Question

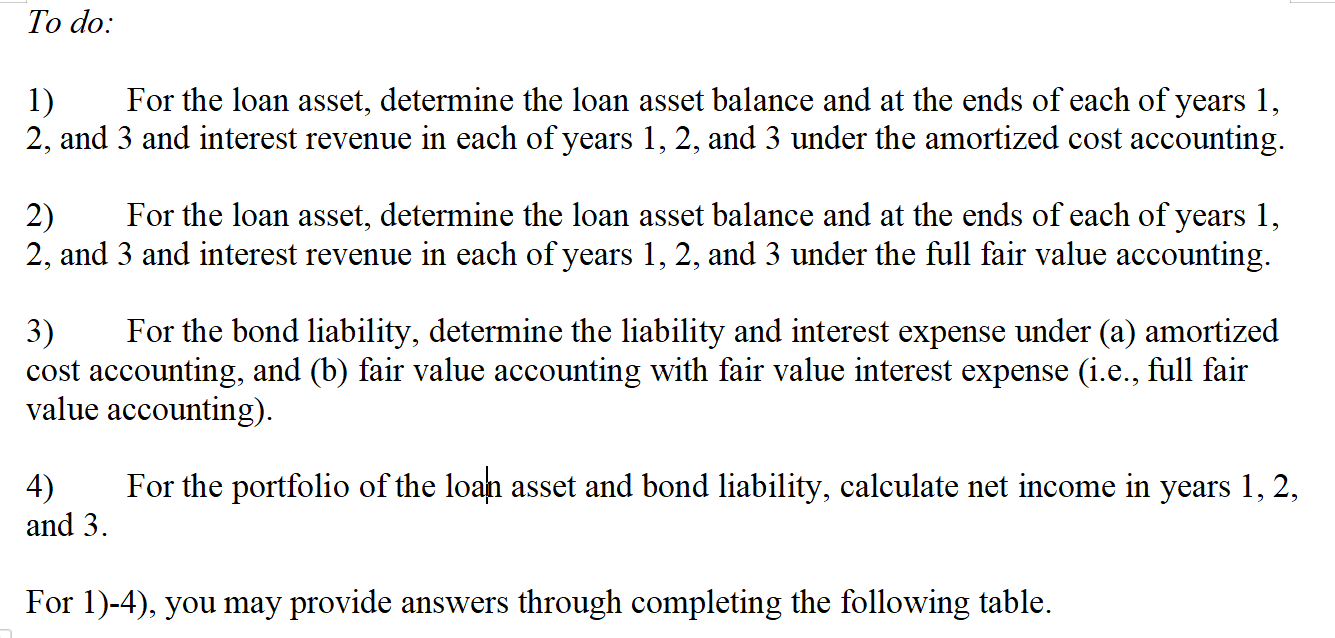

At the beginning of year 1, Unbalanced Bank makes a three-year, fixed-rate loan to Butterfly Corp. Butterfly promises to repay Unbalanced in three installments of

At the beginning of year 1, Unbalanced Bank makes a three-year, fixed-rate loan to Butterfly Corp. Butterfly promises to repay Unbalanced in three installments of $100 each year at the ends of years 1, 2, and 3. The initial market interest rate is 6% at the time of issuance. The market rate falls to 4% at the end of year 1 and rises to 5% at the end of year 2.

Also at the beginning of year 1, Unbalanced finances this loan asset by issuing a three-year, floating-rate, annual paying bond liability at the beginning of year 1. The initial coupon rate on the bond is 6%. The floating rate changes to the market rate 4% at the end of year 1 and 5% at the end of year 2. Unbalanced promises to pay the coupon payments at the ends of years 1, 2, and 3 and the face value at the end of year 3.

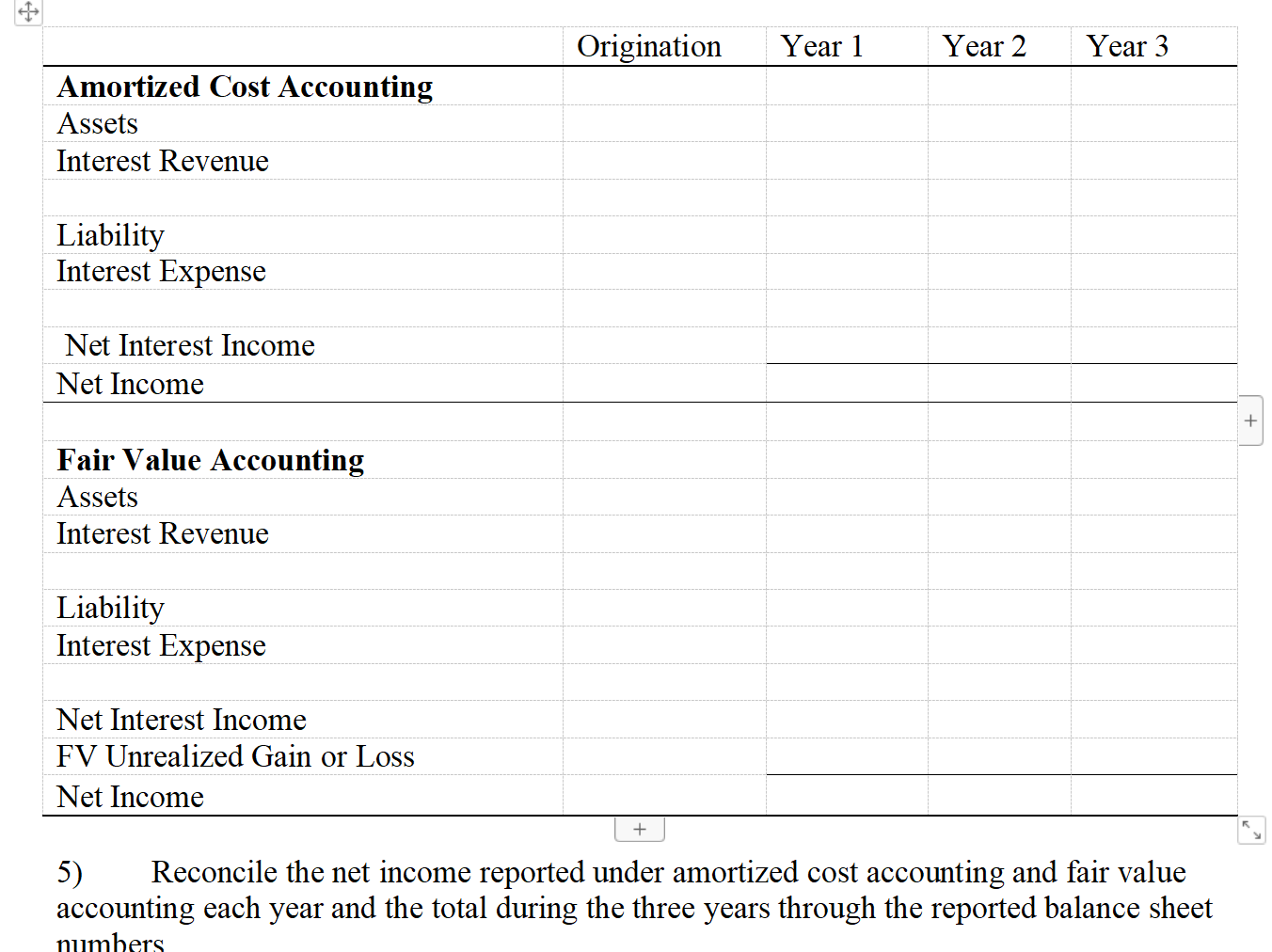

Origination Year 1 Year 2 Year 3 Amortized Cost Accounting Assets Interest Revenue Liability Interest Expense Net Interest Income Net Income Fair Value Accounting Assets Interest Revenue Liability Interest Expense Net Interest Income FV Unrealized Gain or Loss Net Income 5) + Reconcile the net income reported under amortized cost accounting and fair value accounting each year and the total during the three years through the reported balance sheet numbers +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate the present value of each future cash flow using a discount rate of 6 Year 1 20000 PV 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started