Answered step by step

Verified Expert Solution

Question

1 Approved Answer

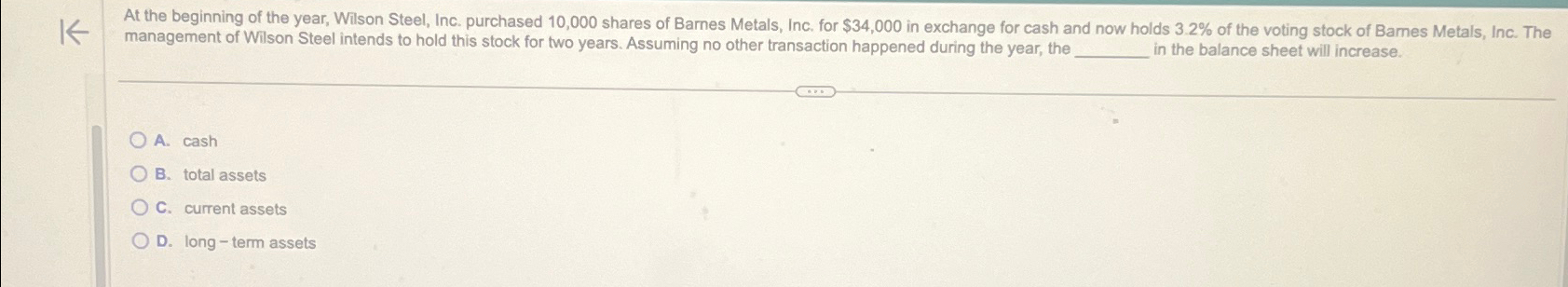

At the beginning of the year, Wilson Steel, Inc. purchased 1 0 , 0 0 0 shares of Barnes Metals, Inc. for $ 3 4

At the beginning of the year, Wilson Steel, Inc. purchased shares of Barnes Metals, Inc. for $ in exchange for cash and now holds of the voting stock of Bames Metals, Inc. The management of Wilson Steel intends to hold this stock for two years. Assuming no other transaction happened during the year, the in the batance sheet will increase.

A cash

B total assets

C current assets

D long term assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started