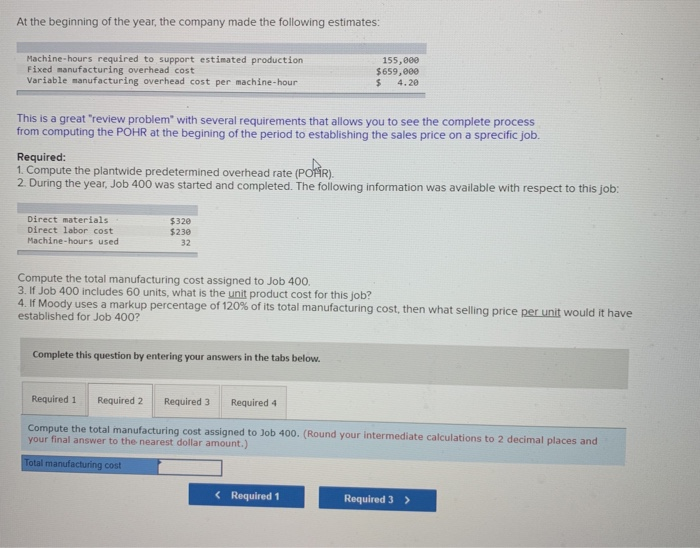

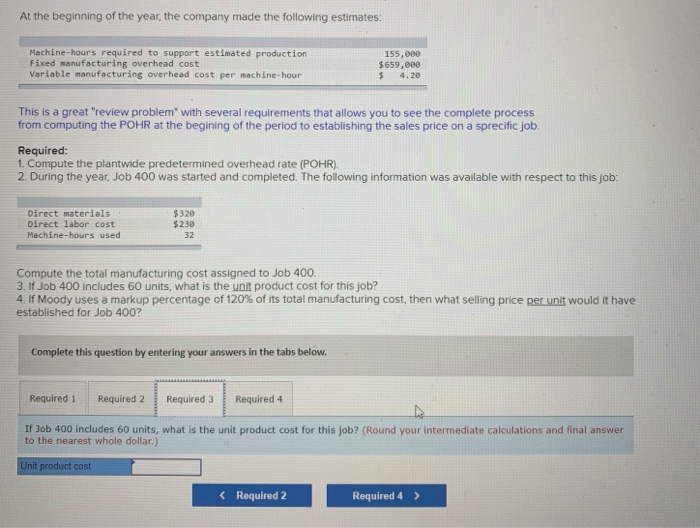

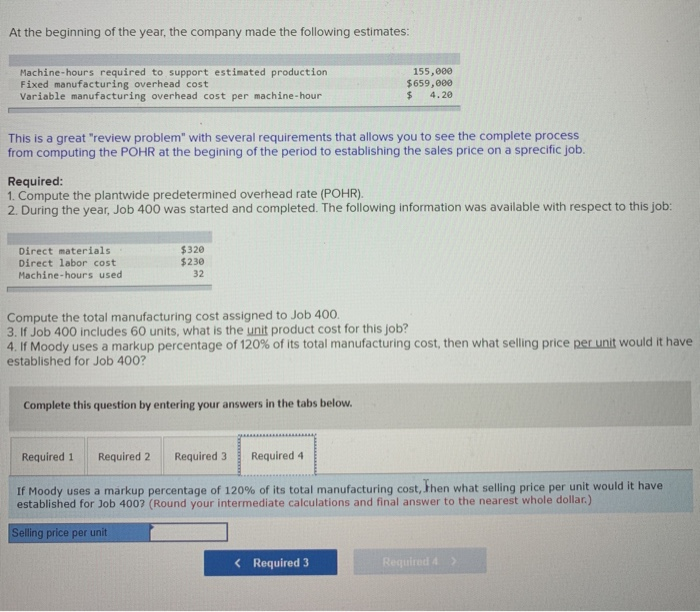

At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour 155,000 $659,000 $ 4.20 This is a great "review problem with several requirements that allows you to see the complete process from computing the POHR at the begining of the period to establishing the sales price on a sprecific job. Required: 1. Compute the plantwide predetermined overhead rate (POR). 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $320 $230 32 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the total manufacturing cost assigned to Job 400. (Round your intermediate calculations to 2 decimal places and your final answer to the nearest dollar amount.) Total manufacturing cost At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour 155,000 $659,000 $ 4.20 This is a great "review problem with several requirements that allows you to see the complete process from computing the POHR at the begining of the period to establishing the sales price on a sprecific job. Required: 1. Compute the plantwide predetermined overhead rate (POHR). 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $320 $230 32 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If Job 400 includes 60 units, what is the unit product cost for this job? (Round your intermediate calculations and final answer to the nearest whole dollar.) Unit product cost At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour 155,000 $659,000 $ 4.20 This is a great "review problem" with several requirements that allows you to see the complete process from computing the POHR at the begining of the period to establishing the sales price on a sprecific job. Required: 1. Compute the plantwide predetermined overhead rate (POHR) 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $320 $230 32 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If Moody uses a markup percentage of 120% of its total manufacturing cost, Then what selling price per unit would it have established for Job 4007 (Round your intermediate calculations and final answer to the nearest whole dollar) Selling price per unit