Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of Year 1, Mike Co. had 100,000 shares of $1 par-value common stock outstanding. Mike's Year 1 net income before the

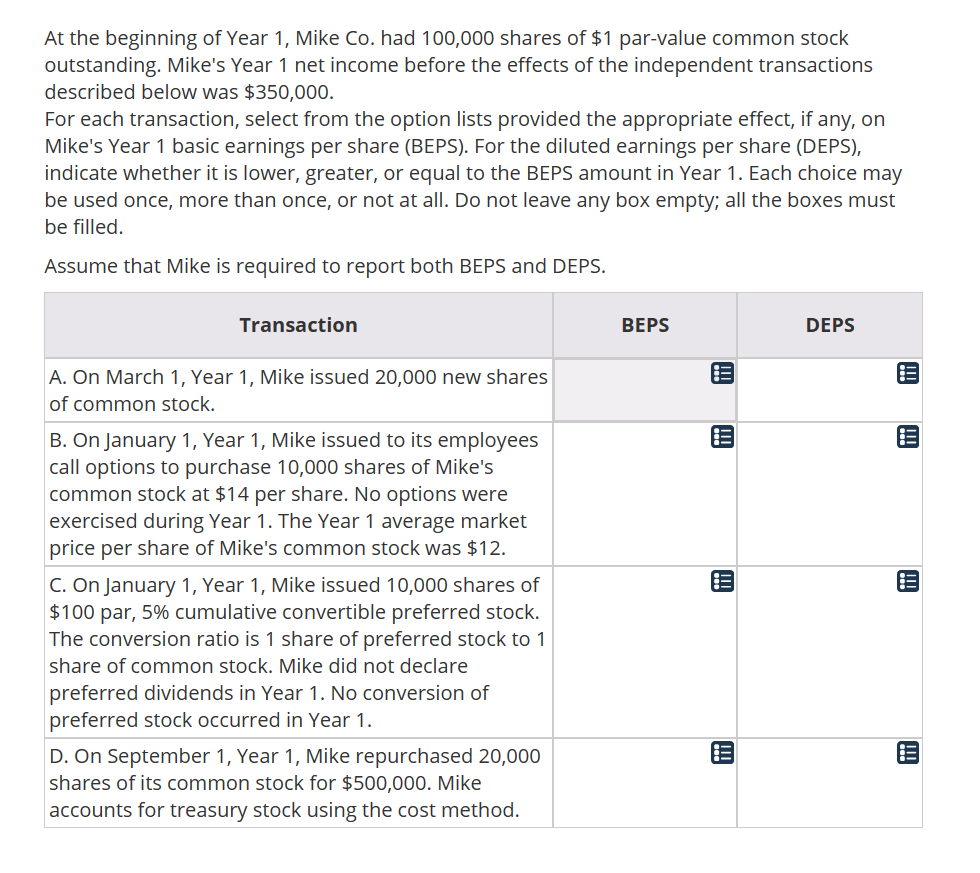

At the beginning of Year 1, Mike Co. had 100,000 shares of $1 par-value common stock outstanding. Mike's Year 1 net income before the effects of the independent transactions described below was $350,000. For each transaction, select from the option lists provided the appropriate effect, if any, on Mike's Year 1 basic earnings per share (BEPS). For the diluted earnings per share (DEPS), indicate whether it is lower, greater, or equal to the BEPS amount in Year 1. Each choice may be used once, more than once, or not at all. Do not leave any box empty; all the boxes must be filled. Assume that Mike is required to report both BEPS and DEPS. Transaction A. On March 1, Year 1, Mike issued 20,000 new shares of common stock. B. On January 1, Year 1, Mike issued to its employees call options to purchase 10,000 shares of Mike's common stock at $14 per share. No options were exercised during Year 1. The Year 1 average market price per share of Mike's common stock was $12. C. On January 1, Year 1, Mike issued 10,000 shares of $100 par, 5% cumulative convertible preferred stock. The conversion ratio is 1 share of preferred stock to 1 share of common stock. Mike did not declare preferred dividends in Year 1. No conversion of preferred stock occurred in Year 1. D. On September 1, Year 1, Mike repurchased 20,000 shares of its common stock for $500,000. Mike accounts for treasury stock using the cost method. BEPS BE E E !!!! DEPS = !!! !!!

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Effects on Mikes Year 1 Earnings per Share Transaction BEPS DEPS A Issued 20000 new shares Decrease ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started