Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the close of the trading day you sell an at-the-money 6-month European call on a non-dividend paying stock trading at $80.00 with an

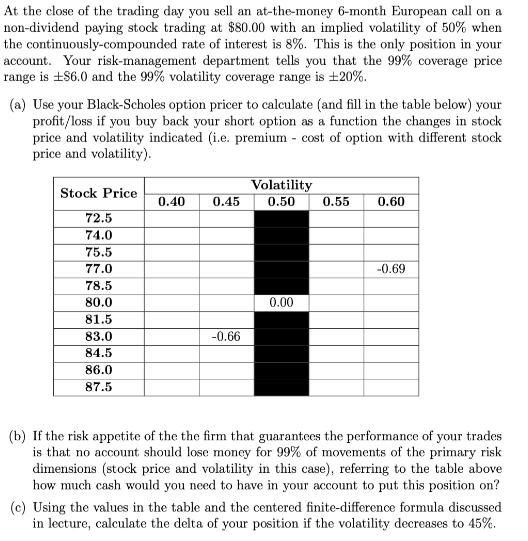

At the close of the trading day you sell an at-the-money 6-month European call on a non-dividend paying stock trading at $80.00 with an implied volatility of 50% when the continuously-compounded rate of interest is 8%. This is the only position in your account. Your risk-management department tells you that the 99% coverage price range is 186.0 and the 99% volatility coverage range is 20%. (a) Use your Black-Scholes option pricer to calculate (and fill in the table below) your profit/loss if you buy back your short option as a function the changes in stock price and volatility indicated (i.e. premium cost of option with different stock price and volatility). Stock Price 72.5 74.0 75.5 77.0 78.5 80.0 81.5 83.0 84.5 86.0 87.5 0.40 Volatility 0.45 0.50 0.55 0.60 -0.66 0.00 -0.69 (b) If the risk appetite of the the firm that guarantees the performance of your trades is that no account should lose money for 99% of movements of the primary risk dimensions (stock price and volatility in this case), referring to the table above how much cash would you need to have in your account to put this position on? (c) Using the values in the table and the centered finite-difference formula discussed in lecture, calculate the delta of your position if the volatility decreases to 45%.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Given P50 premium when volatility 50 062 Volatility is decreasing from 50 to 45 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started