Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of the year partners Ahmed and Ali have capital balances in a partnership of 50,000 and 75,000 respectively, Ahmed and Ali agreed

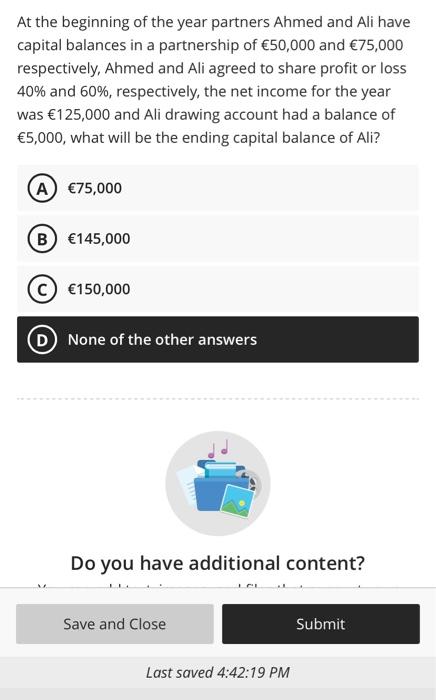

At the beginning of the year partners Ahmed and Ali have capital balances in a partnership of 50,000 and 75,000 respectively, Ahmed and Ali agreed to share profit or loss 40% and 60%, respectively, the net income for the year was 125,000 and Ali drawing account had a balance of 5,000, what will be the ending capital balance of Ali?

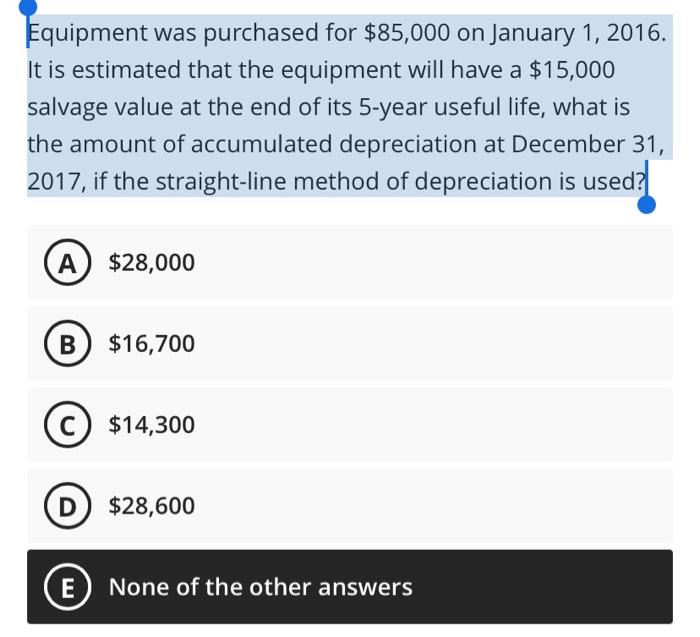

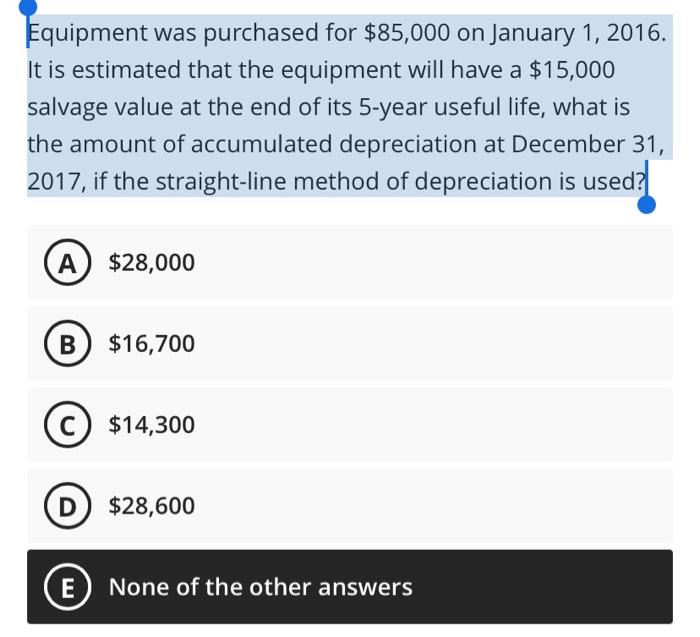

Equipment was purchased for $85,000 on January 1, 2016. It is estimated that the equipment will have a $15,000 salvage value at the end of its 5-year useful life, what is the amount of accumulated depreciation at December 31, 2017, if the straight-line method of depreciation is used?

Equipment was purchased for $85,000 on January 1, 2016. It is estimated that the equipment will have a $15,000 salvage value at the end of its 5-year useful life, what is the amount of accumulated depreciation at December 31, 2017, if the straight-line method of depreciation is used?

At the beginning of the year partners Ahmed and Ali have capital balances in a partnership of 50,000 and 75,000 respectively, Ahmed and Ali agreed to share profit or loss 40% and 60%, respectively, the net income for the year was 125,000 and Ali drawing account had a balance of 5,000, what will be the ending capital balance of Ali? (A 75,000 B 145,000 150,000 None of the other answers Do you have additional content? Save and Close Submit Last saved 4:42:19 PM Equipment was purchased for $85,000 on January 1, 2016. It is estimated that the equipment will have a $15,000 salvage value at the end of its 5-year useful life, what is the amount of accumulated depreciation at December 31, 2017, if the straight-line method of depreciation is used? . $28,000 B) $16,700 C) $14,300 D) $28,600 E None of the other answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started