Question

14 At the beginning of the year, Lucca purchases 2,000 units of the Apex Growth Segregated Fund at a net asset value per unit

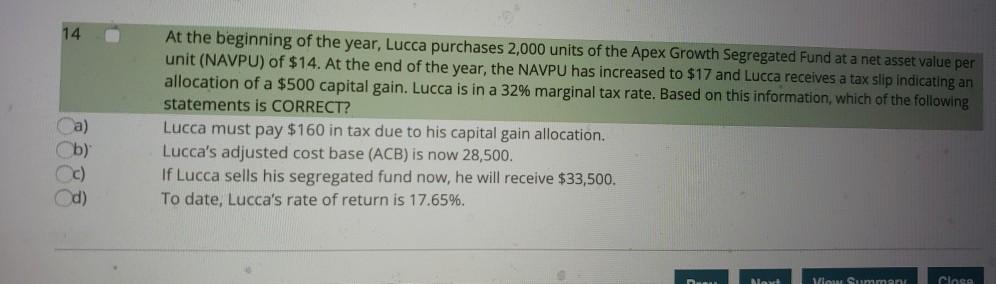

14 At the beginning of the year, Lucca purchases 2,000 units of the Apex Growth Segregated Fund at a net asset value per unit (NAVPU) of $14. At the end of the year, the NAVPU has increased to $17 and Lucca receives a tax slip indicating an allocation of a $500 capital gain. Lucca is in a 32% marginal tax rate. Based on this information, which of the following statements is CORRECT? Ca) Cb) Cc) Od) Lucca must pay $160 in tax due to his capital gain allocation. Lucca's adjusted cost base (ACB) is now 28,500. If Lucca sells his segregated fund now, he will receive $33,500. To date, Lucca's rate of return is 17.65%. Viow Summan Close Novt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App