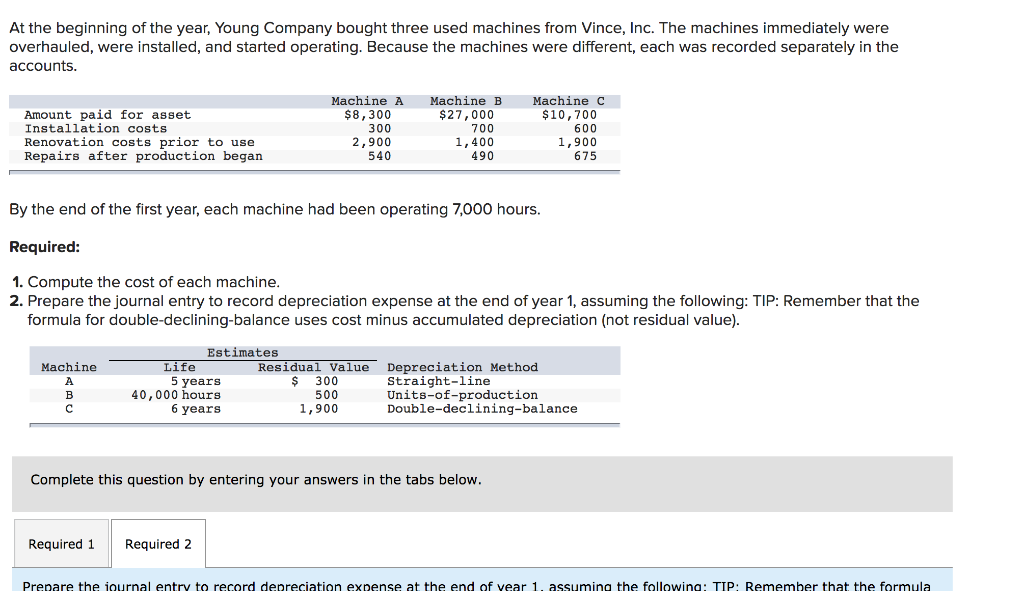

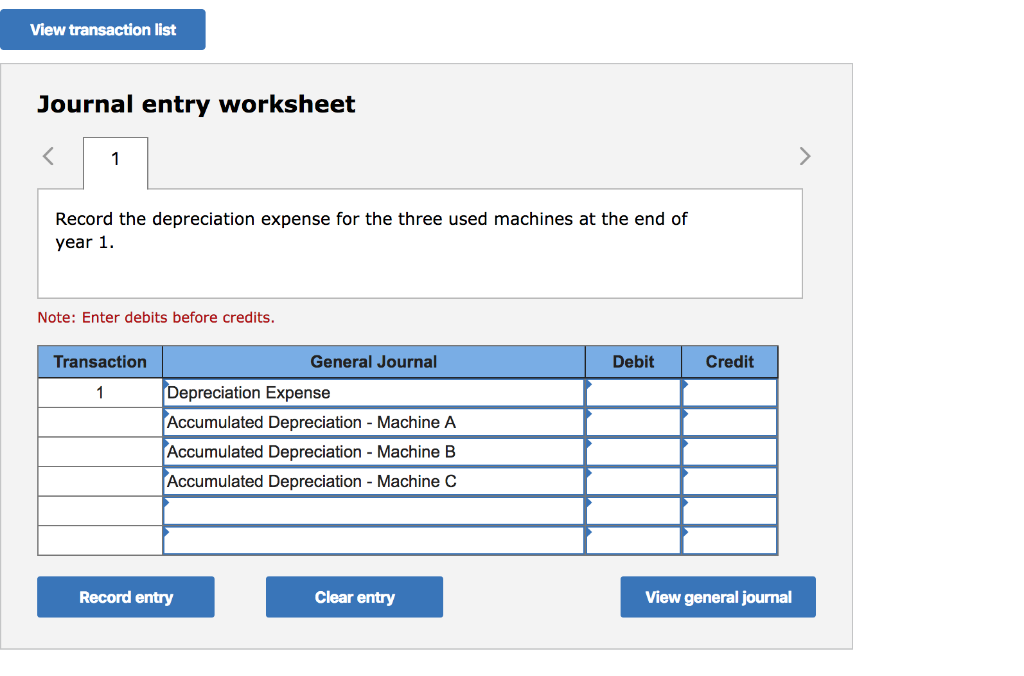

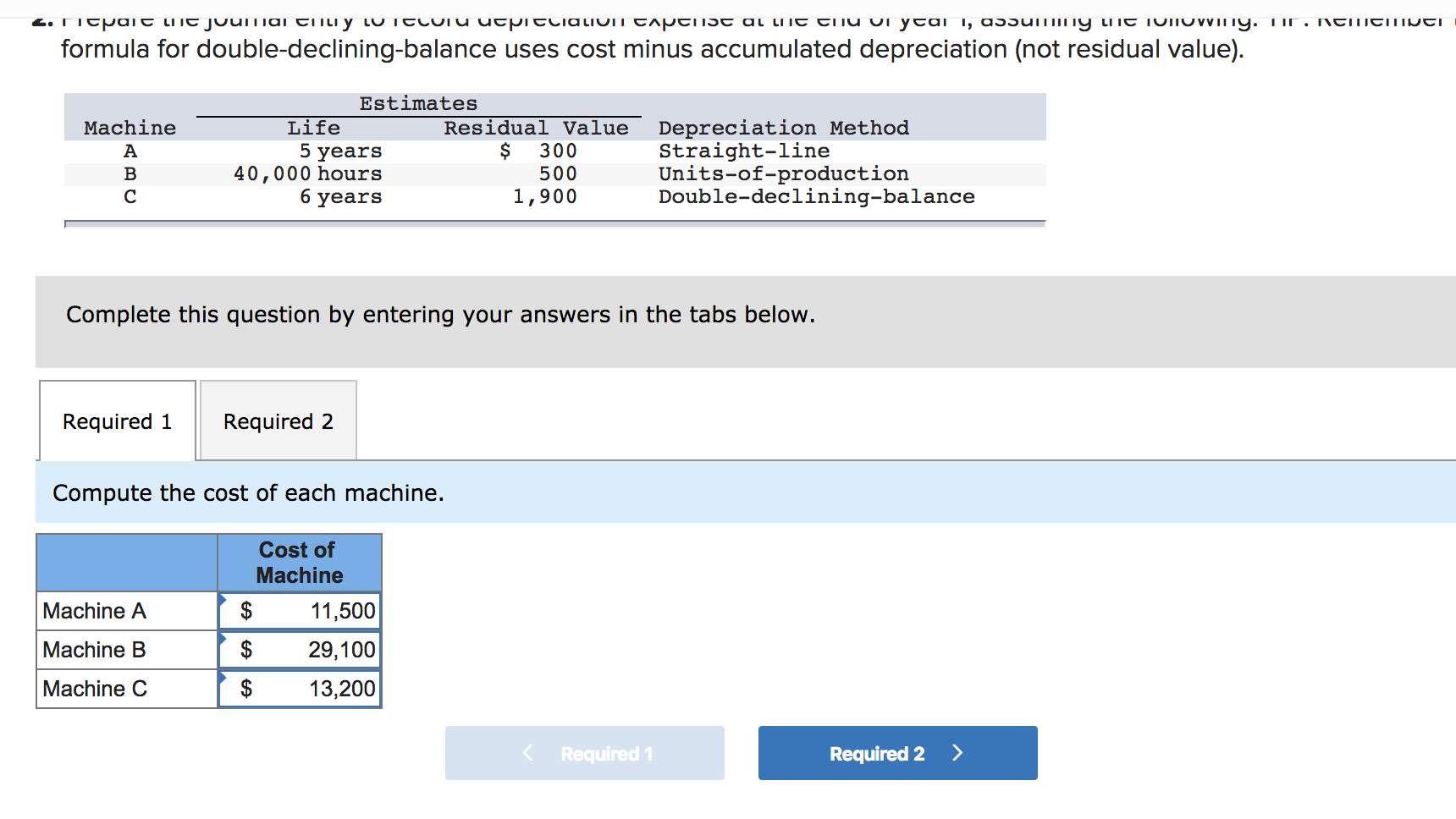

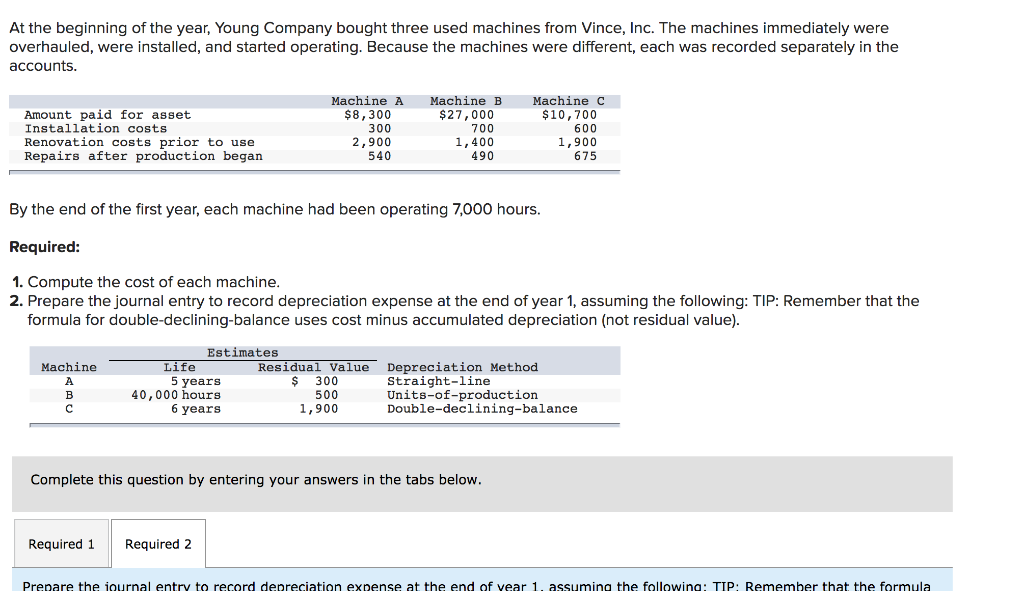

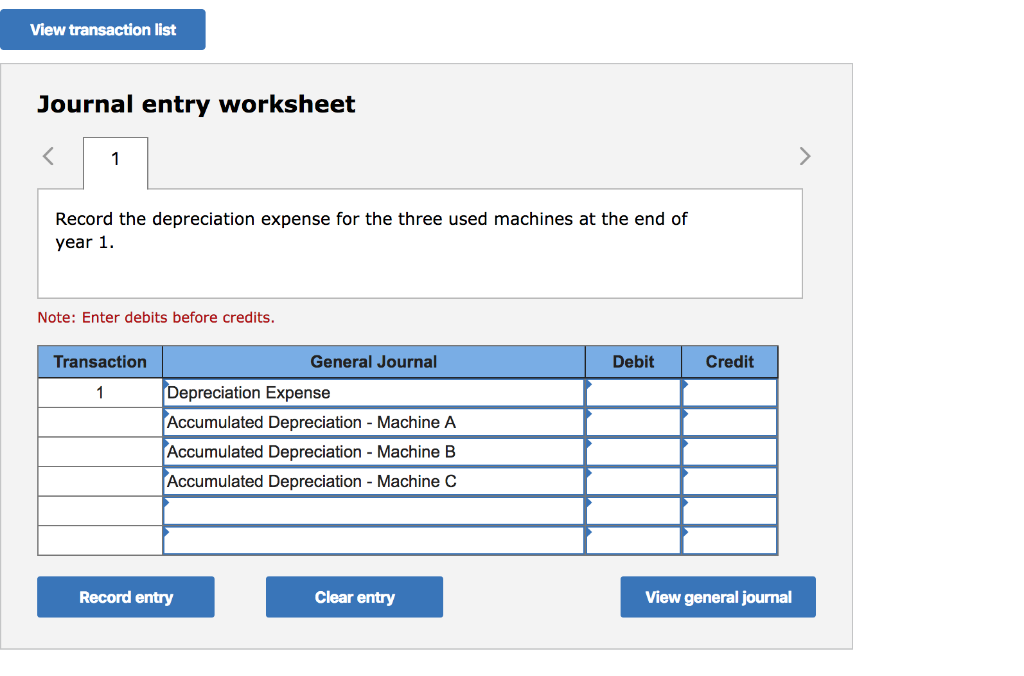

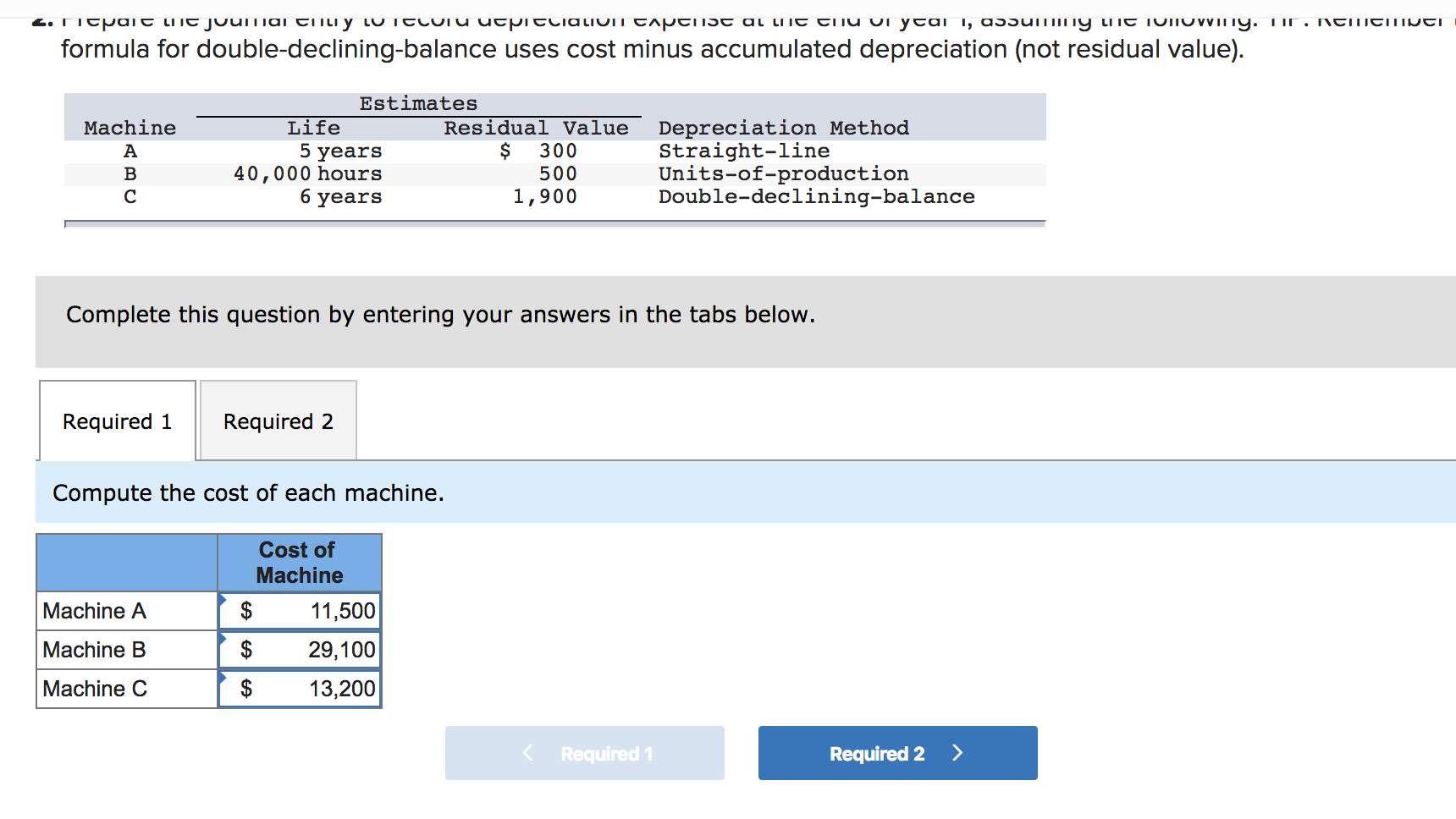

At the beginning of the year, Young Company bought three used machines from Vince, Inc. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Amount paid for asset Installation costs Renovation costs prior to use Repairs after production began Machine A $8,300 300 2,900 540 Machine B $ 27,000 700 1,400 490 Machine C $10,700 600 1,900 675 By the end of the first year, each machine had been operating 7,000 hours. Required: 1. Compute the cost of each machine. 2. Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: TIP: Remember that the formula for double-declining-balance uses cost minus accumulated depreciation (not residual value). Machine Estimates Life Residual Value Depreciation Method 5 years $ 300 Straight-line 40,000 hours 500 Units-of-production 6 years 1,900 Double-declining-balance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the iournal entry to record depreciation expense at the end of vear 1. assuming the following: TIP: Remember that the formula View transaction list Journal entry worksheet Record the depreciation expense for the three used machines at the end of year 1. Note: Enter debits before credits. Transaction Debit Credit General Journal Depreciation Expense Accumulated Depreciation - Machine A Accumulated Depreciation - Machine B Accumulated Depreciation - Machine C Record entry Clear entry View general journal 4. Ticparc WC juurmai cui y Lu Tccuru ucpiciaLUIT capenst al uit vi ytai i, assumumny LTC TUNTUVviriy. TR. NEMEMUNCU formula for double-declining-balance uses cost minus accumulated depreciation (not residual value). Machine Estimates Life Residual Value Depreciation Method 5 years $ 300 Straight-line 40,000 hours 500 Units-of-production 6 years 1,900 Double-declining-balance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost of each machine. Machine A Machine B Machine C Cost of Machine 1 $ 11,500 $ 29,100 $ 13,200