Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of year 1, a company acquires a $1,000,000 term loan with an interest rate of 7.50% and an annual payment based

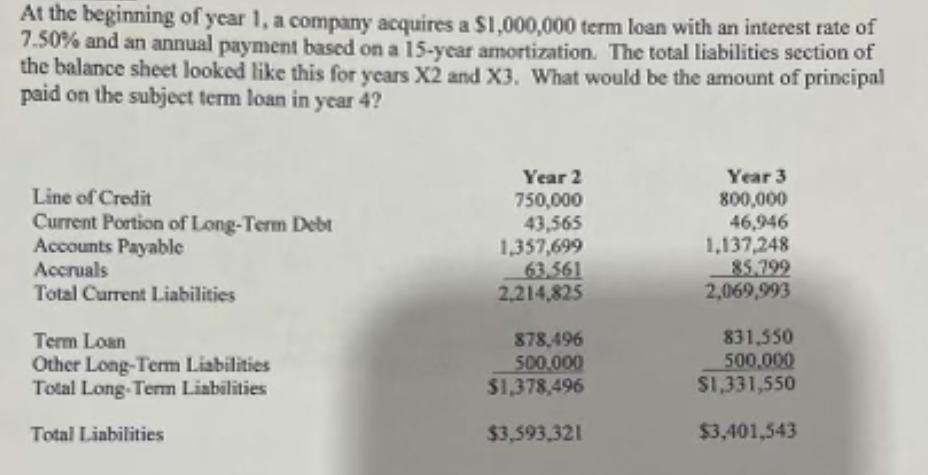

At the beginning of year 1, a company acquires a $1,000,000 term loan with an interest rate of 7.50% and an annual payment based on a 15-year amortization. The total liabilities section of the balance sheet looked like this for years X2 and X3. What would be the amount of principal paid on the subject term loan in year 4? Year 2 Line of Credit 750,000 Year 3 800,000 Current Portion of Long-Term Debt 43,565 Accounts Payable 1,357,699 46,946 1,137,248 Accruals Total Current Liabilities 63.561 2,214,825 85.799 2,069,993 Term Loan 878,496 831,550 Other Long-Term Liabilities 500,000 500,000 Total Long-Term Liabilities $1,378,496 $1,331,550 Total Liabilities $3,593,321 $3,401,543

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started