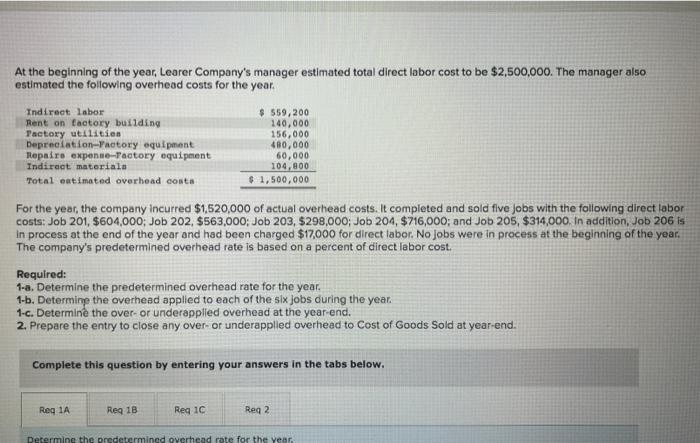

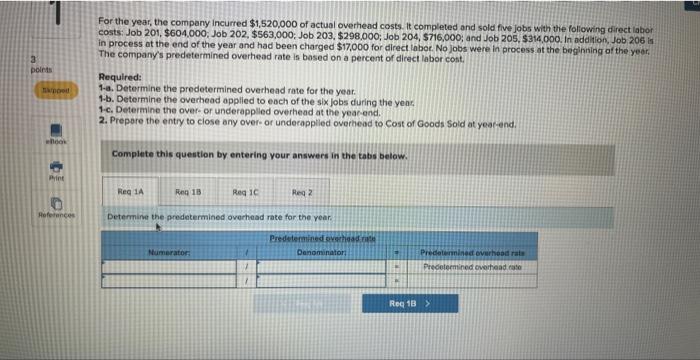

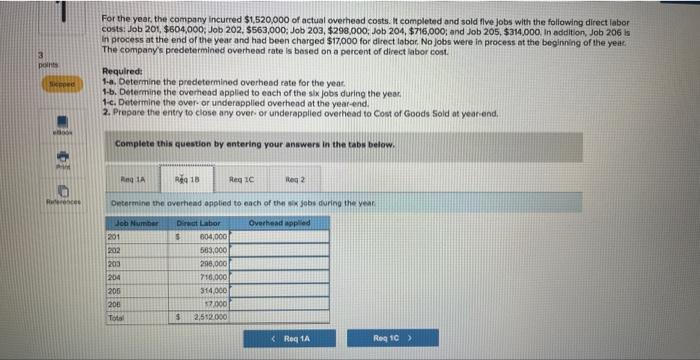

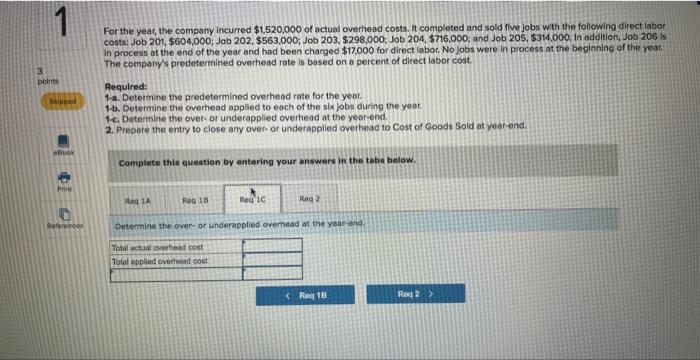

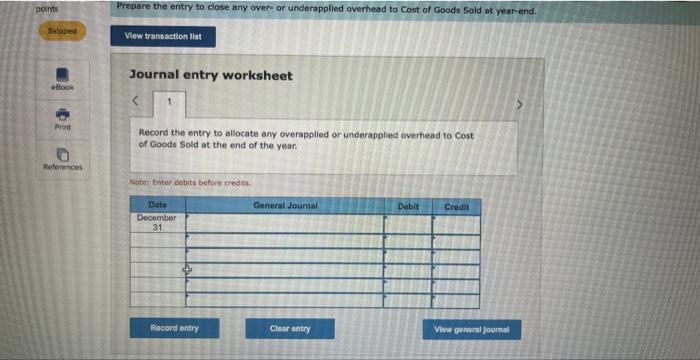

At the beginning of the year, Learer Company's manager estimated total direct labor cost to be $2,500,000. The manager also estimated the following overhead costs for the year. For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Job 205, \$314,000. In addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1-b. Determing the overhead applied to each of the six jobs during the year. 1-c. Determine the over-or underapplled overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct iabor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Jlob 205, 5314, 000, In addilion, Job, 206 is in process at the end of the year and had been charged $17,000 for direct laboc. No jobs were in process at the beginning of the year, The company's predetermined overhead rate is bosed on a percent of direct labor cont. Required: 1-a. Determine the predetermined overhead rate for the year. 1.b. Determine the overhead applied to each of the six jobs during the year, 1.c. Determine the over-or underapplled overhead at the yeac-and. 2. Prepere the entry to ciose any over- or underapplled overhead to Cost of Goods Sold at yeat-end. Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate for the year. For the year, the company incurred $1,520,000 of actual overheod costs. It completed and sold flve jobs with the following direct iabor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Job 205, $314,000, in addition, Job 206 is In process at the end of the year and had been charged $17,000 for direct labar. No jobs were in process at the beginning of the year The companys predetermined overheod rate is based on a percent of dicect labor coat. Required: 1.3. Determine the predetermined overheod rate for the yeat. 1-b. Determine the overnead applied to each of the slix jobs during the year 1.c. Determine the over-or underapplled overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end, Complete this question by entering your answers in the tabs below. Ontermine the overhead applied to each of the sx jobs during the year. For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$298,000; Job 204, \$716,000; and Job 205, \$34,000, In adelition, Jab 206 is in process bt the end of the yeat and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the yeat. The company's predetermined overhead rate is based on a percent of direct labor cost. Required: 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the yeot. 1-c. Determine the over- or underapplied overhead at the yeor-end. 2. Prepere the entry to close any over- or underapplied overhead to Cost of Goods Sold at yeat-end. Compiete this question by entering your answers in the tabis belaw. Determine the over- or underapplied overhead at the year-end. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to Cost of Goods sold at the end of the year. Nate: Enter debits before credits