Answered step by step

Verified Expert Solution

Question

1 Approved Answer

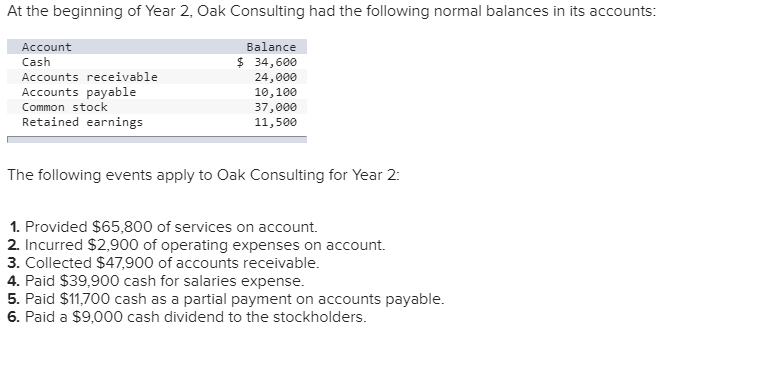

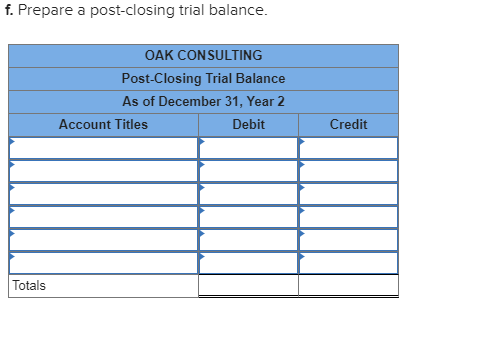

At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts: Account Cash Accounts receivable Accounts payable Common stock Retained

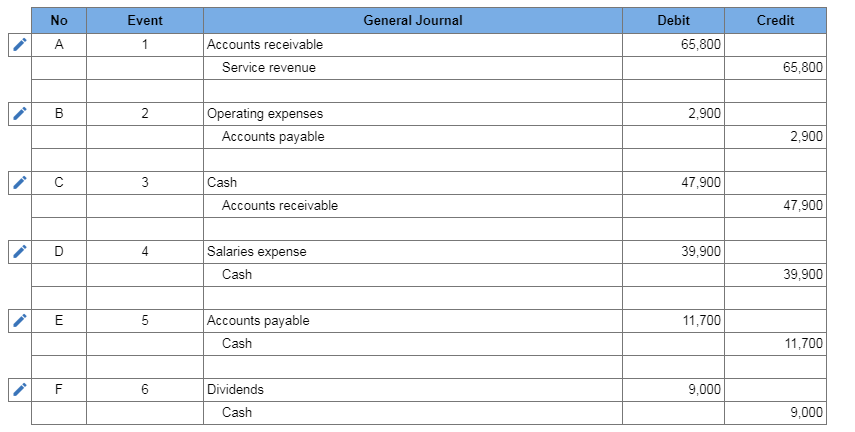

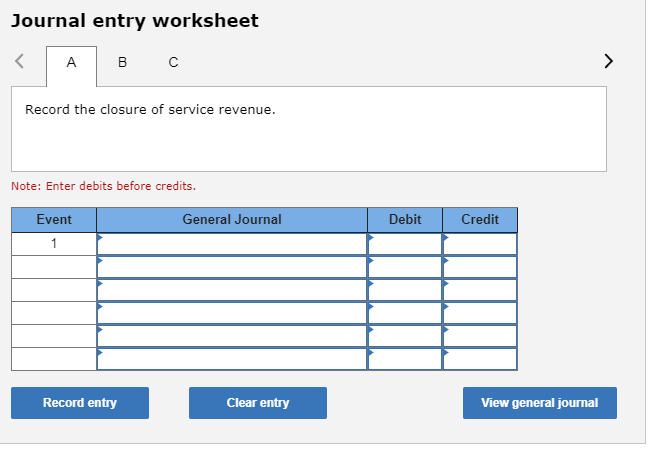

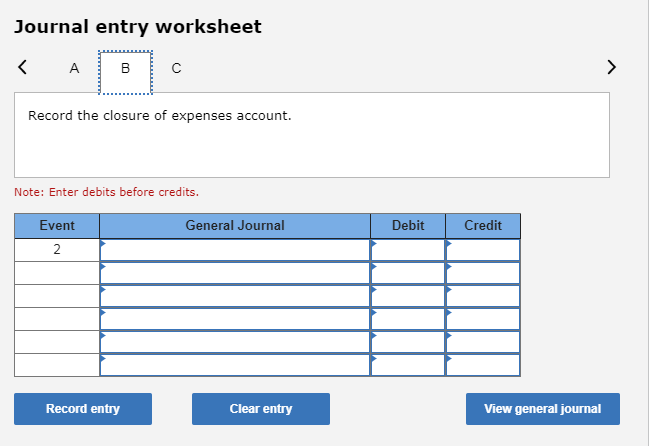

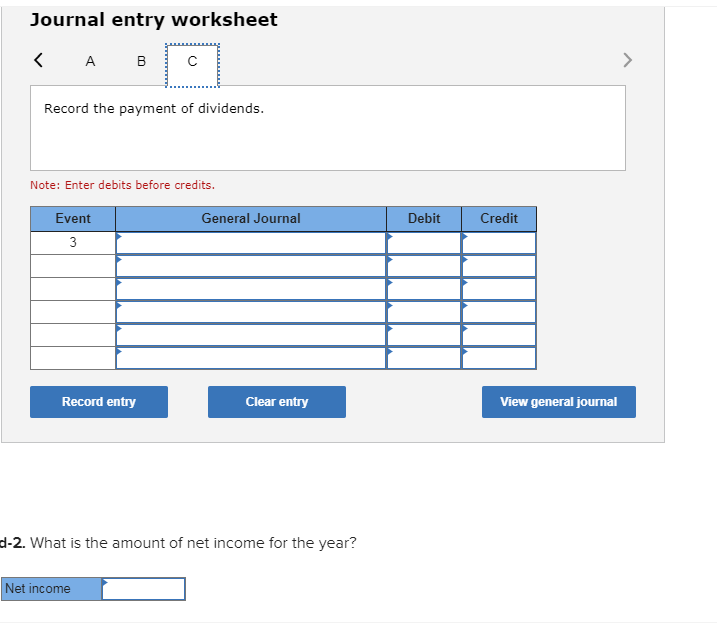

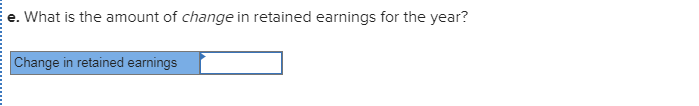

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

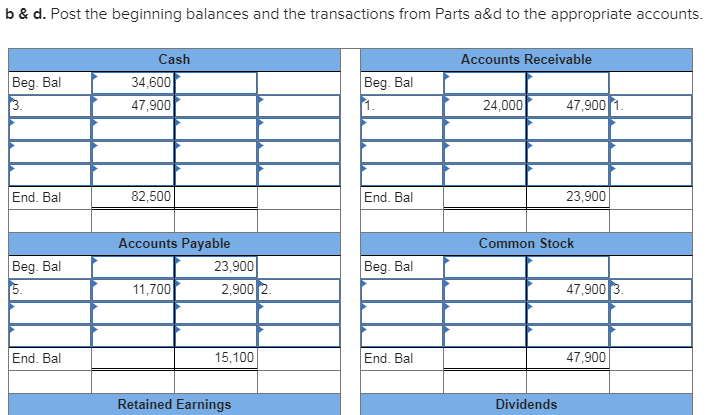

Step: 2

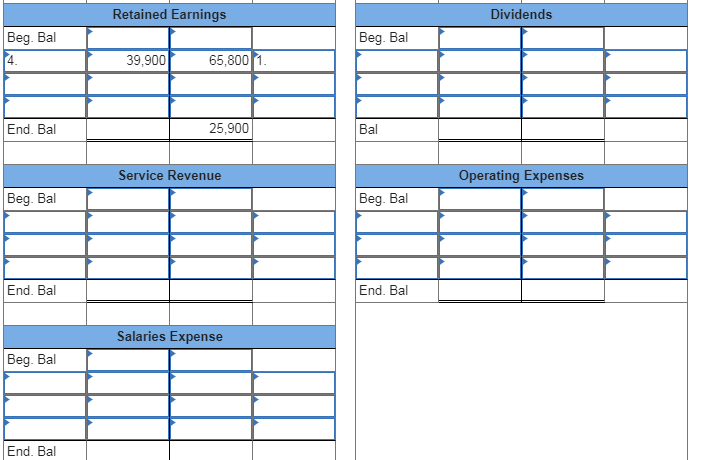

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started