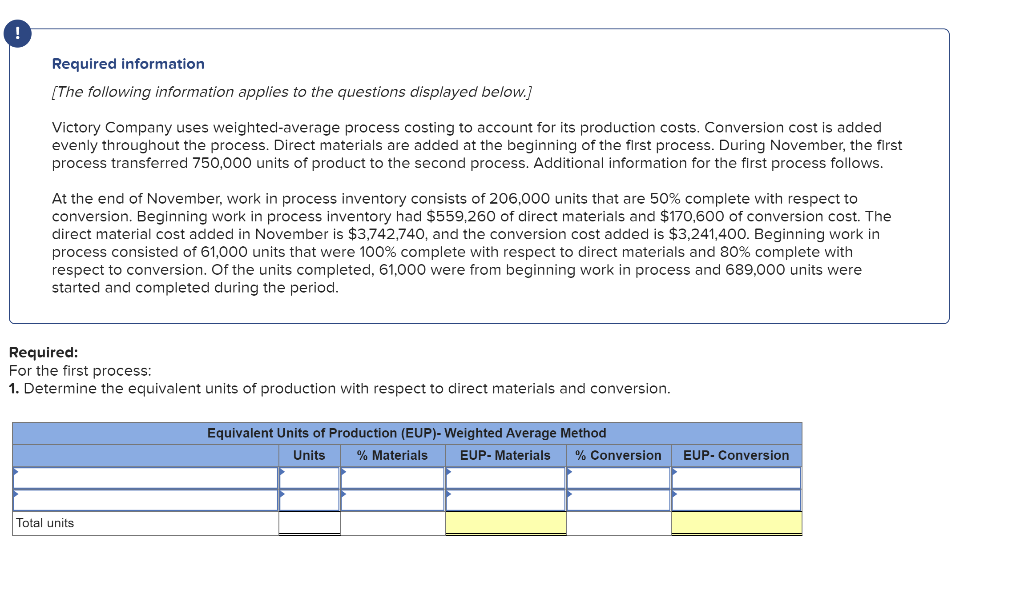

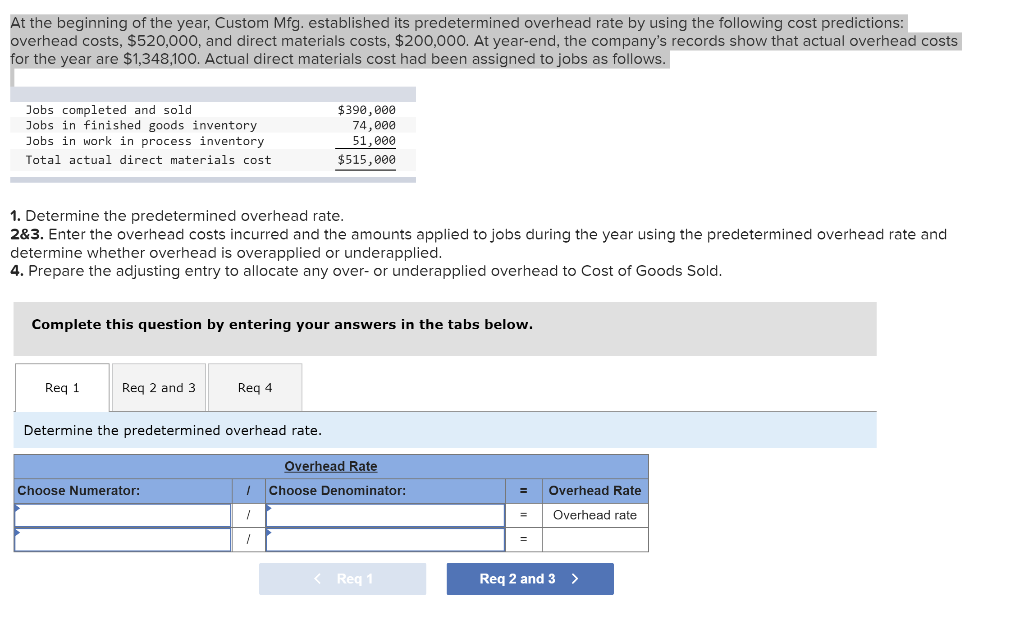

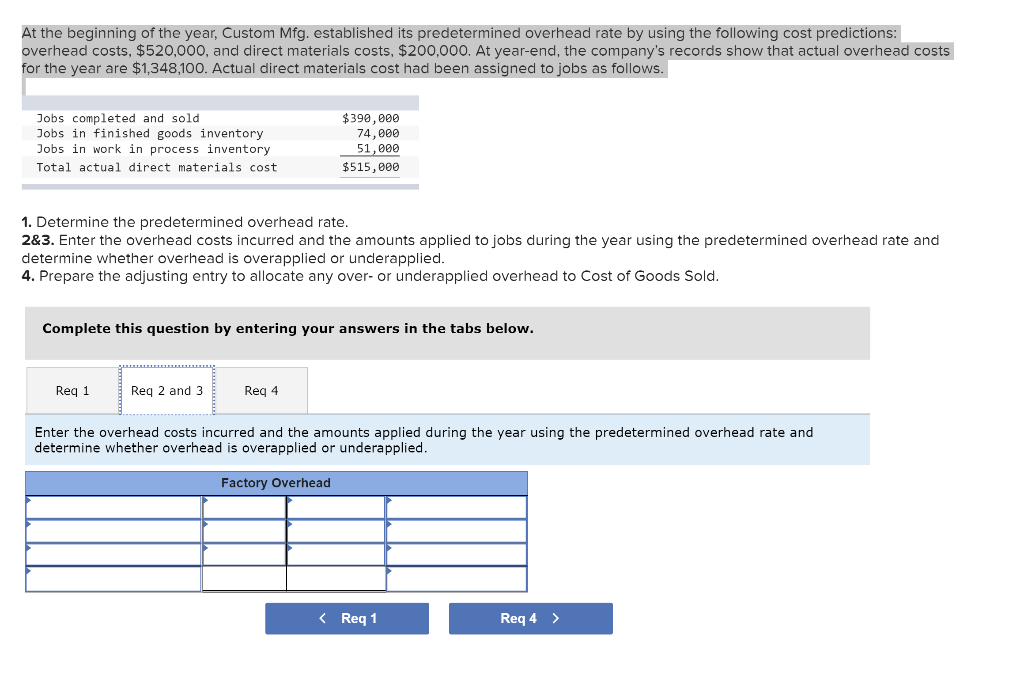

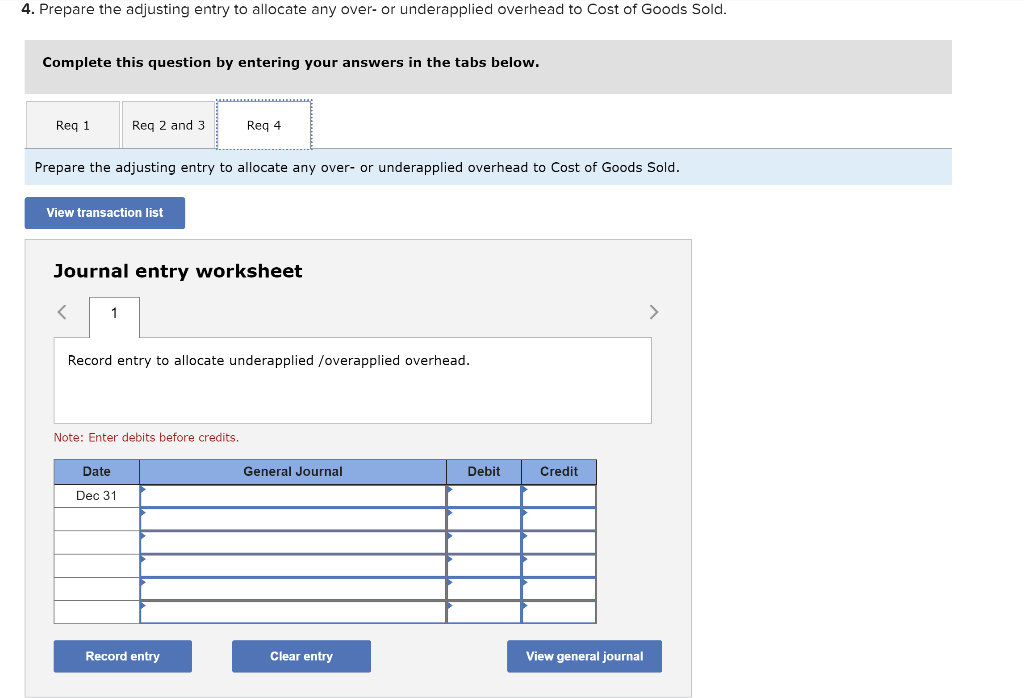

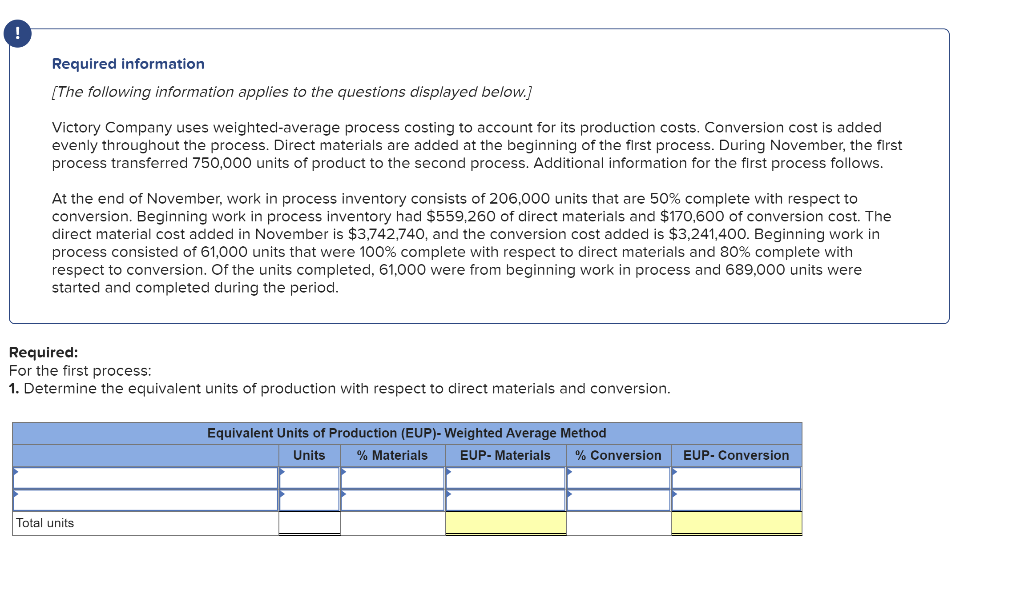

At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions: overhead costs, $520,000, and direct materials costs, $200,000. At year-end, the company's records show that actual overhead costs for the year are $1,348,100. Actual direct materials cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost $390,000 74,000 51,000 $515,000 1. Determine the predetermined overhead rate. 2&3. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Reg 1 Reg and 3 Reg 4 Determine the predetermined overhead rate. Overhead Rate Choose Numerator: 1 Choose Denominator: Overhead Rate 1 Overhead rate / = At the beginning of the year, Custom Mfg. established its predetermined overhead rate by using the following cost predictions: overhead costs, $520,000, and direct materials costs, $200,000. At year-end, the company's records show that actual overhead costs for the year are $1,348,100. Actual direct materials cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost $390,000 74,000 51,000 $515,000 1. Determine the predetermined overhead rate. 2&3. Enter the overhead costs incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Reg 4 Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. Factory Overhead 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Req 4 Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. View transaction list Journal entry worksheet Record entry to allocate underapplied /overapplied overhead. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Required information (The following information applies to the questions displayed below.] Victory Company uses weighted average process costing to account for its production costs, Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 750,000 units of product to the second process. Additional information for the first process follows. At the end of November, work in process inventory consists of 206,000 units that are 50% complete with respect to conversion. Beginning work in process inventory had $559,260 of direct materials and $170,600 of conversion cost. The direct material cost added in November is $3,742,740, and the conversion cost added is $3,241,400. Beginning work in process consisted of 61,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 61,000 were from beginning work in process and 689,000 units were started and completed during the period. Required: For the first process: 1. Determine the equivalent units of production with respect to direct materials and conversion. Equivalent Units of Production (EUP)- Weighted Average Method Units % Materials EUP- Materials % Conversion EUP- Conversion Total units