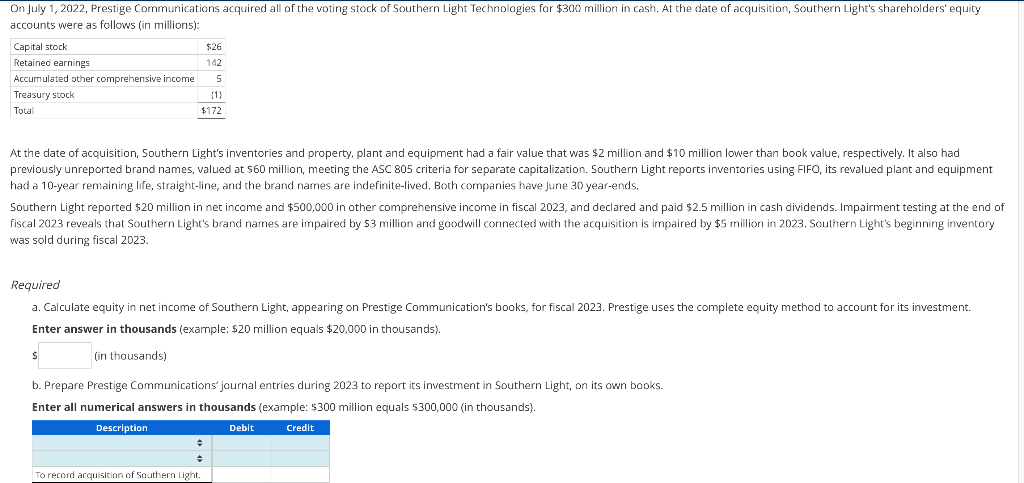

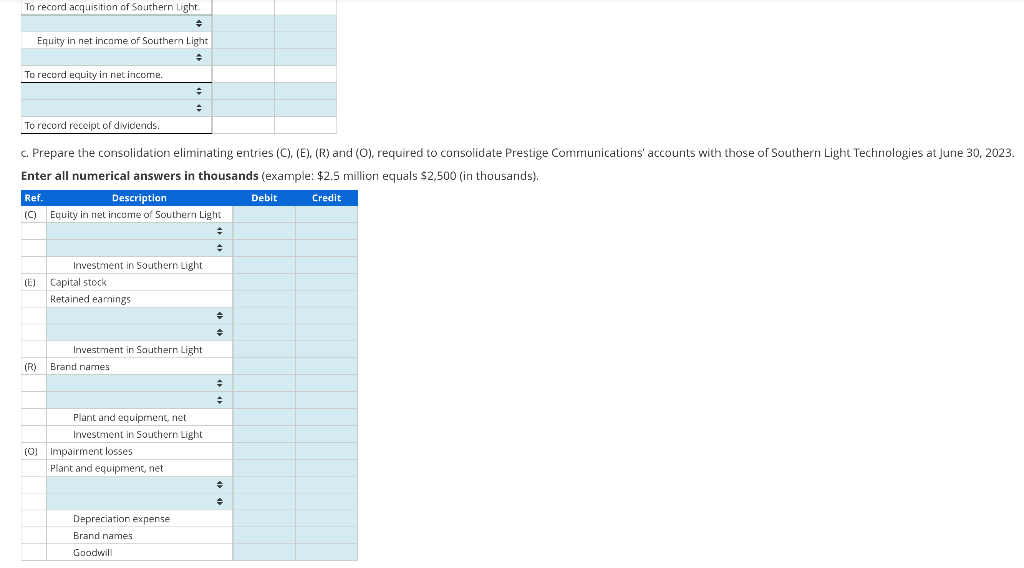

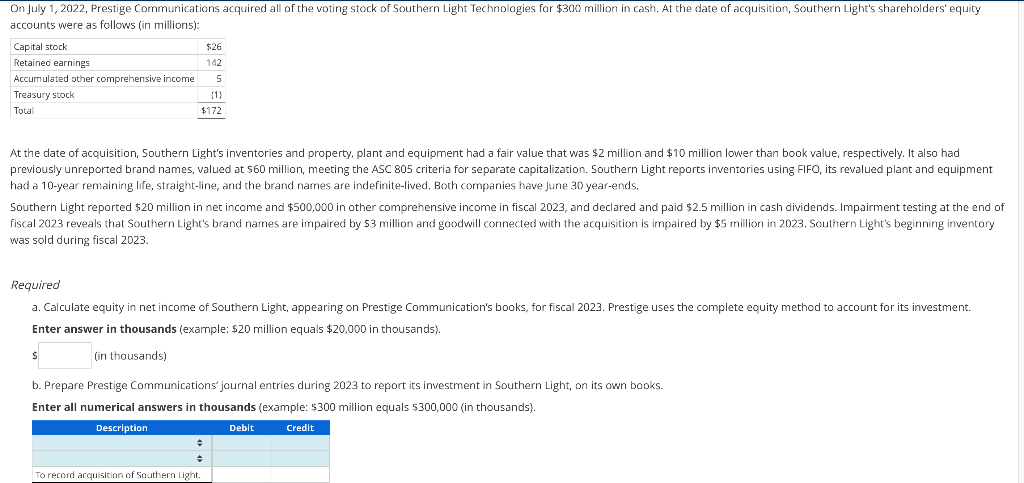

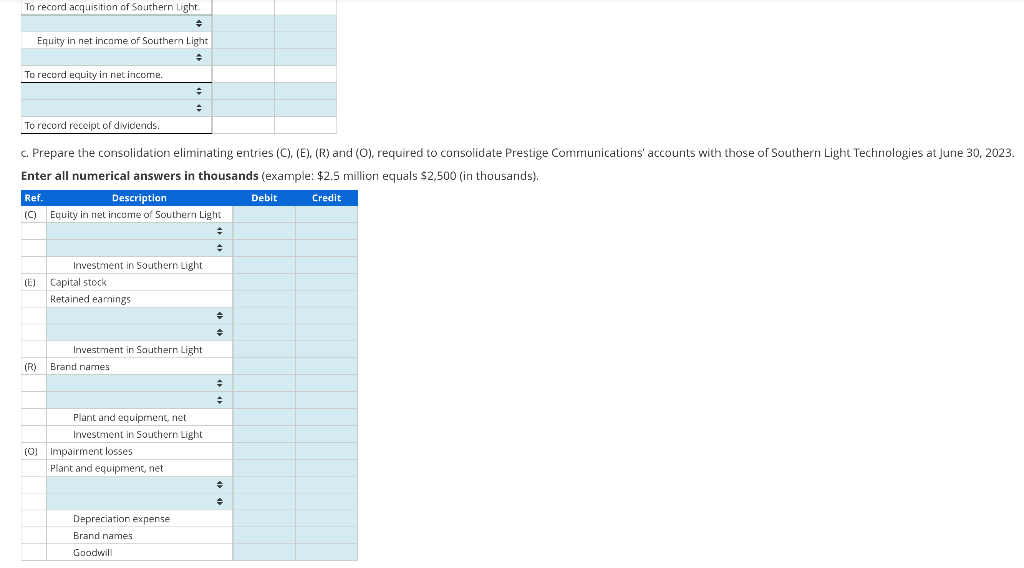

At the date of acquisition, Southern Light's inventories and property, plant and equipment had a fair value that was $2 million and $10 million lower than book value, respectively. It also had previously unreported brand names, valued at 560 million, meeting the ASC 805 criteria for separate capitalization. Southern Light reports inventories using FIFO, its revalued plant and equipment had a 10-year remaining life, straight-line, and the brand names are indefinite-lived. Both companies have June 30 year-ends. Southern Light reported $20 million in net income and $500,000 in other comprehensive income in fiscal 2023, and declared and paid $2.5 million in cash dividends. Impairment testing at the end fiscal 2023 reveals that Southern Light's brand names are impaired by $3 million and goodwill connected with the acquisition is impaired by $5 million in 2023 . Southern Light's beginning inventory was sold during fiscal 2023. Required a. Calculate equity in net income of Southern Light, appearing on Prestige Communication's books, for fiscal 2023. Prestige uses the complete equity method to account for its investment. Enter answer in thousands (example: $20 million equals $20,000 in thousands). s (in thousands) b. Prepare Prestige Communications'journal entries during 2023 to report its investment in Southern Light, on its own books. Enter all numerical answers in thousands (example: $300 million equals $300,000 (in thousands). c. Prepare the consolidation eliminating entries (C), (E), (R) and (O), required to consolidate Prestige Communications' accounts with those of Southern Light Technologies at june 30,2023. Enter all numerical answers in thousands (example: $2.5 million equals $2,500 (in thousands). At the date of acquisition, Southern Light's inventories and property, plant and equipment had a fair value that was $2 million and $10 million lower than book value, respectively. It also had previously unreported brand names, valued at 560 million, meeting the ASC 805 criteria for separate capitalization. Southern Light reports inventories using FIFO, its revalued plant and equipment had a 10-year remaining life, straight-line, and the brand names are indefinite-lived. Both companies have June 30 year-ends. Southern Light reported $20 million in net income and $500,000 in other comprehensive income in fiscal 2023, and declared and paid $2.5 million in cash dividends. Impairment testing at the end fiscal 2023 reveals that Southern Light's brand names are impaired by $3 million and goodwill connected with the acquisition is impaired by $5 million in 2023 . Southern Light's beginning inventory was sold during fiscal 2023. Required a. Calculate equity in net income of Southern Light, appearing on Prestige Communication's books, for fiscal 2023. Prestige uses the complete equity method to account for its investment. Enter answer in thousands (example: $20 million equals $20,000 in thousands). s (in thousands) b. Prepare Prestige Communications'journal entries during 2023 to report its investment in Southern Light, on its own books. Enter all numerical answers in thousands (example: $300 million equals $300,000 (in thousands). c. Prepare the consolidation eliminating entries (C), (E), (R) and (O), required to consolidate Prestige Communications' accounts with those of Southern Light Technologies at june 30,2023. Enter all numerical answers in thousands (example: $2.5 million equals $2,500 (in thousands)