Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of 10 years, the robot will have a salvage value of $20,000. Assume that the company's cost of capital is 12 percent.

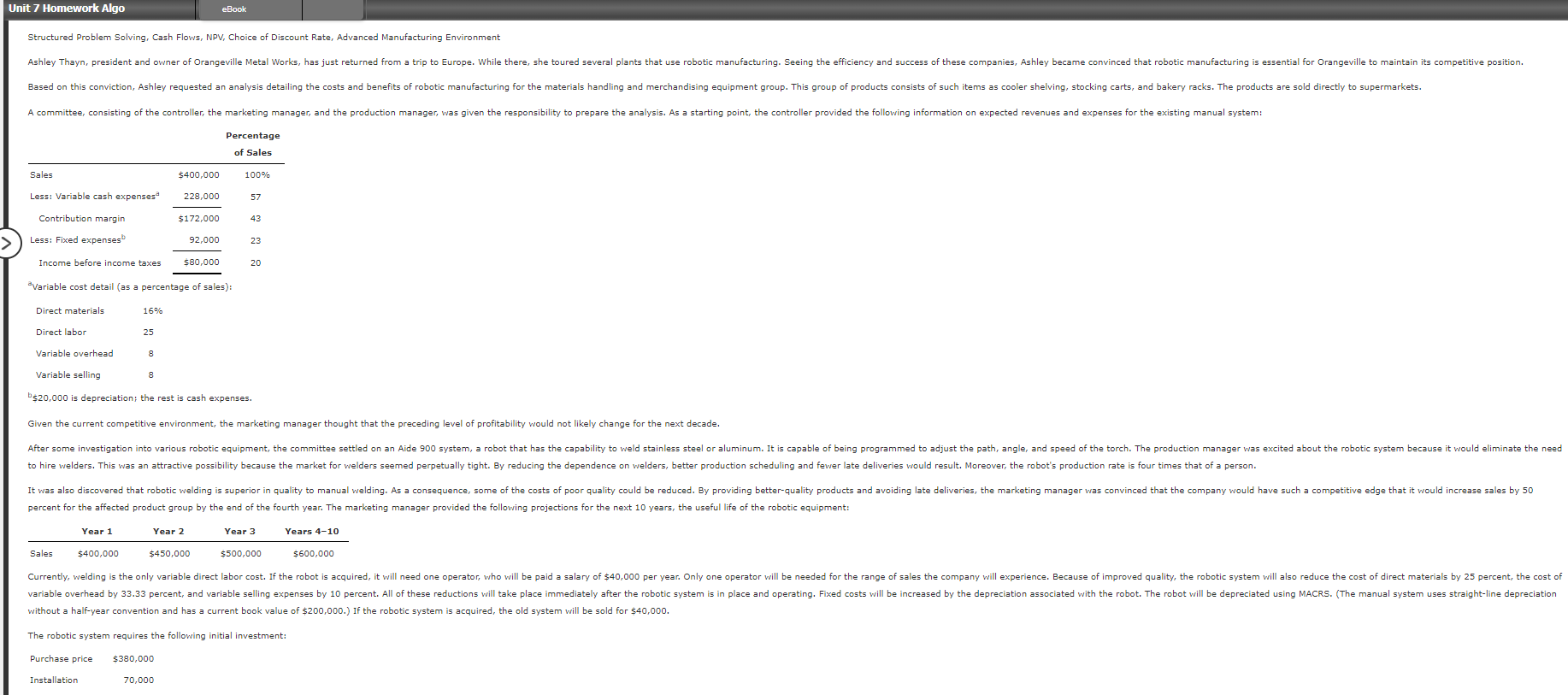

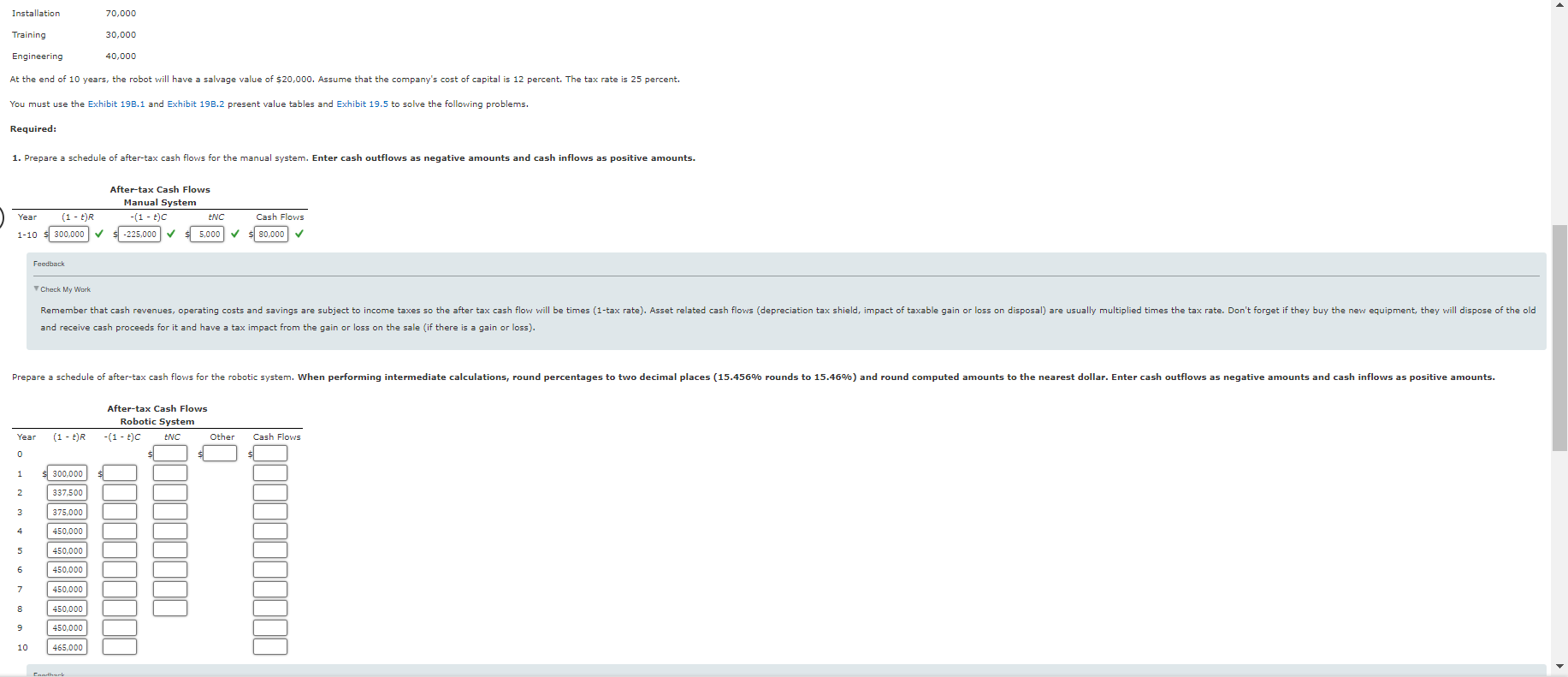

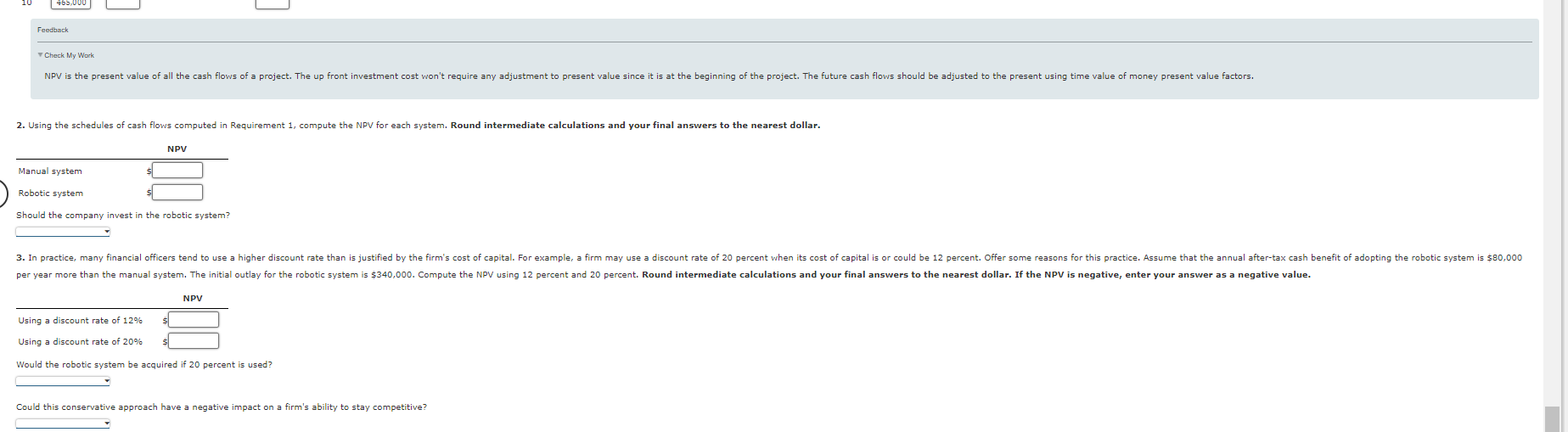

At the end of 10 years, the robot will have a salvage value of $20,000. Assume that the company's cost of capital is 12 percent. The tax rate is 25 percent. You must use the Exhibit 19B.1 and Exhibit 19B.2 present value tables and Exhibit 19.5 to solve the following problems. Required: 1. Prepare a schedule of after-tax cash flows for the manual system. Enter cash outflows as negative amounts and cash inflows as positive amounts. Feedbark VCheck My Work and receive cash proceeds for it and have a tax impact from the gain or loss on the sale (if there is a gain or loss). Would the robotic system be acquired if 20 percent is used? Could this conservative approach have a negative impact on a firm's ability to stay competitive? Unit 7 Homework Algo Structured Problem Solving, Cash Flows, NPV, Choice of Discount Rate, Advanced Manufacturing Environment b$20,000 is depreciation; the rest is cash expenses. Given the current competitive environment, the marketing manager thought that the preceding level of profitability would not likely change for the next decade. percent for the affected product group by the end of the fourth year. The marketing manager provided the following projections for the next 10 years, the useful life of the robotic equipment: \begin{tabular}{ccccc} & Year 1 & Year 2 & Year 3 & Years 4-10 \\ \hline Sales & $400,000 & $450,000 & $500,000 & $600,000 \end{tabular} without a half-year convention and has a current book value of $200,000.) If the robotic system is acquired, the old system will be sold for $40,000. The robotic system requires the following initial investment: Purchase price $380,000 Installation 70,000

At the end of 10 years, the robot will have a salvage value of $20,000. Assume that the company's cost of capital is 12 percent. The tax rate is 25 percent. You must use the Exhibit 19B.1 and Exhibit 19B.2 present value tables and Exhibit 19.5 to solve the following problems. Required: 1. Prepare a schedule of after-tax cash flows for the manual system. Enter cash outflows as negative amounts and cash inflows as positive amounts. Feedbark VCheck My Work and receive cash proceeds for it and have a tax impact from the gain or loss on the sale (if there is a gain or loss). Would the robotic system be acquired if 20 percent is used? Could this conservative approach have a negative impact on a firm's ability to stay competitive? Unit 7 Homework Algo Structured Problem Solving, Cash Flows, NPV, Choice of Discount Rate, Advanced Manufacturing Environment b$20,000 is depreciation; the rest is cash expenses. Given the current competitive environment, the marketing manager thought that the preceding level of profitability would not likely change for the next decade. percent for the affected product group by the end of the fourth year. The marketing manager provided the following projections for the next 10 years, the useful life of the robotic equipment: \begin{tabular}{ccccc} & Year 1 & Year 2 & Year 3 & Years 4-10 \\ \hline Sales & $400,000 & $450,000 & $500,000 & $600,000 \end{tabular} without a half-year convention and has a current book value of $200,000.) If the robotic system is acquired, the old system will be sold for $40,000. The robotic system requires the following initial investment: Purchase price $380,000 Installation 70,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started