at the bottom here is my question!

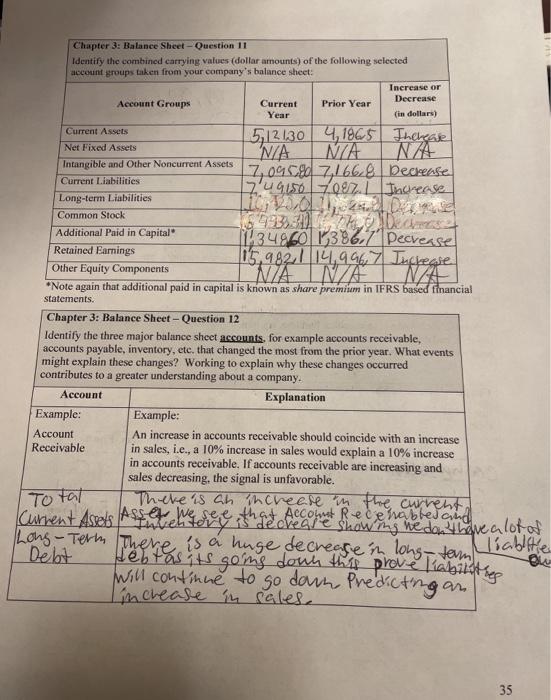

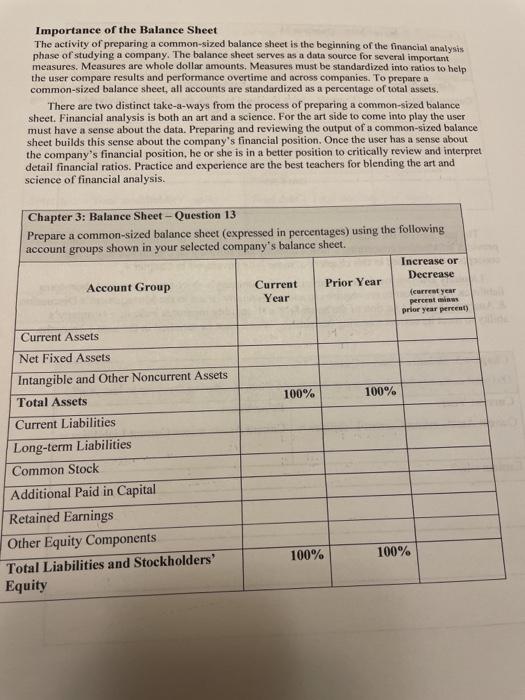

Chapter 3: Balance Sheet - Question 11 Identify the combined carrying values (dollar amounts) of the following selected account groups taken from your company's balance sheet: Increase or Account Groups Decrease Current Prior Year Year (in dollars) Current Assets 512130 4,1865 Thergare Net Fixed Assets INA NA Intangible and Other Noncurrent Assets 3095d716628 Decrease Current Liabilities 17.49450 7087. 1. Increase Long-term Liabilities Common Stock Additional Paid in Capital" 11349601386.7'Decrease Retained Earnings 15,982, 114,997 Increase Other Equity Components NA *Note again that additional paid in capital is known as share premium in IFRS based financial statements. Chapter 3: Balance Sheet - Question 12 Identify the three major balance sheet accounts, for example accounts receivable, accounts payable, inventory, etc. that changed the most from the prior year. What events might explain these changes? Working to explain why these changes occurred contributes to a greater understanding about a company. Account Explanation Example: Example: Account An increase in accounts receivable should coincide with an increase Receivable in sales, i.e., a 10% increase in sales would explain a 10% increase in accounts receivable. If accounts receivable are increasing and sales decreasing, the signal is unfavorable. There is an increase in the current, Current Aspels Assemenee de creare showing we do have a lot of Long-Term There is a huge decreare'n long-term liablite Debt debtas its going down this prove liabilities Iincrease in sales Total will continue to so dan Predicting an 35 Importance of the Balance Sheet The activity of preparing a common-sized balance sheet is the beginning of the financial analysis phase of studying a company. The balance sheet serves as a data source for several important measures. Measures are whole dollar amounts. Measures must be standardized into raios to help the user compare results and performance overtime and across companies. To prepare a common-sized balance sheet, all accounts are standardized as a percentage of total assets. There are two distinct take-4-ways from the process of preparing a common-sized balance sheet. Financial analysis is both an art and a science. For the art side to come into play the user must have a sense about the data. Preparing and reviewing the output of a common-sized balance sheet builds this sense about the company's financial position. Once the user has a sense about the company's financial position, he or she is in a better position to critically review and interpret detail financial ratios. Practice and experience are the best teachers for blending the art and science of financial analysis. Chapter 3: Balance Sheet - Question 13 Prepare a common-sized balance sheet (expressed in percentages) using the following account groups shown in your selected company's balance sheet. Increase or Decrease Account Group Current Prior Year Year percet mis {current year prior year percent) 100% 100% Current Assets Net Fixed Assets Intangible and Other Noncurrent Assets Total Assets Current Liabilities Long-term Liabilities Common Stock Additional Paid in Capital Retained Earnings Other Equity Components Total Liabilities and Stockholders' Equity 100% 100%