Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of 2017, Chopin Ltd had free cash flow to the firm (FCFF) of R4 million and 1000000 shares outstanding. At the same

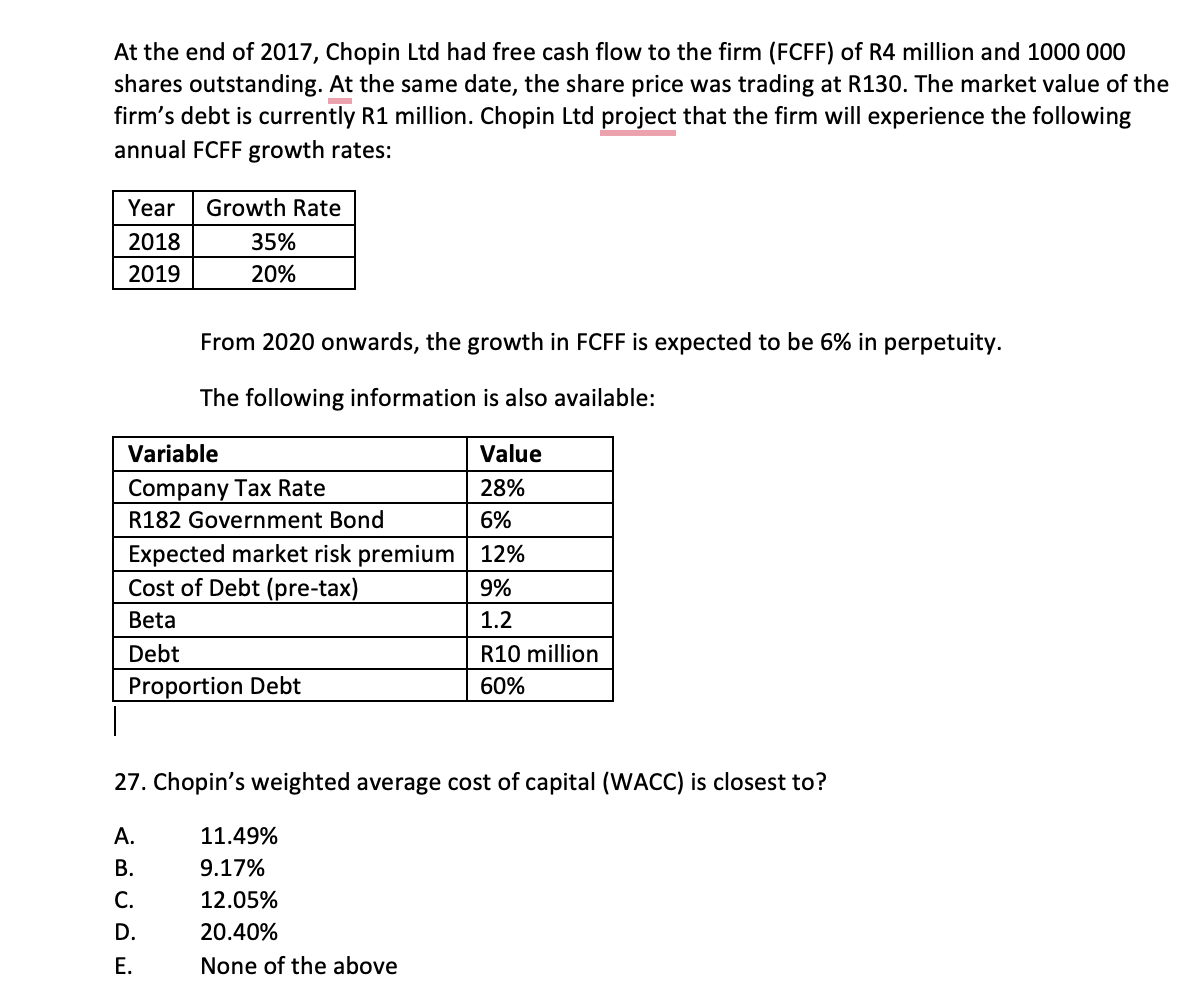

At the end of 2017, Chopin Ltd had free cash flow to the firm (FCFF) of R4 million and 1000000 shares outstanding. At the same date, the share price was trading at R130. The market value of the firm's debt is currently R1 million. Chopin Ltd project that the firm will experience the following annual FCFF growth rates: From 2020 onwards, the growth in FCFF is expected to be 6% in perpetuity. The following information is also available: 27. Chopin's weighted average cost of capital (WACC) is closest to? A. 11.49% B. 9.17% C. 12.05% D. 20.40% E. None of the above

At the end of 2017, Chopin Ltd had free cash flow to the firm (FCFF) of R4 million and 1000000 shares outstanding. At the same date, the share price was trading at R130. The market value of the firm's debt is currently R1 million. Chopin Ltd project that the firm will experience the following annual FCFF growth rates: From 2020 onwards, the growth in FCFF is expected to be 6% in perpetuity. The following information is also available: 27. Chopin's weighted average cost of capital (WACC) is closest to? A. 11.49% B. 9.17% C. 12.05% D. 20.40% E. None of the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started