Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the Black&Scholes&Merton call and put premiums S = 29.50, K = 32.5, T - t = 53 days, the annual risk-free rate with

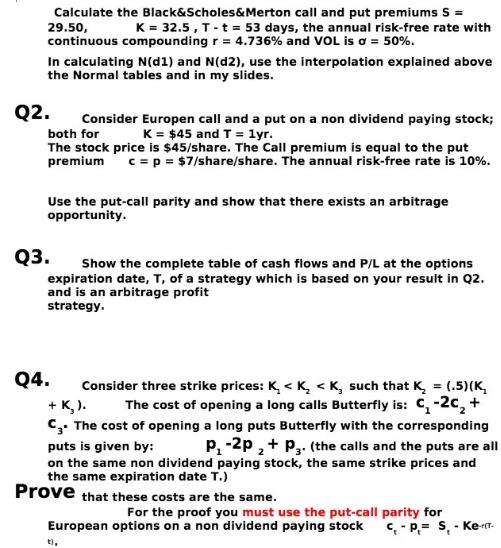

Calculate the Black&Scholes&Merton call and put premiums S = 29.50, K = 32.5, T - t = 53 days, the annual risk-free rate with continuous compounding r = 4.736% and VOL is a = 50%. In calculating N(d1) and N(d2), use the interpolation explained above the Normal tables and in my slides. Q2. Consider Europen call and a put on a non dividend paying stock; both for K = $45 and T = 1yr. The stock price is $45/share. The Call premium is equal to the put premium c = p = $7/share/share. The annual risk-free rate is 10%. Use the put-call parity and show that there exists an arbitrage opportunity. Q3. Show the complete table of cash flows and P/L at the options expiration date, T, of a strategy which is based on your result in Q2. and is an arbitrage profit strategy. Q4. Consider three strike prices: K < K

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Calculation of BlackScholesMerton Call and Put Premiums Given Stock price S 2950 Strike price K 3250 Time to expiration Tt 53 days or 53365 years A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started